AUD USD advances towards 2014 highs

AUD/USD (daily chart) has advanced to closely approach its year-to-date high of 0.9460, which was established in early April. For almost three months, the currency […]

AUD/USD (daily chart) has advanced to closely approach its year-to-date high of 0.9460, which was established in early April. For almost three months, the currency […]

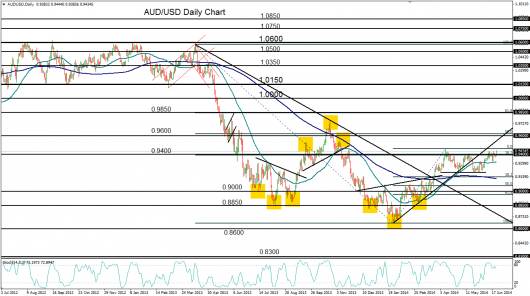

AUD/USD (daily chart) has advanced to closely approach its year-to-date high of 0.9460, which was established in early April. For almost three months, the currency pair has been entrenched in a trading range between the key 0.9200 support level to the downside and the noted 0.9460 high to the upside. The current advance within this trading range occurs on a month-long rise from the 0.9200 support that has gone on to break out above the 50-day moving average as well as tentatively above the 0.9400 resistance level.

Currently, with the 0.9460 year-to-date high directly to the upside, the currency pair could soon attempt to cross a major barrier. Any strong breach of the 2014 high could place AUD/USD on the road to recover the bullish trend that has been in place for the past five months since late January. In the event of this breakout, AUD/USD could rise to target the major 0.9600 level objective once again. To the downside, with any further range trading below the 0.9460 high, the 0.9200 level continues to serve as major support.