For all the doom and gloom headlines surrounding the rise in the unemployment rate, there were some encouraging components within the jobs report.

Headline employment driven by gains in part-time jobs rose by 201.8k, double the consensus expectations of 100k. The participation rate rose to 64.0% from 62.7% and can be interpreted as a sign that people have been encouraged to re-enter the workforce, following the easing of restrictions and faster than expected reopening of the economy.

Offsetting this not all of those re-entering the labour force were able to find jobs explaining why the unemployment rate rose from 7.1% to 7.4%. The true unemployment rate would likely be well above 10% if all of the 665k workers who left the labour force all together and those on employment benefits who technically remain “employed” yet worked zero hours were taken into account.

The recent lockdown of Victoria which accounts for about 25% of the labour force will be felt in next month’s jobs report and the prospect of this has overshadowed the encouraging developments outlined above. It has also limited the AUDUSD’s ability to make any impression against the recent .7064 high.

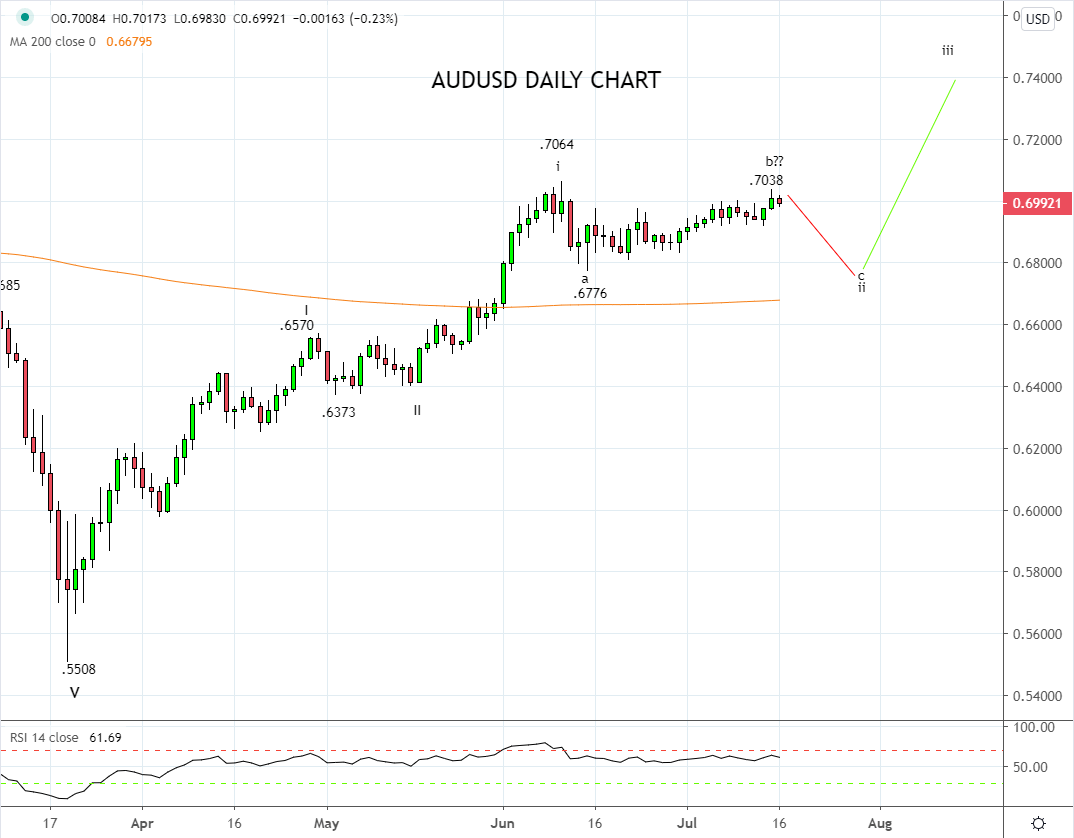

Technically the view remains while the AUDUSD trades below the June .7064 high it is at risk of another corrective leg lower towards the .6775/50 support zone, where I will look to be a be a buyer providing signs of stablisation emerge. A break of the near term support at .6965 would be the first indication that this pullback is underway.

Keeping in mind that should the expected pullback fail to materialize and the AUDUSD was to break above the .7064 high it would suggest the next leg higher towards .7300/.7500c has commenced and a more aggressive entry is required.

Source Tradingview. The figures stated areas of the 16th of July 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation