This morning saw the release of the RBA’s May meeting minutes. The market was hoping for clues on the likely size of next month’s rate hike, particularly after the bank caught all commentators on the wrong foot last month by raising rates by 25bp to 0.35%.

The minutes noted that members considered three options for the size of the rate increase at the May meeting - raising the cash rate by 15bp, by 25bp or by 40bp, before settling on 25 bp for the reasons outlined below.

“A 15basis point increase would [also] be inconsistent with the historical practice of changing the cash rate in increments of at least 25basis points. An argument for an increase of 40basis points could be made given the upside risks to inflation and the current very low level of interest rates. However, members agreed that the preferred option was 25basis points.”

Given the RBA’s desire to get the cash rate away from emergency settings and back on the 25bp increments it usually prefers, our preference is that the RBA will deliver a 40bp hike at the June 7 meeting, taking the cash rate back to 0.75%.

“Members agreed that the condition the Board had set to increase the cash rate had been met. They also agreed that further increases in interest rates would likely be required to ensure that inflation in Australia returns to the target over time.”

This should be supported by labour force data for April released on Thursday that is likely to show the unemployment rate edged lower again from 4% to 3.9% - On track to reach the 3 1/2% rate the RBA expects to see by early 2023.

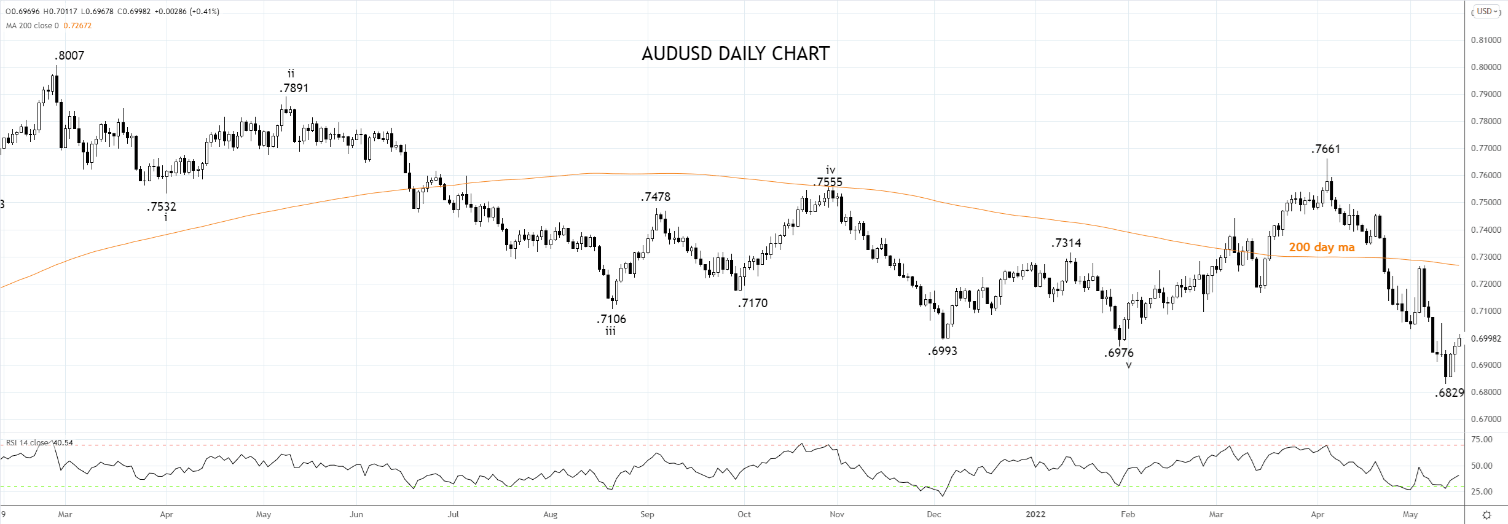

The acknowledgement that the RBA did table a 40bp hike in May and headlines from China that indicate the damaging lockdown in Shanghai will start to ease later this week has pushed the AUDUSD back above .7000c. Extending its rebound from the January 2016 .6826 low, it tagged last week.

Technically there is room for the recovery to extend to the .7053 high from last week. However, providing the AUDUSD does not see a sustained break and close above resistance at .7100/20c, the risks remain for another leg low towards support near .6600c.

Source Tradingview. The figures stated are as of May 17, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade