Medium-term technical outlook on AUD/JPY

click to enlarge charts

Key Levels (1 to 3 weeks)

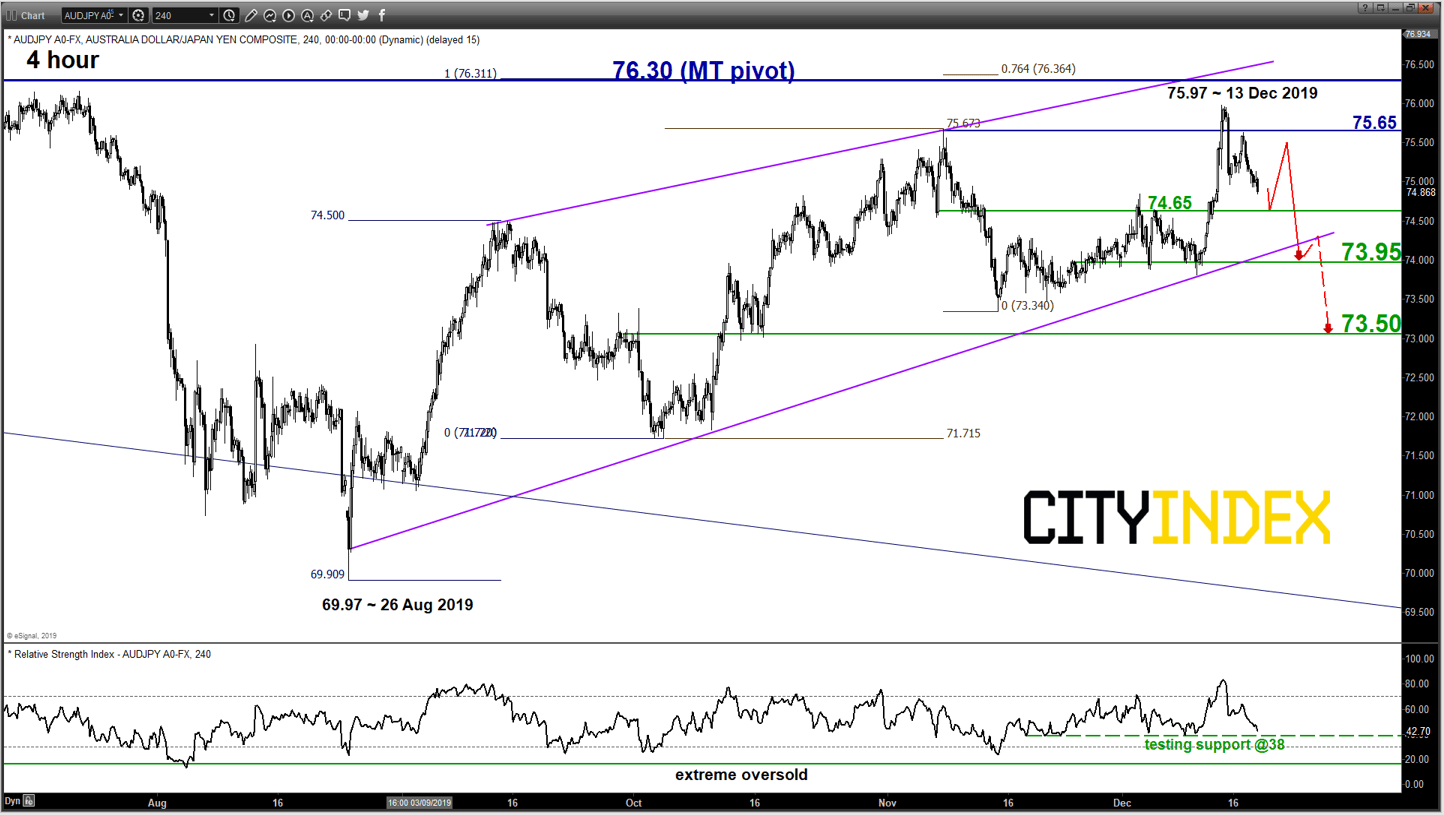

Intermediate resistance: 75.65

Pivot (key resistance): 76.30

Supports: 74.65, 73.95 & 73.50

Next resistances: 77.75 & 80.50 (LT pivot)

Directional Bias (1 to 3 weeks)

Bearish bias in any bounces below 76.30 key medium-term pivotal resistance for a potential push down to target 73.95 (the “bearish flag” support) and a break below it reinforces a further slide to target the next near-term support at 73.50 (minor congestion area of 28 Sep/16 Oct 2019 & 50% Fibonacci retracement of the recent 3-month plus rally from 26 Aug low to 13 Dec 2019 high).

However, a clearance with a daily close above 76.30 invalidates the bearish scenario for a further corrective up move towards the next intermediate resistance at 77.75.

Key elements

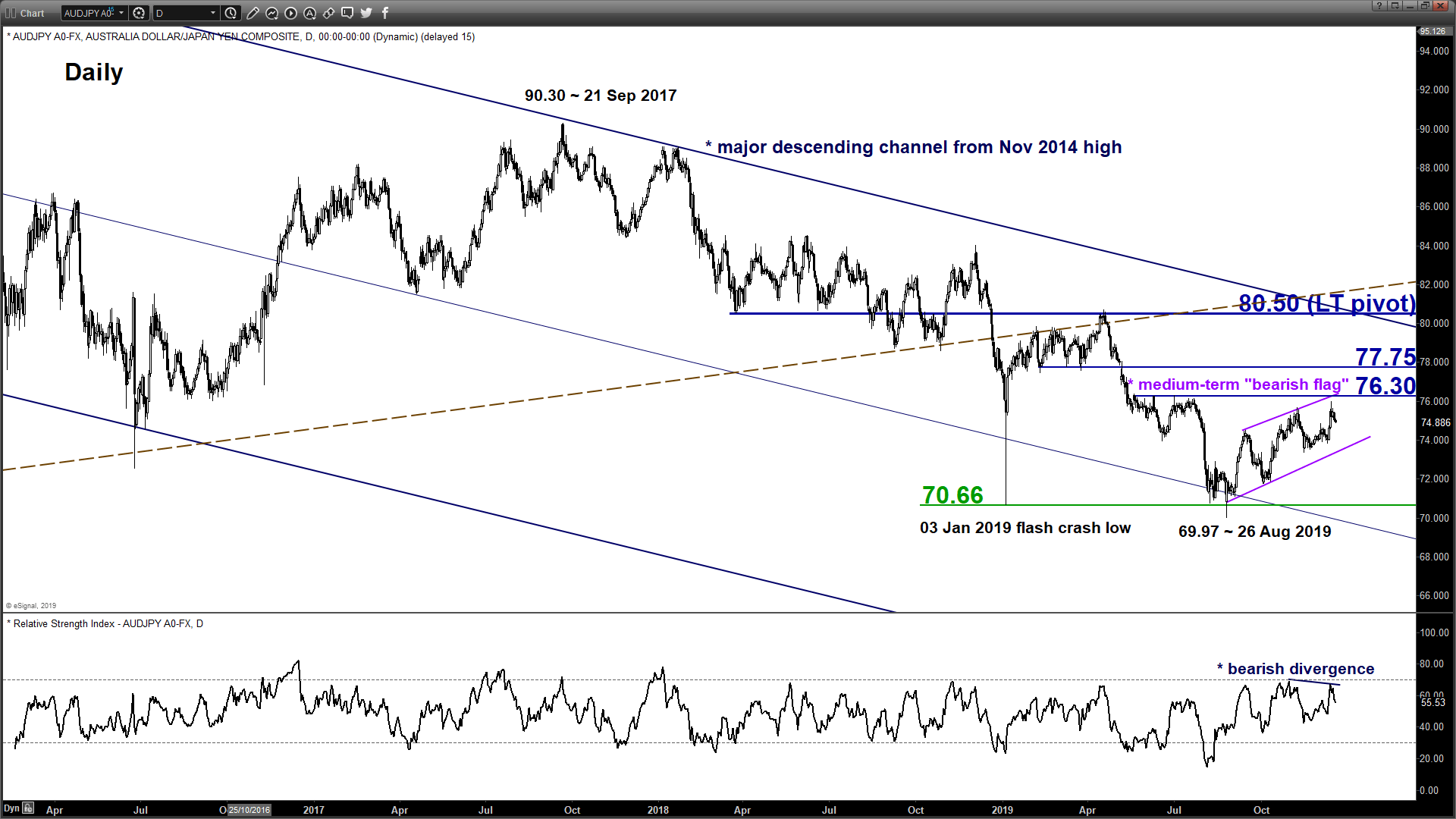

- The 6-big figure up move from 26 Aug 2019 low of 69.97 low of the AUD/JPY cross pair has started to evolve within a medium-term ascending “bearish flag” configuration, a potential consolidation/dead-cat bounce motion within its major descending channel in place since Nov 2014 high.

- In addition, the daily RSI oscillator has just traced out a bearish divergence at its overbought region which indicates that the recent upside momentum has abated. These observations coupled with the graphical analysis suggest that AUD/JPY may resume its impulsive down move sequence soon.

- The 76.30 key medium-term resistance is defined by the upper boundary of the “bearish flag”, swing high areas that rejected previous up moves during May/July 2019 and a Fibonacci expansion cluster.

- The lower boundary of the “bearish flag” is acting as a support at 73.95.