AUD USD poised to continue downtrend after rebound

AUD/USD (daily chart shown below) rebounded modestly back up to its 50-day moving average on a pullback this week in US dollar strength. This occurs […]

AUD/USD (daily chart shown below) rebounded modestly back up to its 50-day moving average on a pullback this week in US dollar strength. This occurs […]

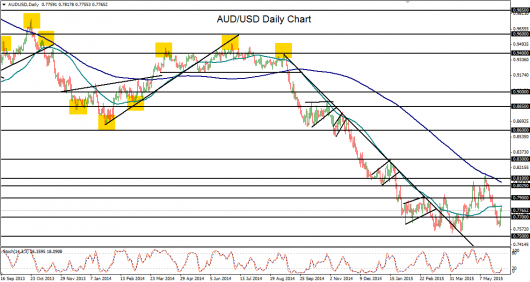

AUD/USD (daily chart shown below) rebounded modestly back up to its 50-day moving average on a pullback this week in US dollar strength. This occurs after the currency pair plummeted for the prior two weeks, approaching the five-year low of 0.7532 that was established in early April.

The sharp drop in the past two weeks since mid-May’s high of 0.8162 has renewed the bearish trend momentum that had been in place since mid-year last year.

After establishing April’s noted multi-year low, AUD/USD rebounded for the next month and a half. This partial recovery hit the noted mid-May high of 0.8162, right around the key 200-day moving average, before retreating from resistance into the recent two-week slide.

Tuesday’s rebound, driven primarily by US dollar weakening, reached a tentative high right at the 50-day moving average on Wednesday before falling back.

With a deeply entrenched bearish trend as well as short-term weakness continuing to weigh down the currency pair, AUD/USD could well be poised for further downside.

Any re-break below the 0.7700 level should push the currency pair back down towards its original 0.7500 support target, which would confirm a continuation of the bearish trend. Further to the downside on any break below 0.7500 lies the next major support target at 0.7300.