From a market perspective, the government’s decision to extend the JobKeeper and JobSeeker coronavirus government supplements is the most meaningful of today’s events.

The Jobkeeper program originally scheduled to end on the 27th of September 2020 will now be extended to 28th of March 2021 with payments cut from $1500 a fortnight for full-time workers to $1200 as of the 28th of September. The payment will step down again at the start of January to $1000 a fortnight, until the end of March.

The JobSeeker payment originally scheduled to end on the 24th of September 2020 will be extended to the 31st December but at a reduced rate of $250 per fortnight (down from $550) with reinstated means-testing.

The decision to extend both programs will cost the government an extra $20bn. However, the program will help the economy weather the impact of the Victorian lockdown, a possible second wave in other states and support sectors of the economy where the impact of the coronavirus lingers including hospitality and international tourism.

Importantly the extensions of both programs will reduce the prospect of the Australian economy falling off the “fiscal cliff” at the end of September and helped AUDNZD rally post the announcement.

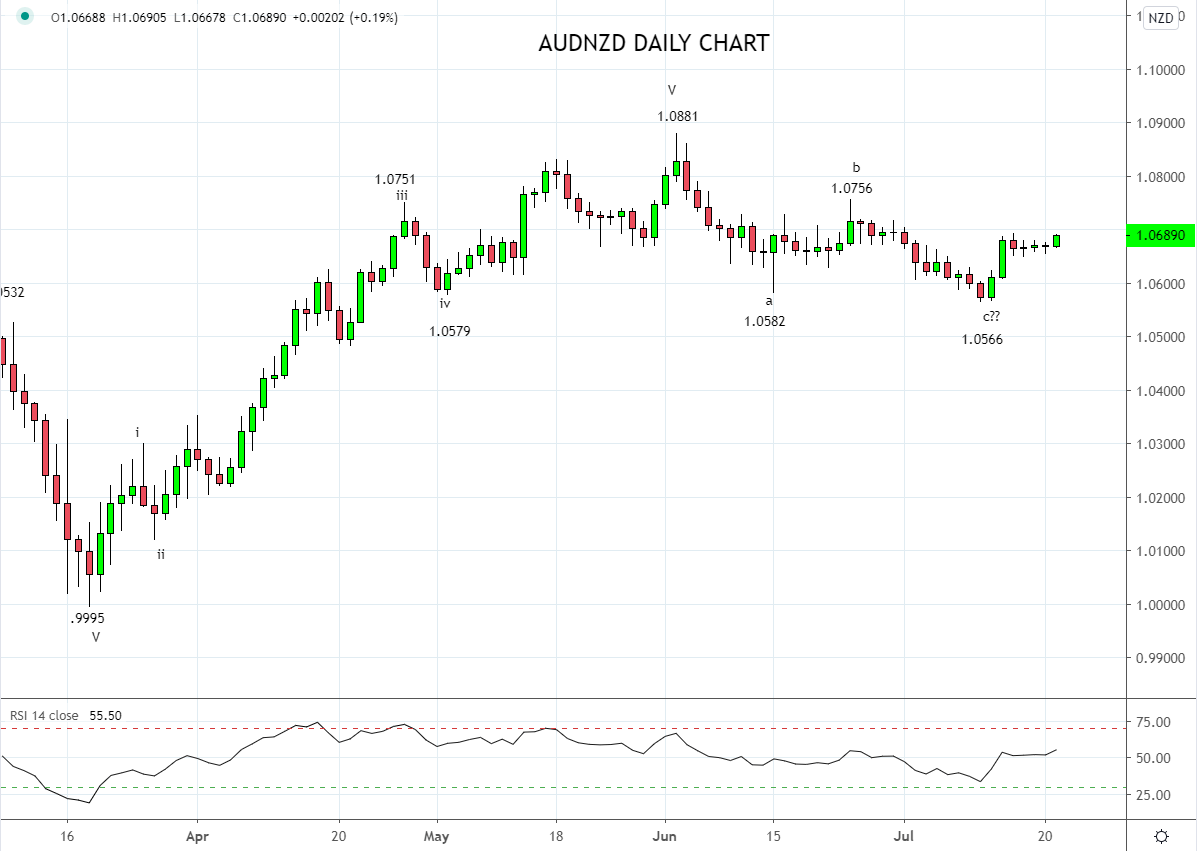

Technically a case can be made that AUDNZD completed a three-wave corrective pullback at last week’s 1.0566 low and that the uptrend is on the verge of resuming.

Should AUDNZD now break and then post daily close above the short term resistance 1.0690/00 traders might like to use it as initial confirmation the next leg higher has commenced and consider entering longs in AUDNZD with a stop loss placed below the 1.0566 swing low. The target is a retest and break of the 1.0881 June high.

Keeping in mind that the outlook for this trade idea would be reduced should the number of coronavirus cases accelerate sharply in the state of NSW in the days/weeks ahead.

Source Tradingview. The figures stated areas of the 21st of July 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation