With key U.S. equity markets out overnight for a holiday, the lead for traders in the Asian time zone has come from a warning from Apple that it was unlikely to meet its revenue guidance in the March quarter and the RBA Boards February meeting minutes.

Apples warning is a direct result of the impact of coronavirus and comes as data released this morning showed the rate of new coronavirus infections has continued to fall both in the epicentre Hubei and the rest of China. Assuming a similar rate of decline in new infections in the coming days, by next week the number of new daily cases will be minimal and confirm the rate of new infections peaked two weeks ago.

While some disruption to Apples revenues was expected, the impact has been worse than feared. According to Apple the impact will last longer than anticipated “we are experiencing a slower return to normal conditions than we had anticipated.”

Apple shares have been a pivotal player in the strong start to the year for U.S. equity markets and in light of this, it’s not surprising today's warning has prompted a modest fall in S&P500 futures and ushered in a tone of mild risk aversion across Asia.

Compounding the risk aversion move for AUDJPY, the release of the RBA minutes for February showed the bank retains a firm easing bias, particularly if the labour market was to deteriorate. A very good reason why Thursdays Australian Labour force report will be closely watched.

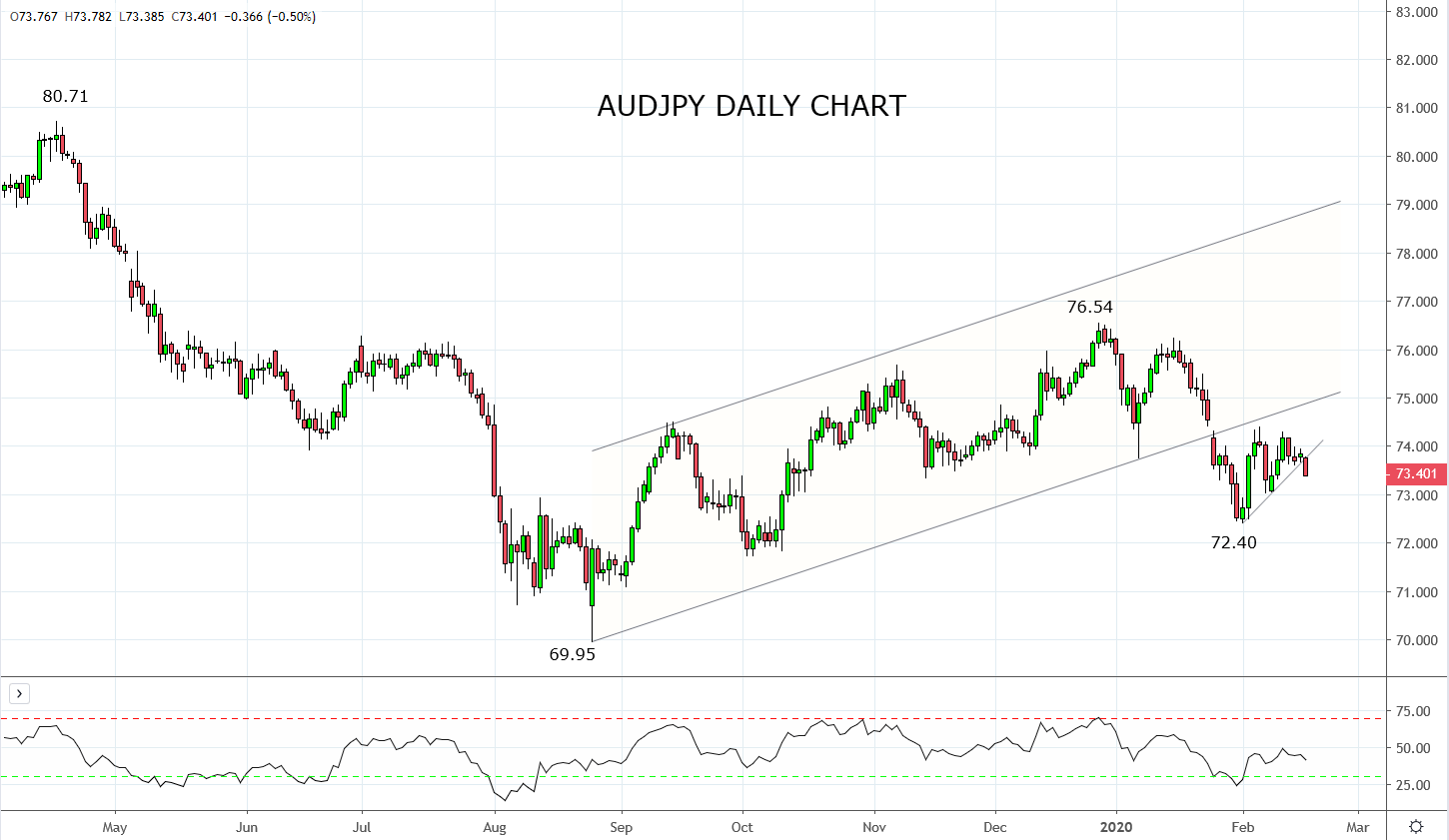

As can be viewed on the chart below, AUDJPY slipped out of a corrective trend channel in late January trading to a low of 72.40. Despite best attempts to recover the lost ground in February, today's double impact has resulted in AUDJPY breaking short term trendline support and recent lows 73.60.

This break should set up a retest of last weeks 73.00 low, although it will probably take a weaker than expected Labour force report to see AUDJPY break the year to date lows.

Source Tradingview. The figures stated areas of the 18th of February 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation