Despite a Japanese bank holiday on Monday, it could be a busy Asian session for Chinese and related markets as investors respond to the latest GDP, industrial production and retail sales data from the world’s second largest economy. If China’s upcoming data deteriorates further then we could see the likes of the Aussie and kiwi comes under renewed pressure because of the fact China is Australia and NZ’s largest trading partner. But if the numbers are surprisingly strong then the AUD/USD and NZD/USD could catch up with the CAD/USD and break higher. In addition to Chinese data, we will also have the Aussie jobs numbers to look forward to on Thursday of next week. So, the Australian dollar could be in for some much-needed volatility in any case.

On Friday we learnt that China’s trade balance improved noticeably in June, but this was only because imports fell sharply (by 7.3% y/y in dollar terms) relative to exports which declined more modestly (1.3% y/y). The slowdown was undoubtedly exacerbated by China’s ongoing trade dispute with the US. Indeed, in the first half the year, China’s exports to the US fell by more than 8%, while imports dropped by almost 30%. So, things aren’t looking too good ahead of the GDP and industrial production numbers on Monday. We will discuss these in greater detail in our upcoming Week Ahead report later.

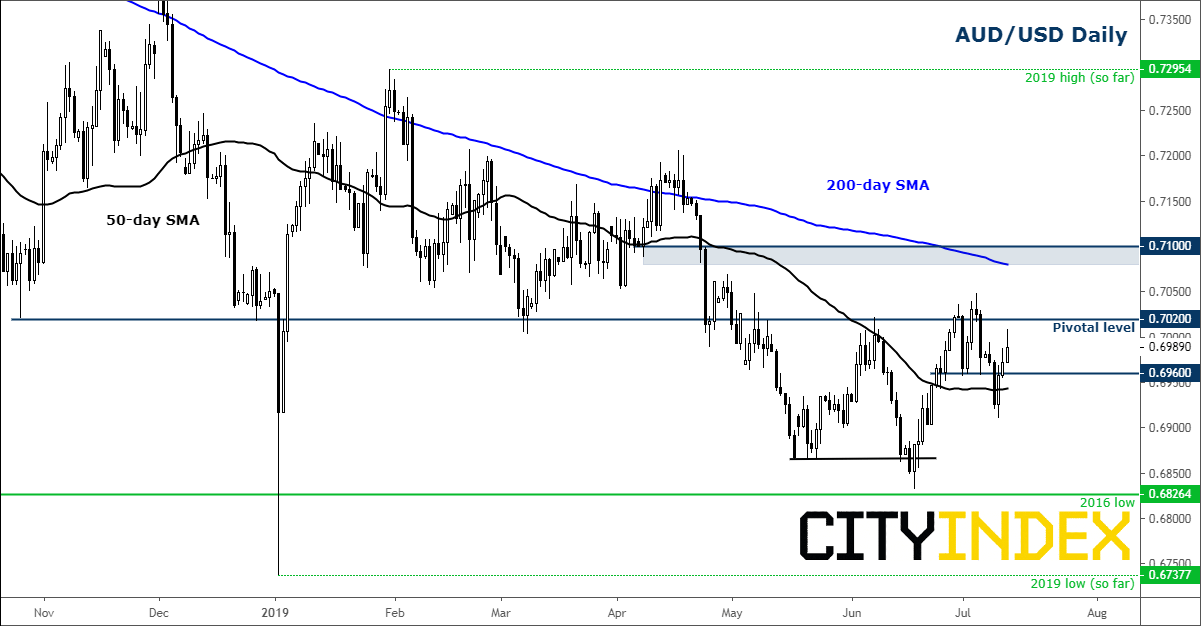

From a technical point of view, the AUD/USD has struggled to show the sort of bullish price action one would have expected after it created what looked like a false break reversal around the 0.6865 level in mid-June. Although it went on to make a new higher high above the prior resistance in the 0.7020 region, it couldn’t make further bullish progress and it fell back within the existing range. So, it needs to break and hold above the 0.7020 pivotal level for the technical bias to turn bullish again. Otherwise, the Aussie could drift further lower and head towards the 2019’s lows again.

Source: Trading View and City Index