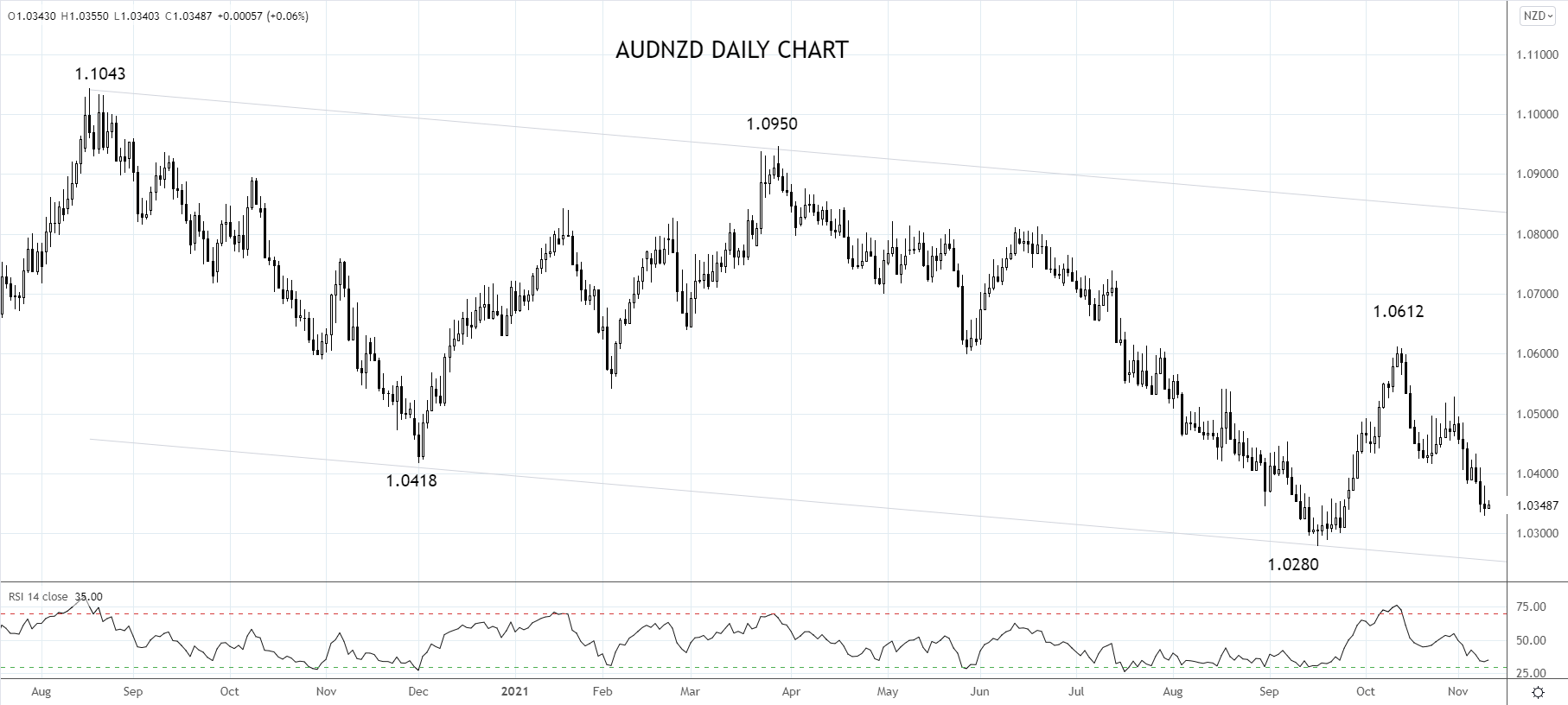

This article reviews the release of stronger Australian consumer and business confidence data and what it means for the AUDNZD cross rate, which market time overnight closing near 1.0350.

Within the details, a 16pt jump in forward orders was encouraging, as was a lift in the employment index as companies added staff ahead of the reopening.

This morning the Westpac Consumer Sentiment showed similarly. The headline index rose to 105.3 from 104.6 while employment expectations improved to their best level since the mid-1990s, reflecting a high level of job vacancies.

Overall the two surveys point to limited scarring from the lockdowns and indicate the labour market is tightening following the reopening.

An encouraging sign for the economy and the RBA who have noted a tighter labour market and stronger wage growth is required to see inflation sustainably within their target band and the prerequisite for rate hikes.

Tomorrow's October labour force report will provide further insights into the healing of the labour market, as will next week's wage growth index for the three months to September.

Providing AUDNZD remains below short-term resistance at 1.0420/30 on a closing basis, the expectation is for the cross to continue to decline towards the bottom of the 15-month trend channel near 1.0250 in the coming weeks.

Source Tradingview. The figures stated areas of November 10th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade