AUD USD further advance impeded by resistance

The AUD/USD (daily chart) for the past two weeks has been unable to make a significant upside breach of key resistance around the 0.9075 level, […]

The AUD/USD (daily chart) for the past two weeks has been unable to make a significant upside breach of key resistance around the 0.9075 level, […]

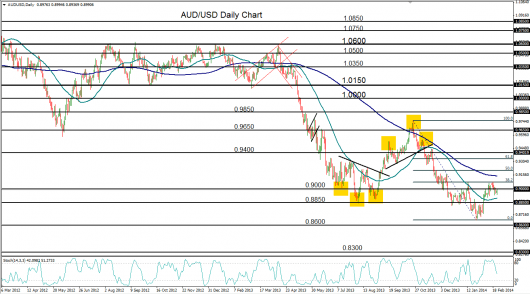

The AUD/USD (daily chart) for the past two weeks has been unable to make a significant upside breach of key resistance around the 0.9075 level, which was first established as a key high in mid-January. There was a close approach of that resistance level two weeks ago, followed by a slight breach of it last week, before the currency pair failed and retreated to the downside. AUD/USD’s attempt to emerge from late January’s three-and-a-half-year low of 0.8659 comes within a strong bearish trend, currently still intact, which extends back to the April 2013 high near 1.0600. Two opposing scenarios could likely occur for AUD/USD that should provide further directional guidance for the pair.

First, the noted 0.9075-area resistance represents a clear 38% Fibonacci retracement of the last major downtrend – from October’s 0.9757 high down to January’s noted 0.8659 long-term low. Continued failure to breach this 0.9075-area resistance could signify a move towards continuation of the entrenched bearish trend, with further downside support targets around 0.8600 and then 0.8300. The second scenario shows a potential inverse head-and-shoulders pattern (left shoulder at mid-December’s low, head at late January’s long-term low, and right shoulder yet to be determined), which could portend a potentially disruptive bullish run with upside resistance targets around 0.9150 and then 0.9300.