AUD overtakes NZD on a breakout! AUD/NZD

As mentioned in the European Open, Australia released its February employment change. The print was +88,700 jobs, beating expectations! Almost all the jobs were fulltime jobs. In addition, the Unemployment Rate dropped from 6.4% to 5.8%! Just as the Canadian jobs report and the US NFP report showed earlier in the month, employment data is getting better. A few hours before the Australian employment change was released, New Zealand released data of its own. Although outdated, New Zealand released its Q4 2020 GDP Growth Rate. The print was -1% MoM vs an expectation of +0.1% MoM. The result was a firmer AUD/NZD!

AUD explained: a guide to the Australian Dollar

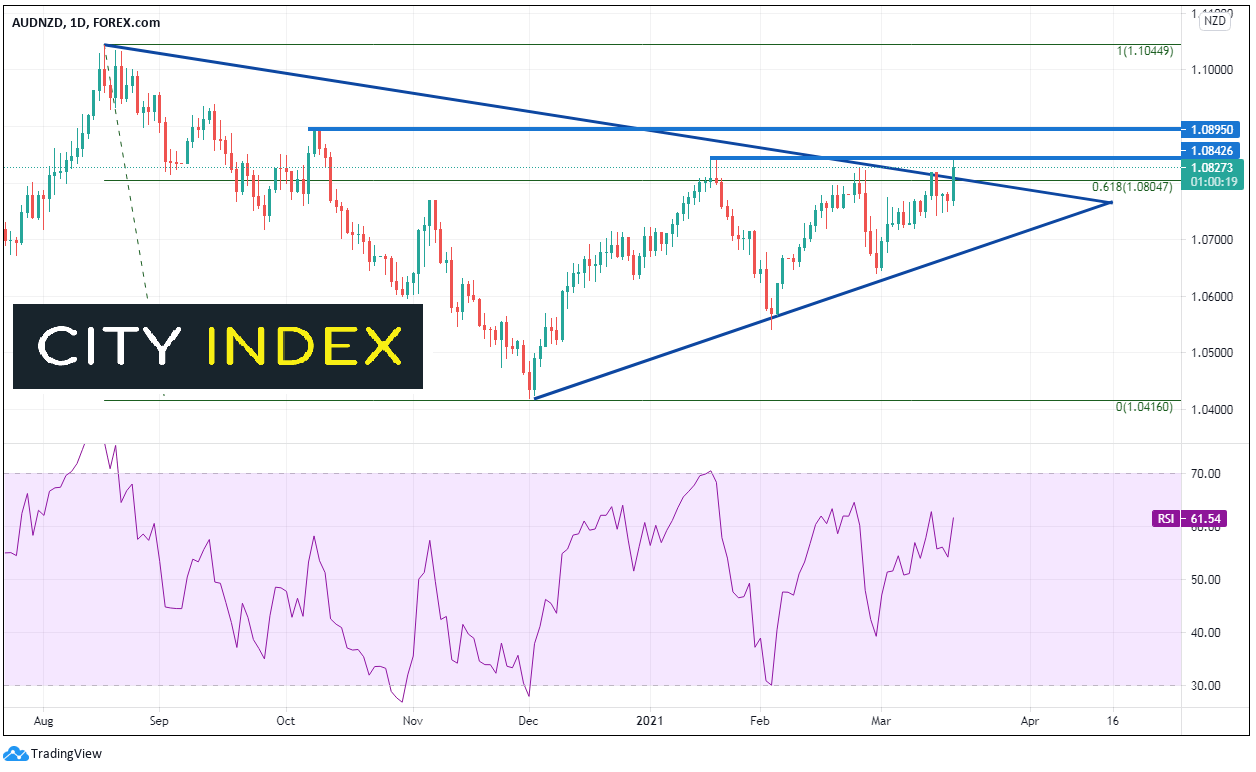

Since August 18th, 2020, AUD/NZD has been trading in a symmetrical triangle on a daily timeframe. In addition, since January 19th, as price coiled to the apex of the triangle, the pair held beneath the 61.8% Fibonacci retracement level from the highs of August 18th to the lows of December 1st, 2020, near 1.0804. Earlier, AUD/NZD broke above the top of the downward sloping trendline from the triangle and came within 2 pips of the January 19th highs near 1.0842!

Source: Tradingview, City Index

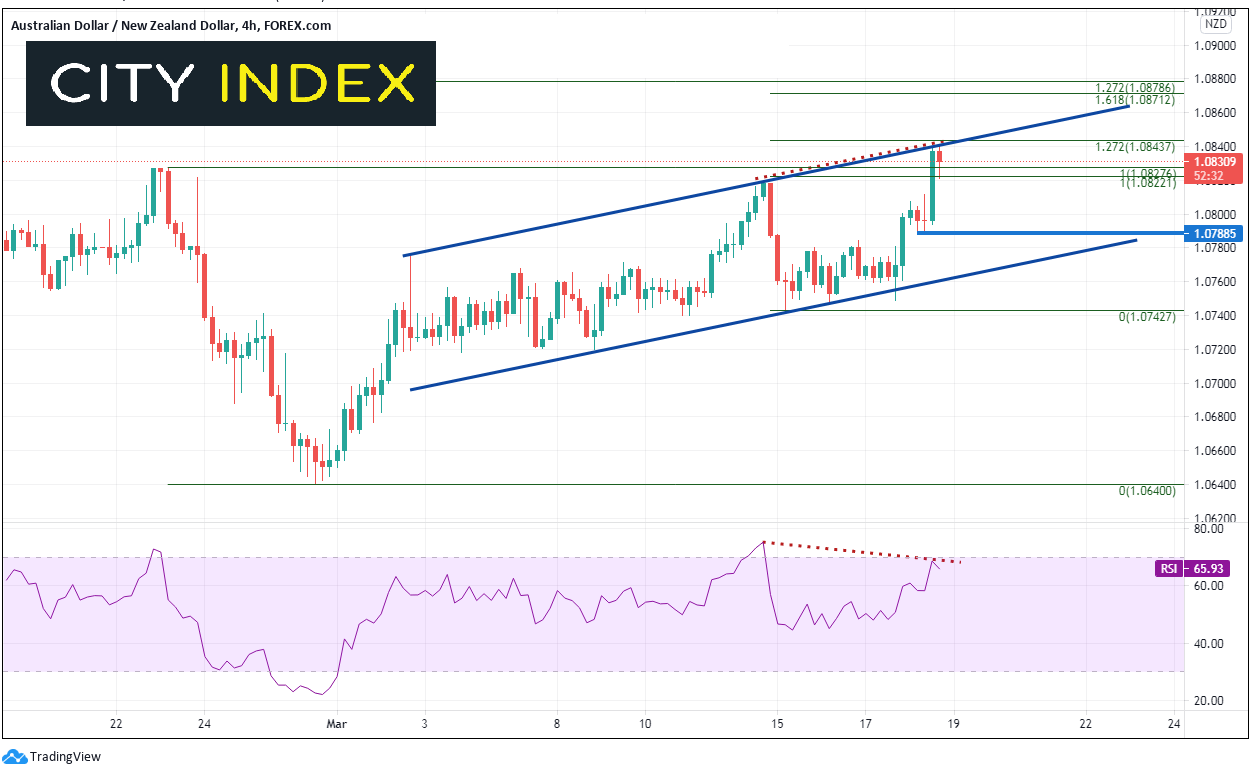

On a 240-minute timeframe, AUD/NZD ran into resistance at the 127.2% Fibonacci extension from the March 15th highs to lows, as well as a top, upward sloping channel trendline dating back to March 2nd near 1.0843. If price can break through there, the next resistance area is between 1.0870 and 1.0880, which is a confluence of Fibonacci extensions: the 161.8% from the previously mentioned timeframe and the 127.2% Fibonacci extension from the February 23rd highs to the February 26th lows. Above there, horizontal resistance crosses just below 1.0900 at the October 20th highs.

Source: Tradingview, City Index

If price does pullback, support is at the day’s lows near 1.0789, then the bottom, upward sloping channel trendline near 1.0760 and then the March 15th lows of 1.0742.

In a few hours, Australia will release Preliminary retail sales data for February. Expectations are +0.4% vs +0.5% in January. If the number is better than expected, AUD/NZD may continue to move higher!

Learn more about forex trading opportunities.