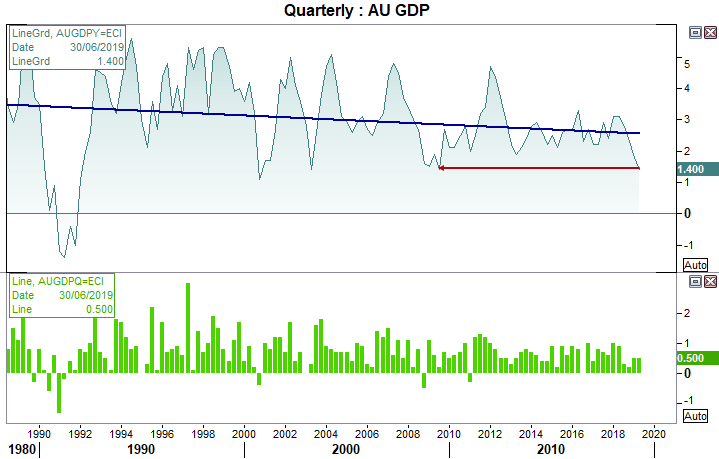

Despite the multi-year low for annual GDP, it came in around expectations to help lift the Aussie from its lows.

Q3 GDP

- 1.4% YoY

- 0.5% MoM

Yesterday we noted that RBA removed any reference to GDP levels in their August statement, which appears to have been a shrewd move. Previously they had pencilled in growth to be ‘around’ 2.5% for 2019; currently average growth for 2019 is just 1.6%, both way below their forecast and trend. Moreover, with annualised growth at just 1.4%, GDP is its lowest since Q3 2009 and clearly beneath trend. Whilst markets are pricing in the potential for a cut this year, they’re still not confident of a cut at their next meeting. That said, expectations for a cut would likely be brought forward if employment data disappoints on the 19th of September.

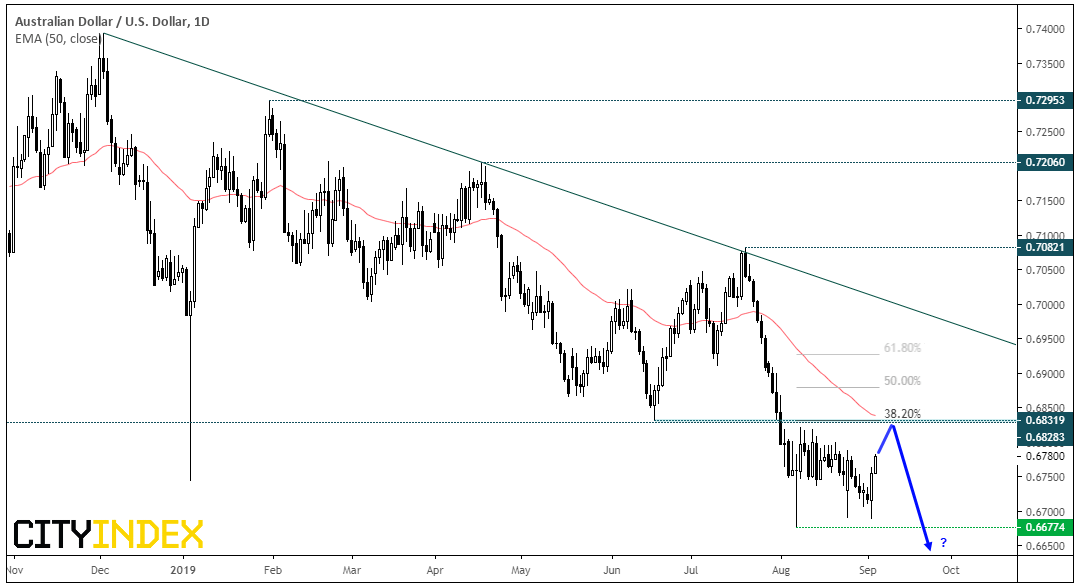

For now, AUD/USD is enjoying its corrective rebound and hit a 6-day high simply because GDP hit expectations. Moreover, the USD rally has hit a speed bump following yesterday’s ISM contraction, which is allowing the Aussie a little more headroom.

- Yesterday’s bullish outside day suggests an interim low could be in place, and intraday bulls could seek long positions towards 0.6832 resistance.

- For now, we favour current price action to be corrective against the bearish trend and possible part of a flat correction (between 0.6677 and 0.6832)

- This could allow bears to fade into moves below 0.6832 on the daily chart. A momentum shift around these levels (ie a strong rejection of the level) suggests the correction is over and AUD/USD could head for a break to new lows

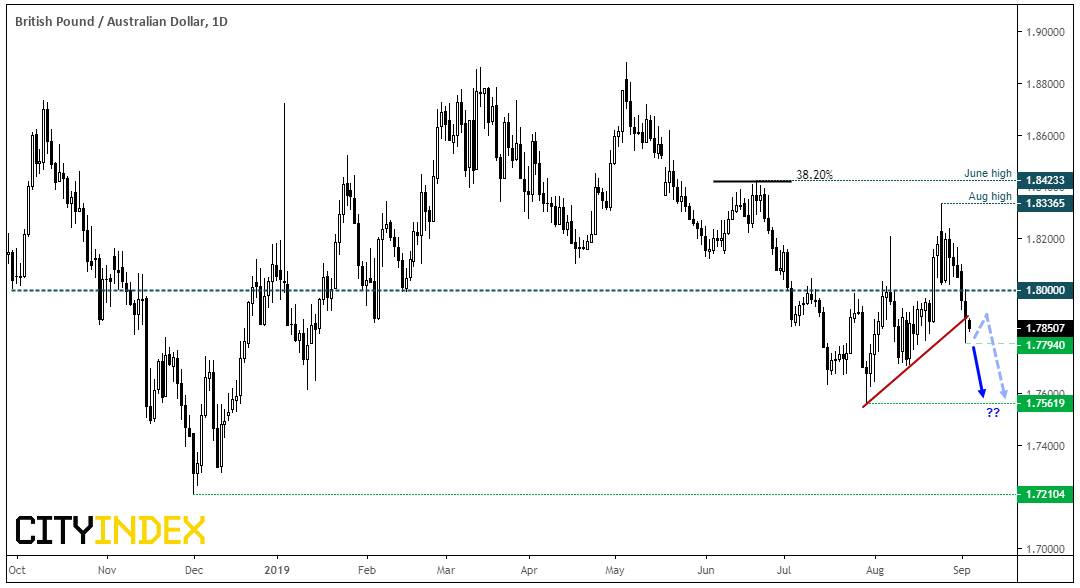

Brexit woes continue to weaken the British pound overall, yet headline risks remain for both directions. That said, the daily structure on GBP/AUD suggests we’ve seen the end of a correction and could be headed back towards the 1.7562 low (and possible lower if the trend holds.

- The daily trend remains bearish below 1.8336, although the break of its correction line suggests its ready to resume its downtrend

- 1.8000 is a pivotal level, being a round number and having acted as support and resistance previously, so we’d seek bearish setups beneath this 1.8000

- This could allow bears to fade into intraday rallies below 1.8000, or wait for a break of yesterday’s low before assuming trend continuation.

- Once caveat with the broken correction line is that we’ve not seen a daily close beneath it, even though current prices are below it. So, one could use a daily close as added confirmation it has broken out.