Hopefully, by the time the colder weather returns in late April/May a coronavirus vaccine has been discovered and distributed to the vulnerable. In the interim, a broader re-opening of the Australian economy and state borders appears imminent, and a travel bubble with New Zealand appears to be back on the cards.

Providing an opportunity to review the AUDNZD cross rate for the first time since a trade update in early August here.

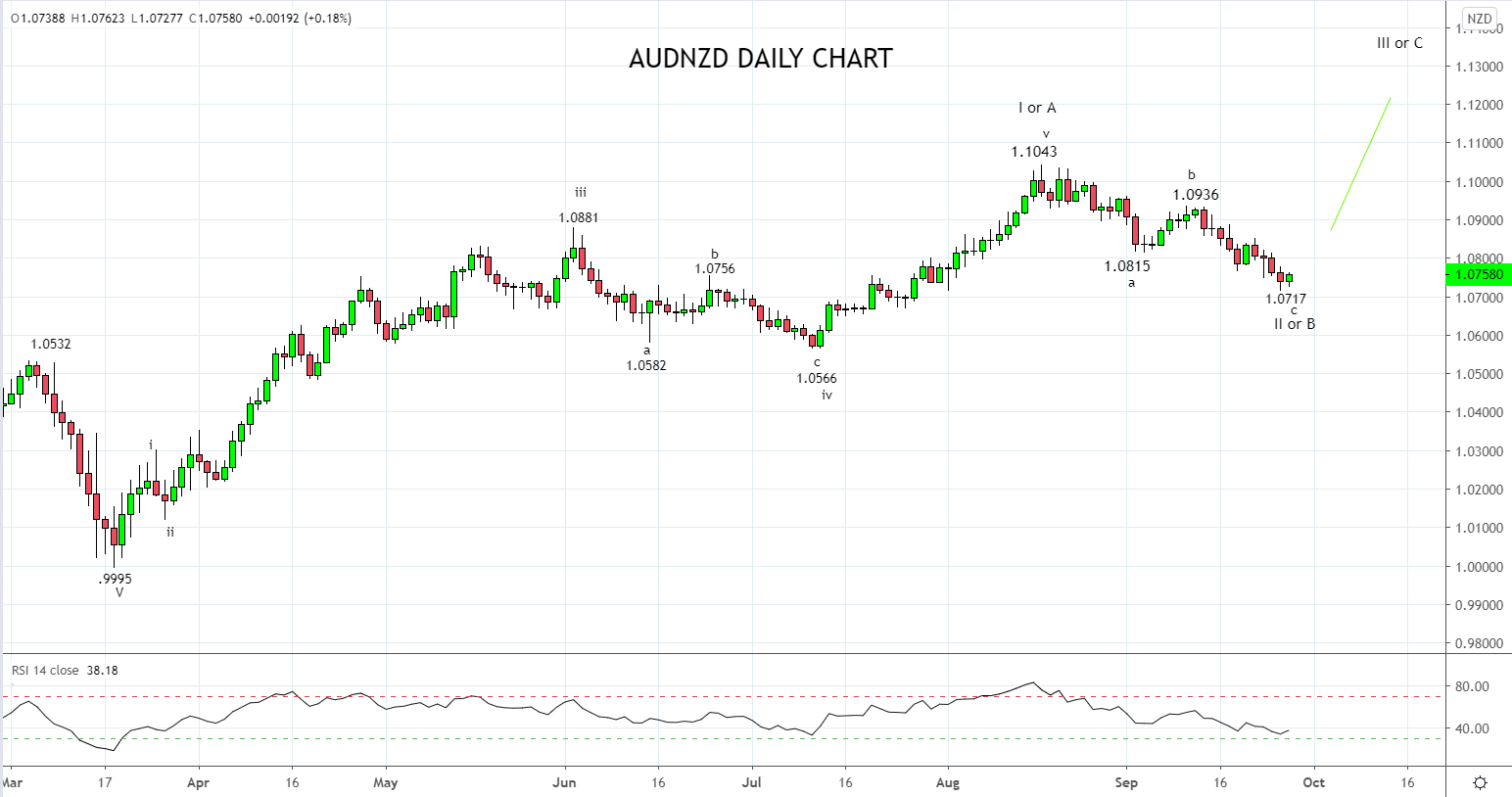

“We recommend raising the stop loss from 1.0566 to just below the overnight low at 1.0715. If triggered this would result in a small profit or at worst a breakeven trade if stopped out. The initial target remains the June 1.0881 high and beyond that 1.1000/50.”

After reaching the secondary profit target of the trade 1.1000/50 area, AUDNZD commenced a pullback. The cause of the pullback, a tightening of the Victorian lockdown, the rising odds of an RBA rate cut by year-end and the deleveraging in September that extended into the prices of Australia’s key commodity exports.

However, with 15bp of an RBA rate cut now priced for November, a stimulatory Australian federal budget to be announced next week, a relaxation of responsible lending bank rules that will likely increase the flow of credit and property prices, and a stabilisation in risk sentiment, the time is right to revisit a long AUDNZD trade idea.

From a technical perspective, last week AUDNZD pulled back to the “abc” wave equality retracement target at 1.0715. While todays recovery is encouraging for the pairs bullish prospects, a break and close above resistance 1.0820/30 is required to provide further confirmation that the uptrend has resumed.

In this instance, consider re-opening longs in AUDNZD, looking for a retest of the August 1.1043 high, before 1.1500, with a stop loss placed at 1.0705. The stop loss should be trailed higher presuming the market rallies as expected.

Source Tradingview. The figures stated areas of the 28th of September 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation