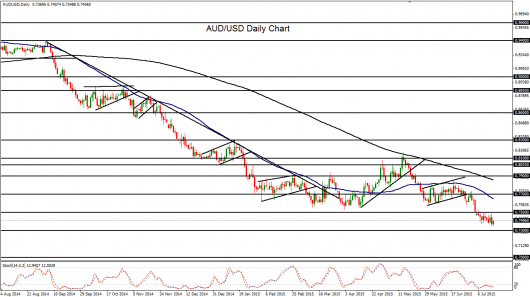

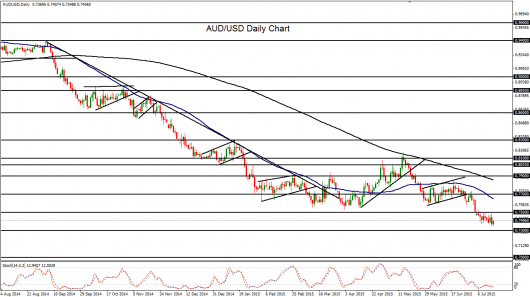

With commodity currencies like the Canadian dollar, Australian dollar and New Zealand dollar suffering substantial losses recently, and the US dollar continuing to dominate against most major currencies, AUD/USD (daily chart shown below) dropped to a new six-year low slightly below 0.7350 on Thursday before rebounding and paring its losses. This is the lowest the currency pair has fallen since May of 2009.

After the US dollar was given yet another boost on Wednesday both from Federal Reserve Chair Janet Yellen’s reiteration of a likely 2015 rate hike as well as a positive Producer Price Index report, the US Labor Department said on Thursday that unemployment claims fell more than expected last week. This provided an indication of a relatively robust job market in the US and served to nudge the dollar higher.

From the Australian dollar side, its correlation with plunging gold prices has helped push the currency to new lows. Gold dropped to a four month low on Thursday, re-testing major support around the 1142 level. Furthermore, Reserve Bank of Australia Governor Glenn Stevens stated last week that further depreciation of the Australian dollar was necessary, especially given the drop in commodity prices.

After its drop below the major 0.7500 psychological support level in early July, AUD/USD has spent the past two weeks consolidating within a bearish pattern below 0.7500. This pattern has confirmed a continuation of the year-long downtrend that has been in place since the 0.9500-area high in July of last year.

Despite its rebound on Thursday after establishing the new six-year low, AUD/USD continues to carry a strong bearish bias from both a technical and fundamental view. If the currency pair continues to trade below the key 0.7500 resistance level, the primary downside target is at the 0.7300 level, followed by the 0.7000 psychological support level.