AUD/JPY has 70.00 in its Crosshairs as Coronavirus Fears Continue

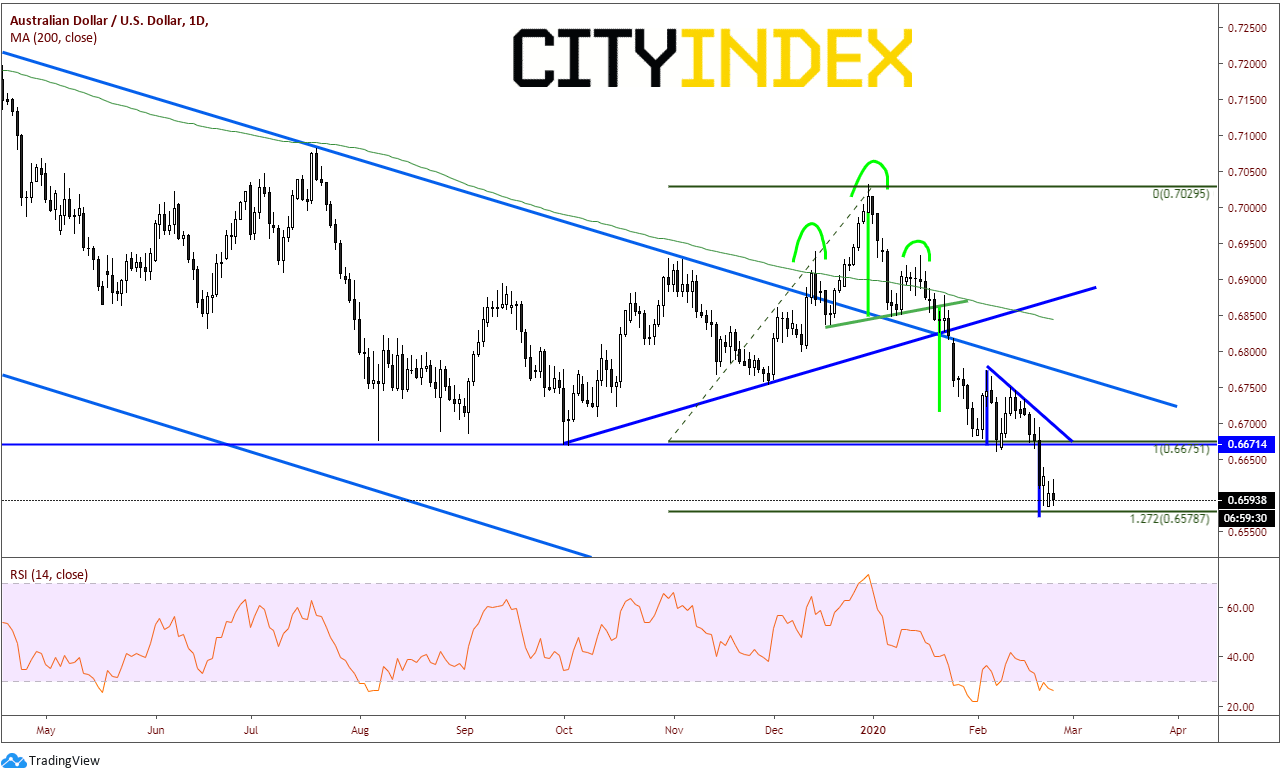

After yesterday’s bloodbath in the equity markets due to coronavirus fears and the selloff in XXX/JPY after recoupling with stocks, where does that leave the Australian Dollar? Australia’s economy is closely tied to that of Chinas. As output from China continues to slow, demand for goods and services China needs from Australia will slow, which will lead to a lower price of the Australian Dollar. AUD/USD has already been under pressure, as price came within 10 pips of our target from the triangle breakdown and the 127.2% Fibonacci extension from the lows on September 30th, 2019 to the highs on December 31st near .6878.

Source: Tradingview, City Index

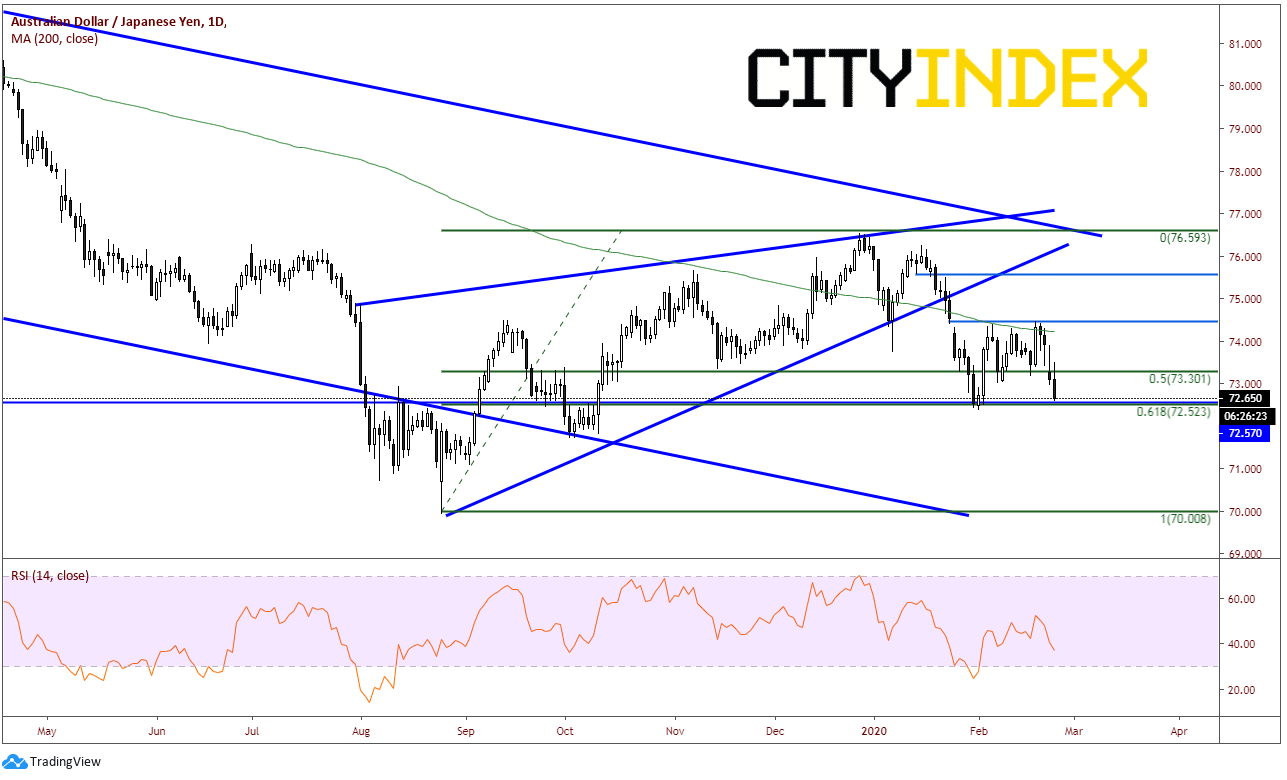

With AUD/USD moving lower, and USD/JPY moving lower, what does that mean for the cross currency, AUD/JPY? One would think this pair may be “The worst of the worst”. The pair had had broken lower out of the rising wedge and below the 200 Day Moving Average on January 24th. When the it reopened on January 27th, price gapped lowed and moved to support hear 72.50. After filling the gap last week, price is currently testing the lows at 72.50, which was the 61.8% retracement from the August 26th , 2019 lows to the December 27th highs. If price breaks through here, it could quickly move down to 70.00 which is the target from the breakdown of the rising wedge, which is 250 pips lower.

Source: Tradingview, City Index

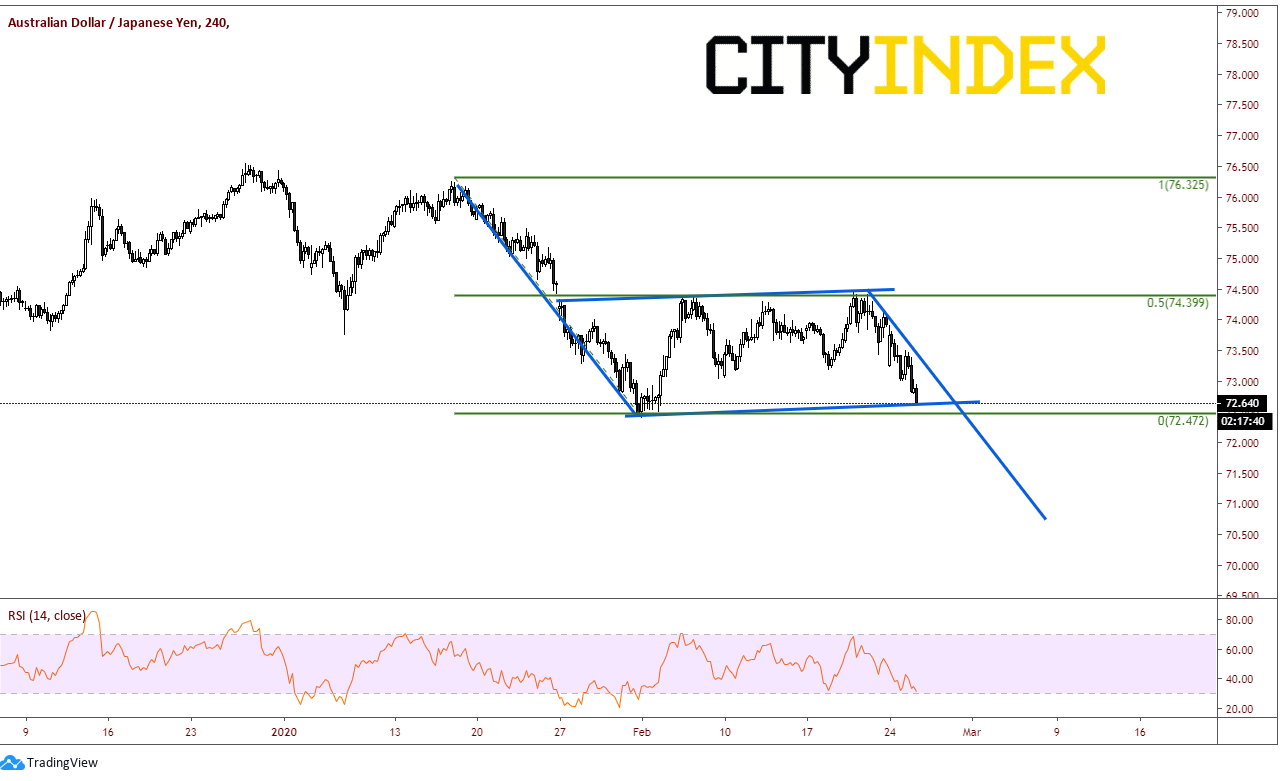

Let’s not get too ahead of ourselves just yet. On a 240-minute time frame, AUD/JPY has been in a flag formation since January 16th from 76.32 down to 72.47 on January 31st. After retracing 50% of that move, price is once again testing the lows and could potentially break lower out of the flag formation. The minimum price target for the breakdown of the flag is 70.75.

Source: Tradingview, City Index

70.75 is the first target from the breakdown of the flag formation and 70.00 is the next target from the rising wedge formation. If more and more negative headlines come out regarding the spread in the number of cases and deaths of the coronavirus, this pair may lead the way.