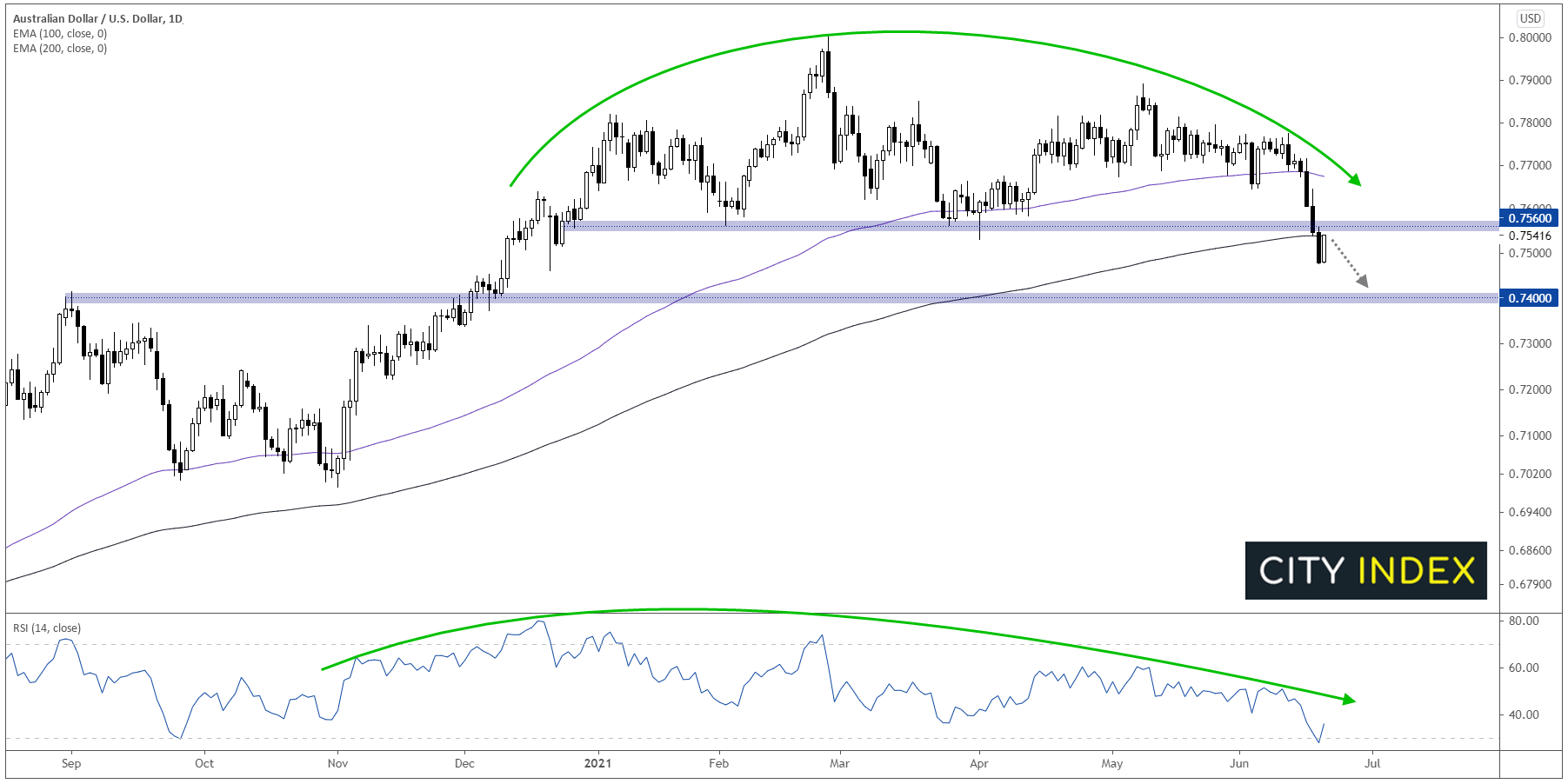

AUD/USD bulls on the run below 0.7560

It’s a new trading week and risk assets are bouncing back from last week’s big selloff. Some less-hawkish-than-feared comments from the Fed on an otherwise quiet day are garnering headlines, though a general sense of optimism over the official start to summer certainly isn’t hurting matters!

Of course, that summertime feeling only applies to the Northern hemisphere, and Australian dollar bulls have seemingly gone into hibernation for the Southern hemisphere winter, today’s price action notwithstanding. Looking at the chart of AUD/USD, rates broke down to a fresh year-to-date low Friday, slicing through their 200-day EMA in the process. Whether you view it as a “generic rounded top” pattern or a messier head-and-shoulders” setup, the price action over the last six months reflects distribution from buyers to sellers and will be difficult to rally back above any time soon.

Source: StoneX, TradingView

As the chart above shows, AUD/USD has retraced back to the proverbial “scene of the crime” – its breakdown below 0.7560 support. This breakdown-retest pattern is a common setup that allows bears who missed the initial breakout a secondary opportunity to enter short positions as long as rates remain below 0.7560. To the downside, the next logical level of support to watch will be previous-resistance-turned-support near 0.7400.

With a lackluster Australian retail sales report (0.1% m/m growth vs. 0.4% expected) already behind us, these are the other economic releases for AUD/USD traders to monitor this week:

- Tuesday: RBA Assistant Governor Ellis speech in Adelaide

- Wednesday: US Markit PMI surveys

- Thursday: US initial unemployment claims and final Q1 GDP revision

- Friday: US Core PCE price index

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.