Following mixed Australian labour force data yesterday, by the close of business, the chance of a follow-up interest rate cut in July had increased to 16bp or just over 60%. Another full rate cut is priced thereafter, which would see the official cash rate at 0.75%. A rate that would allow the RBA a better chance to meet its labour market and underlying inflation forecasts.

With the path of the Australian economy and the cash rate well defined over the next six months the release of Q1 2019, GDP data in New Zealand next Thursday offers an opportunity to see how the New Zealand economy is fairing in comparison.

The New Zealand economy has been slowing for some time now. At the most recent GDP update, growth slowed to 2.3% year on year, the weakest growth rate since Q4 2013. Next Thursday’s data is expected to see growth moderate again, to 2.2% year on year. Domestic business confidence remains low, which is weighing on investment and hiring intentions. The escalation in trade tensions in early May is providing an additional headwind.

At its last meeting in May, the RBNZ cut the cash rate by 25bp to 1.50%. A “one and done” tone prevailed in the accompanying statement; however, the market disagrees, and another cut is fully priced by September to 1.25%. After that pricing of further interest rate cuts appears underdone, and the risks are the RBNZ is forced to follow the RBA’s lead and cut to 0.75%.

Based on the idea that the RBNZ may need to play catch up, not to mention the ongoing rally in the price of Australia’s largest export, iron ore, there appears value in considering long AUDNZD trades.

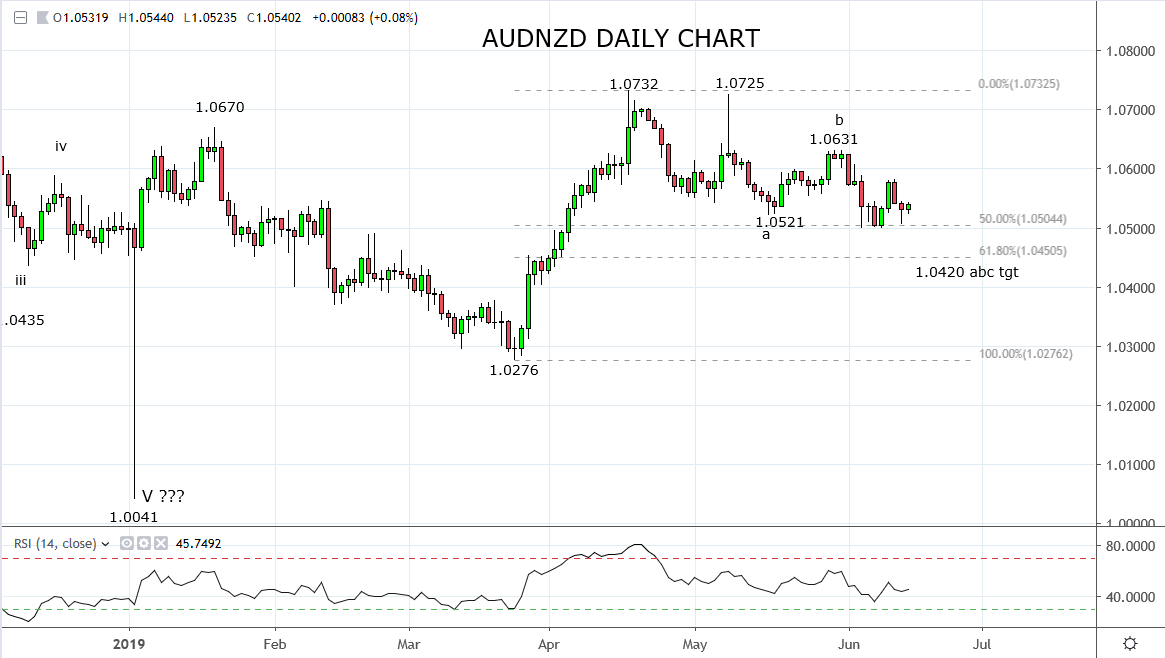

Technically, the pullback from the 1.0730 double top appears corrective and overnight AUDNZD again held the key 50% Fibonacci support at 1.0500. Not far below, resides strong medium-term support, firstly at 1.0450 (the 61.8% Fibonacci) and then at 1.0420 (abc wave equality target).

In short, I like buying dips in AUDNZD towards 1.0530/20, leaving room to add at 1.0450/20. The target is a retest and eventual break of the recent highs near 1.0730 with a stop loss placed below 1.0370.

Source Tradingview. The figures stated are as of the 14th of June 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.