AUD/JPY testing key support ahead of AU data, Tokyo Olympics

Most of Wall Street (and beyond) will be focused on Q2 earnings reports over the next couple of weeks, but traders shouldn’t forget about the key macroeconomic releases on the calendar. On that front, next week brings a highly-anticipated ECB monetary policy meeting (check back on Monday for our full preview) and some key economic data out of Australia, including Tuesday’s RBA meeting minutes and Wednesday’s interim retail sales report.

While it’s not a economic data per se, the Opening Ceremony for the Tokyo “2020” Olympic Games are also on Friday and will draw attention to the Japanese economy. Despite an outbreak of COVID forcing Tokyo into lockdown and preventing fan attendance at the games, the Japanese yen has nonetheless been one of this week’s strongest major currencies.

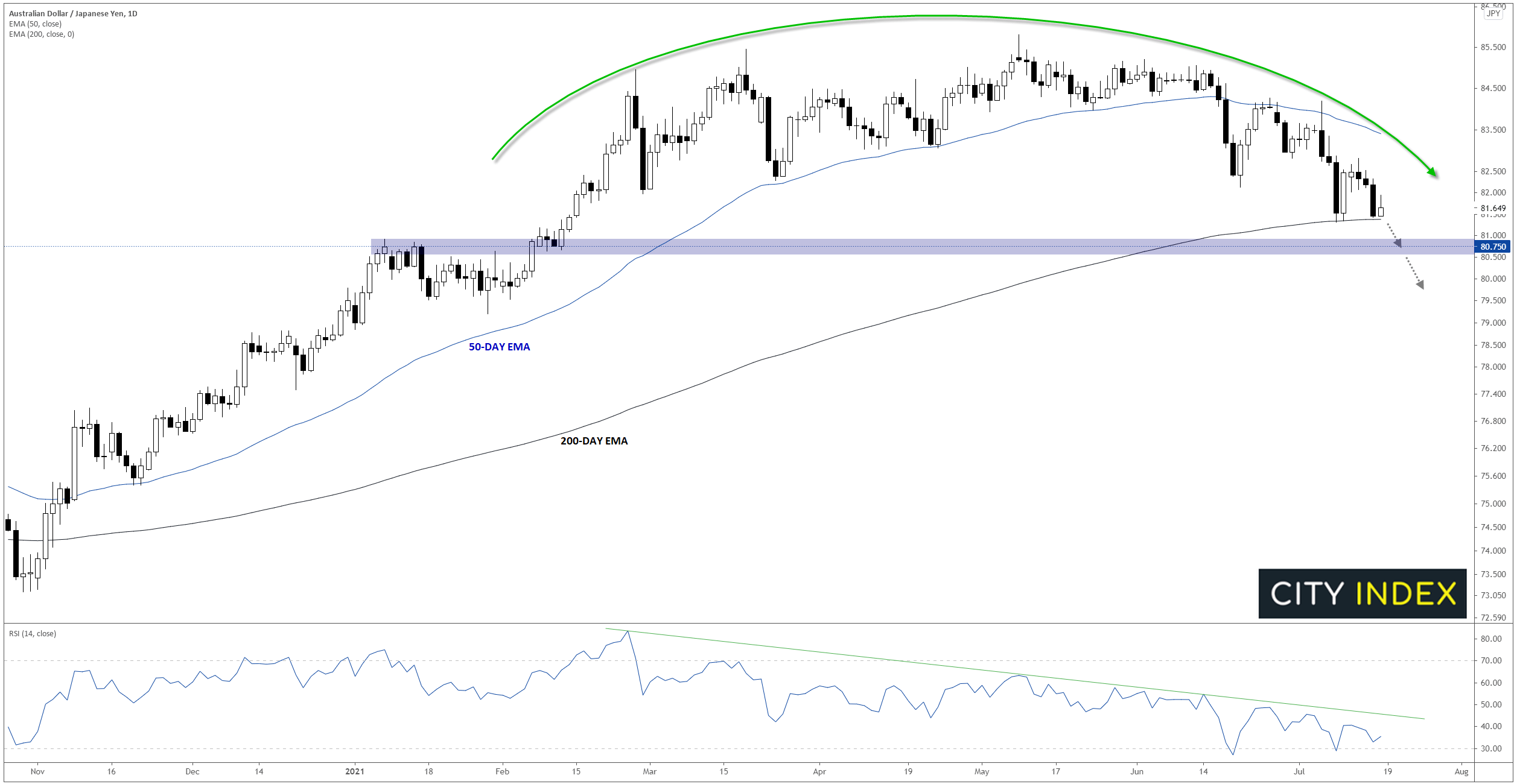

Looking at AUD/JPY, rates have clearly been rolling over for the past five months after stalling out in the mid-80s. Throughout that entire period, the pair’s 14-day RSI indicator has been trending lower, signaling declining buying pressure and “distribution” from buyers who profited from the pair’s post-COVID rally. Now, rates are on the brink of breaking below the 200-day exponential moving average for the first time this year, and Australian data comes in soft, or if risk appetite sours for any reason, AUD/JPY could break this key support level:

Source: StoneX, TradingView

To the downside, previous-resistance-turned-support at 80.75 may provide a modicum of support if reached, but it would likely take a prolonged consolidation and eventual break back above at least 82.50 to erase the near-term bearish bias on AUD/JPY.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.