RBA released their minutes yesterday, although it didn’t reveal much information regarding policy than we’d garnered from their statement; they’re not quite as dovish as they were leading into June’s latest cut, they ‘may’ cut rates again if need be but they remain glued to the incoming data.

Tomorrow’s employment set could be a key driver for the Aussie, particularly if it underwhelms. With lower rates being justified to help speed up employment growth (and therefor wages and inflation), this data set could be the difference between RBA remaining sat on the sidelines again or cutting for a 3rd time this year. And with those expectations, it could take AUD.

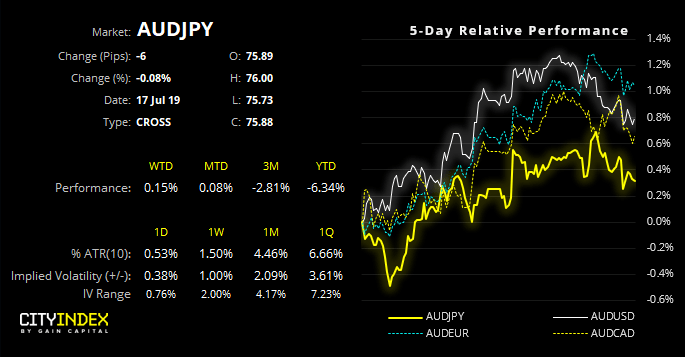

For today’s video we take a look at AUD/JPY, which shows two potential (and opposing) patterns whilst implied volatility rises ahead of realised volatility.