Early next week features some key releases from Australia, including the minutes from the last Reserve Bank of Australia (RBA) monetary policy meeting in early February, and the quarterly Wage Price Index. On February 6th, the RBA left interest rates unchanged as widely expected, marking a full year-and-a-half without any rate changes. The central bank is not expected to raise interest rates until either late this year at the earliest, or possibly next year. The RBA’s recurring concerns about a strong Australian dollar is one of the factors precluding a more immediate rate hike.

Meanwhile, the US Federal Reserve is widely expected to raise interest rates again at its next meeting in March. This may especially be the case since US indicators have recently shown a greater-than-expected increase in inflation, and US government bond yields have remained elevated near new multi-year highs. This monetary policy divergence between the RBA and Fed is potentially a pressuring factor for AUD/USD, though expectations of higher US interest rates have thus far been unable to provide any meaningful boost for the heavily oversold US dollar.

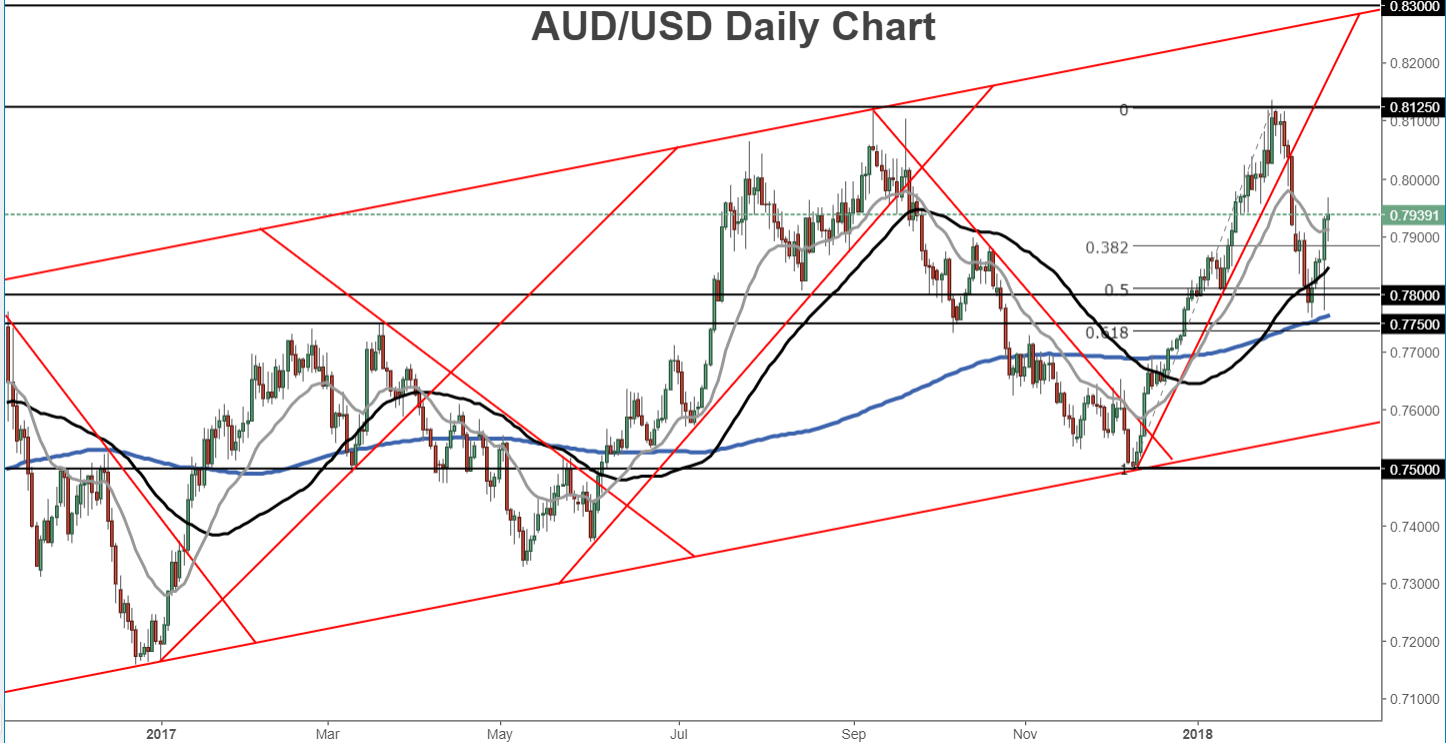

From a technical perspective, AUD/USD has been on the rebound for the past week – mostly due to resumed weakness in the US dollar – after the currency pair dropped precipitously during the first week of February. That drop brought AUD/USD down to approach a key support target around the 0.7750 level before the current rebound. Amid the noted Australian releases early next week, any resumption of weakness in the Australian dollar and/or relief rebound for the beleaguered US dollar, could have the potential to pressure AUD/USD back down towards that 0.7750-area target. Any extended breakdown below 0.7750 would be a key technical event that could lead to significantly further losses for the currency pair.