AUD/USD could Move Lower if Stocks Can’t Bounce Higher

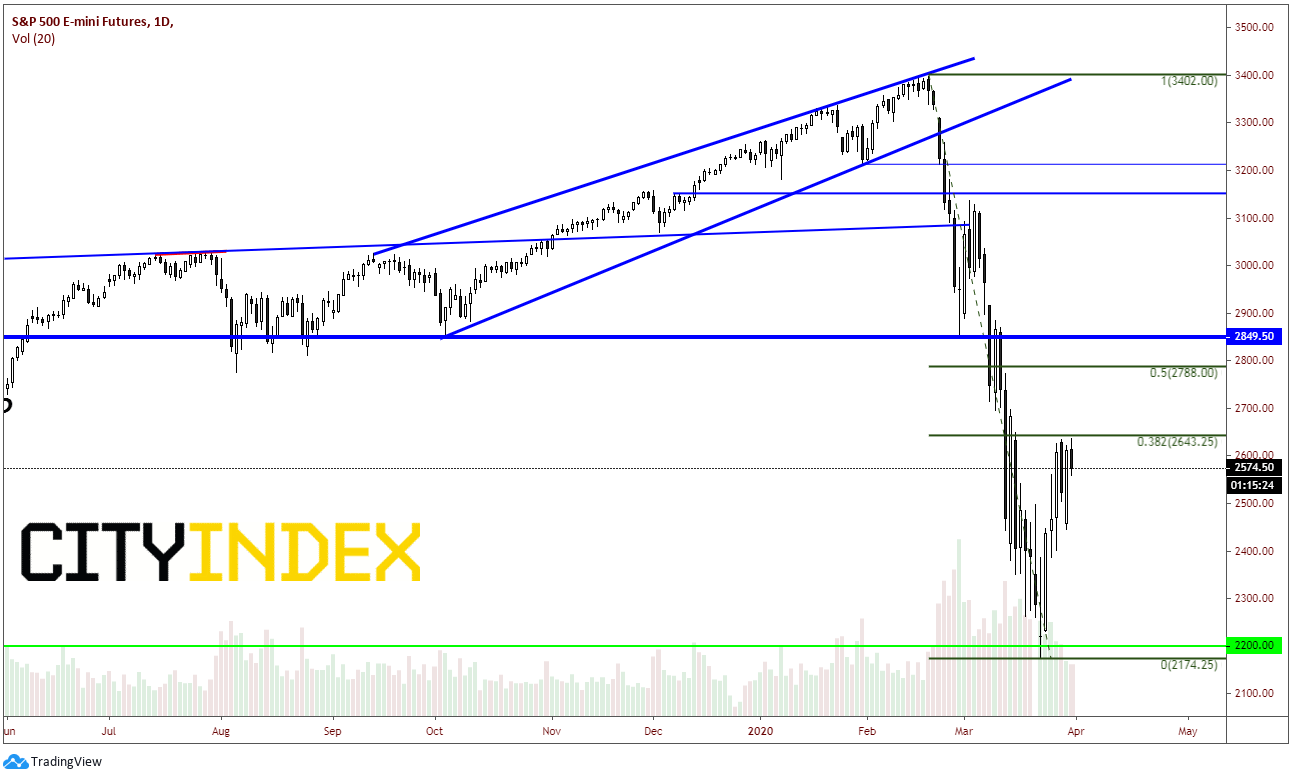

For all the talk we got about month-end buying because of pension fund rebalancing, it turned out to be a quiet day, comparatively speaking. The range on the day today in the S&P 500 was only 77.25 handles! This was not only the smallest daily range of the month, but also since February 21st when the range was 41.25 handles. Today’s price action did put in the highs of the last 6 trading days when price bounced off long-term horizontal support just below 2200. Price then bounced to the 38.2% retracement level from the February 20th highs to the March 23rd lows near 2643.25 and held, trading lower into today’s close.

Source: Tradingview, CME, City Index

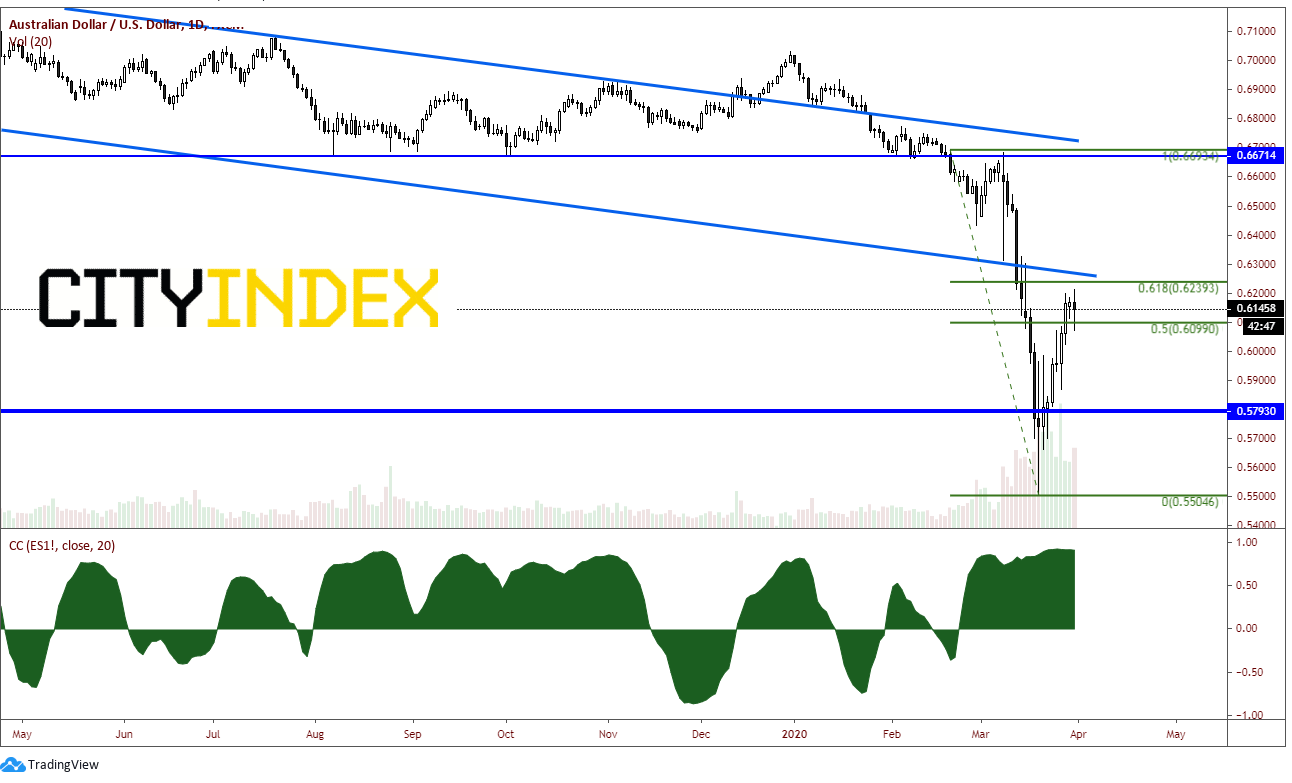

If the stock index can not get any higher than the 38.2% retracement, then this could prove to be a dead cat bounce. And if that is the case and stocks do move lower, then the AUD/USD has plenty of room to fall. As we can see on the bottom of the daily chart, AUD/USD and the S&P 500 are currently highly correlated. The correlation coefficient is +0.91. For comparison, a correlation coefficient of +1.00 means that the two assets are perfectly correlated and move together 100% of the time. AUD/USD fell with stocks at the end of February as worries of the coronavirus spread throughout the world. On March 19th, the pair put in a low of .5504 before bouncing to the 61.8% retracement level from the February 20th highs to the March 19th lows. (There is also a long-term downward sloping trendline from May 2018 which crosses at that same level).

Source: Tradingview, City Index

Since AUD/USD bounced to the 61.8% Fibonacci retracement level, and the S&P 500 only bounced to the 38.2% Fibonacci retracement level, and the trading instruments are highly correlated, then it would make sense that if stocks sold off and made new lows, that AUD/USD would move lower as well!

Keep an eye on this correlation to see if continues to hold. AUD/USD could be in trouble if stocks do move lower!