In recent sessions, the AUDUSD has been resilient, content to ignore a sell-off in its Antipodean counterpart, the NZDUSD yesterday. Content also to look through rising Australian - Chinese trade tensions. An article appeared overnight in the Global Times stating that unless Australia was to rethink its attitude towards China, Australia was “delusional to expect trade relations to remain on track.”

Further evidence of the currency’s resilience on display today following the release of the Australian labour force survey for April.

Heading into the data, Australian Taxation Office data showed that close to 1 million workers had lost their jobs. However, there was conjecture about how directly this would flow through into the official data given classification differences.

The actual fall in employment in April of -594k was very close to market expectations of a -575k fall. The big surprise was a “limited” rise in the unemployment rate from 5.2% to 6.2%, much better than the 8.2% expectation. A function of the participation rate falling to 63.5% from 65.3% and without this, the unemployment rate would have been 9.6%.

The takeaway from this, is the Governments JobKeeper wage subsidy program is working as designed. People are not looking for a job, as they anticipate they will go back to their previous job once the lockdown ends. This suggests the unemployment rate will fall below the 10% previously forecast, helping to explain the limited fall in the currency today.

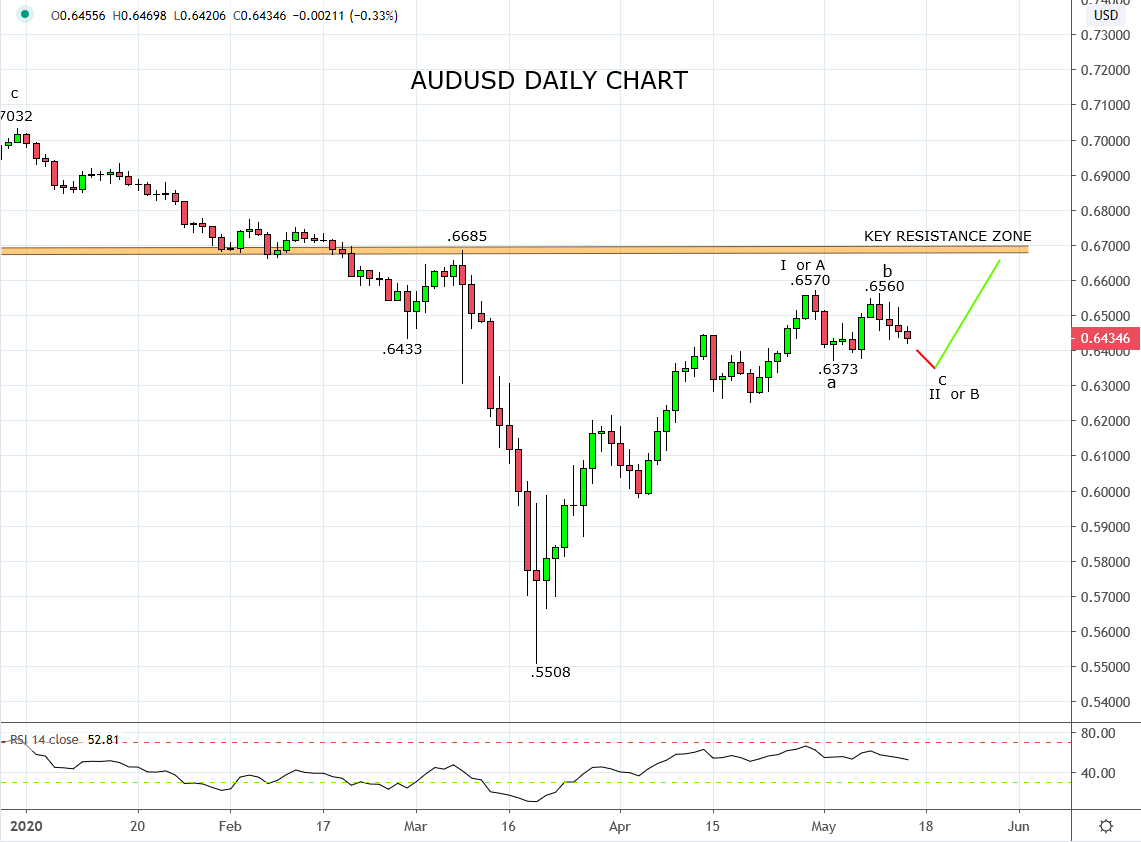

Also helping to explain the technical backdrop. After completing a five-wave rally at the .6570 high, the view is a corrective pullback is underway in the AUDUSD. The target for the pullback is the .6370/50 support level, less than 1% below today’s .6421 low.

Effectively, the begrudging price action suggests the AUDUSD is not far away from a short term low and we are watching for signs of a base to form. Keeping in mind, that if the AUDUSD was to break the .6370/50 support area, it would warn that a deeper retracement back towards .6250 is underway.

Source Tradingview. The figures stated areas of the 14th of May 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation