AUD USD rises to approach major resistance level

AUD/USD (daily chart) has risen once again to approach key resistance around the 0.9400 resistance level, a high that has not been reached for almost […]

AUD/USD (daily chart) has risen once again to approach key resistance around the 0.9400 resistance level, a high that has not been reached for almost […]

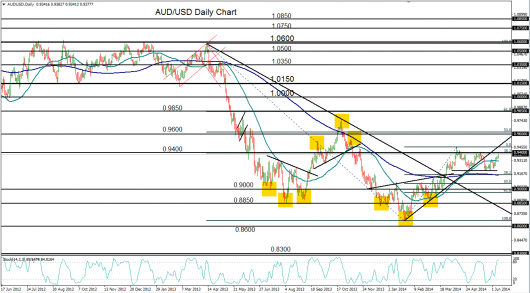

AUD/USD (daily chart) has risen once again to approach key resistance around the 0.9400 resistance level, a high that has not been reached for almost a month, since mid-May. This rise occurs after the currency pair rebounded in late May from the major 0.9200 support level, which has effectively served as solid support since the beginning of April. With this support in place, AUD/USD has formed a short-term base and a relatively tight trading range roughly between 0.9200 and 0.9400.

AUD/USD began to trade in this range after falling from its 2014 high of 0.9460 in early April, and then dropping further to break down below a key uptrend line that had extended back to January’s three-and-a-half year low of 0.8659.

Currently, with the 0.9400 resistance level directly to the upside, the currency pair could soon attempt to cross a major barrier. Any strong breach of the 0.9400 level could place AUD/USD on the road to recover the bullish trend that has been in place since January. A further break above the noted 0.9460 high should target the 0.9600 level once again. To the downside, the 0.9200 level continues to serve as major support within either a continued trading range or resumed recovery scenario.