AUD USD drops sharply below trading range

AUD/USD (daily chart shown below) has dropped sharply below its previous trading range to hit a new five-month low. This prolonged trading range had been […]

AUD/USD (daily chart shown below) has dropped sharply below its previous trading range to hit a new five-month low. This prolonged trading range had been […]

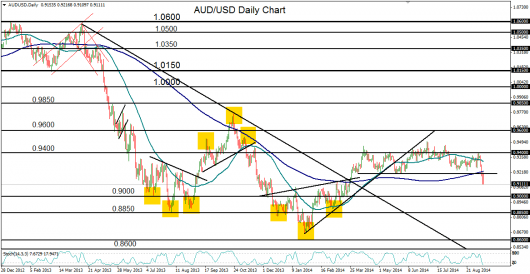

AUD/USD (daily chart shown below) has dropped sharply below its previous trading range to hit a new five-month low. This prolonged trading range had been in effect since early April, when the currency pair established major range support around the 0.9200 level.

Since that support level was established, AUD/USD fluctuated in a range for a full five months, ultimately hitting a 2014 high just above 0.9500 in early July, before retreating. Since that year-to-date high was established, price action drifted steadily to the downside before dropping sharply this entire trading week and breaking below the range support within the past two days.

In breaking below support, the currency pair has also begun trading below its pivotal 200-day moving average, a condition which has not occurred since March.

AUD/USD has now dropped by almost half of its initial 2014 rise from the January 0.8659 multi-year low up to the noted July 0.9500-area high.

In the event that the currency pair continues to trade below its 200-day moving average, the next major support target to the downside resides around the 0.9000 psychological level, followed by the 0.8850 support level.

Tentative upside resistance now resides around the 0.9200 previous range support level.