A more cautious tone during the Asian time zone today as the political fallout from Covid-19 takes a distinctly local twist.

Following Australia’s call for an independent inquiry into the origins of COVID-19, China responded over the weekend with a threat to impose tariffs of up to 80% on Australian barley exports into China, as a result of an anti-dumping investigation.

While there were attempts to link China’s threat to impose tariffs on barley to an earlier decision by Australia to impose tariffs on Chinese exports of steel and aluminium, there can be little doubt that China’s decision to suspended meat imports from four Australian abattoirs today, highlights a growing chasm in the relationship.

Should the diplomatic situation deteriorate further, Australia has most to lose, particularly if China decides to turn its attention to Australian iron ore exports. Fingers and toes crossed that a diplomatic resolution can be found before any real economic damage occurs.

Not prepared to take any chances, currency traders have sold the AUD against the NZD today, also with an eye towards tomorrow’s RBNZ interest rate meeting.

For the record, the consensus view is the RBNZ will keep the overnight cash rate (OCR) on hold at 0.25% and the RBNZ’s quantitative easing (QE) program to be increased from $30bn to $60bn per month. A pace of buying that will leave the RBNZ owning almost 50% of all NZ government bonds on issue within 13 months!!!

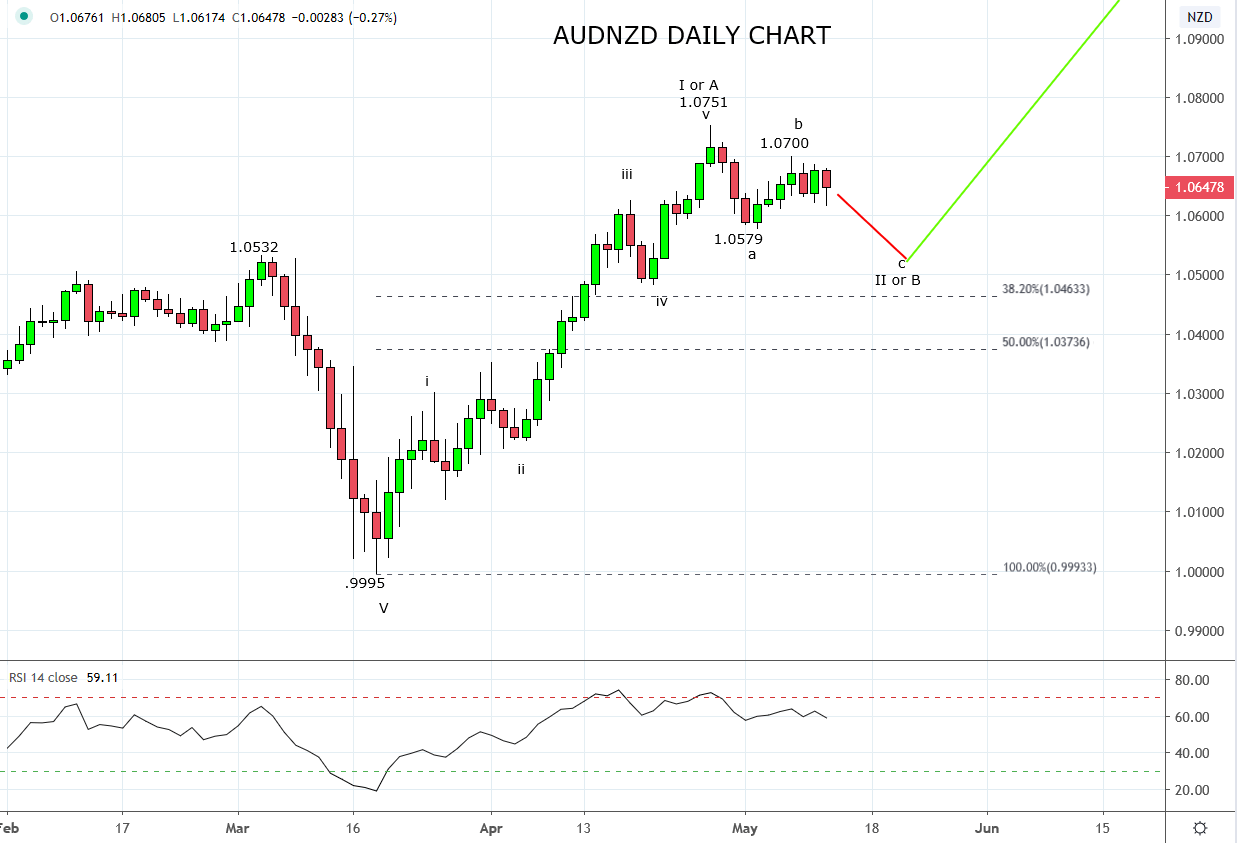

Technically after completing a 5-wave rally at the April 21, 1.0751 high, there is scope for the current pullback to continue lower towards the break out level 1.0550/30 which also aligns with the equal swings, wave equality target.

Presuming Australian - China trade tensions do not continue to escalate and providing signs of a base form in the 1.0550/30 area, it is viewed as an attractive level to look to enter longs, in anticipation of a test and break of the 1.0751 high, before a move towards 1.0865.

Source Tradingview. The figures stated areas of the 12th of May 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation