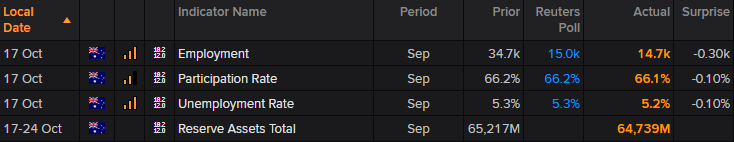

It was a positive surprise for AUD today with unemployment falling to 5.3% versus 5.2% expected. Jobs added didn’t quite hit expectations of 15k, but it was a net positive to see the headline number propped up by an increase in full-time jobs and reduction of pat-time (unlike the prior month). Participation rate also softened, although from a record high, but the number RBA will mostly be happy with is to see unemployment drop to 5.2%.

RBA still have an easing bias but the 1-month OIS has seen a slight reduction for a cut in November, which now sits at 32% probability. The 3-month is pricing in a 77% probability. Still, AUD is the strongest major of the session and some pairs show potential to extend gains.

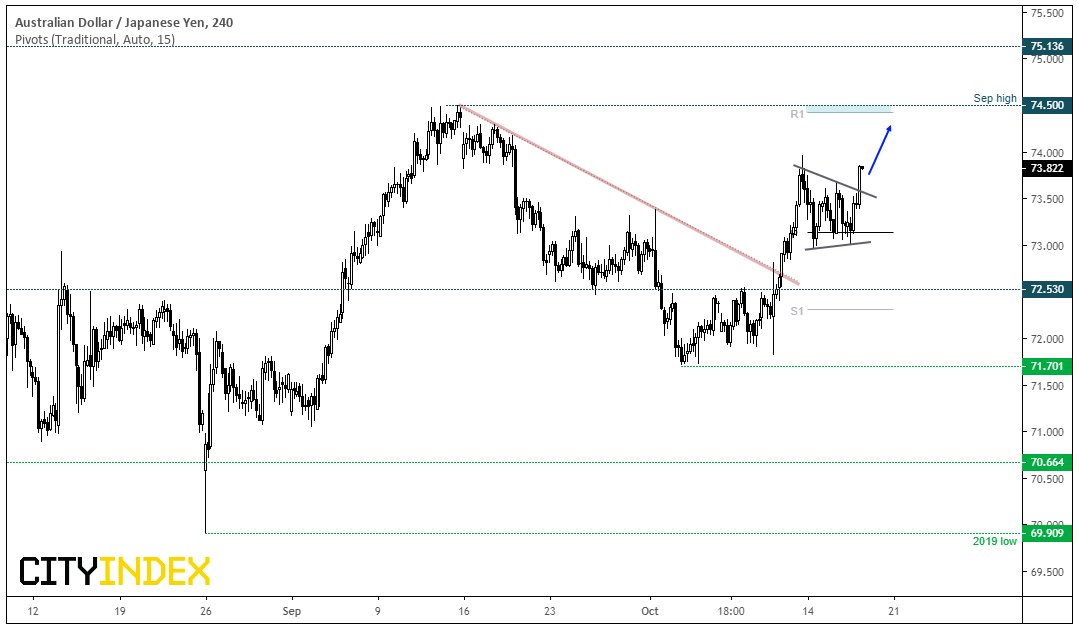

AUD/JPY: We can see on the four-hour chart that AUD/JPY has broken out of compression and looks set for a re-test of the 74.40/50 region. Support had been found around the monthly pivot and monthly R1 sits just off-of the September high. Given the rally from 71.74 has broken a correction line and now appears to be within a 5-wave move, bulls could look to buy dips on lower timeframes towards the resistance target. It’s debatable as to whether it will break above this level initially, given sentiment has been given a boost by Brexit (yet to be confirmed) and Trump’s ‘phase 1’ trade deal (also not yet confirmed). But for now, momentum clearly favours bullish setups for AUD crosses.

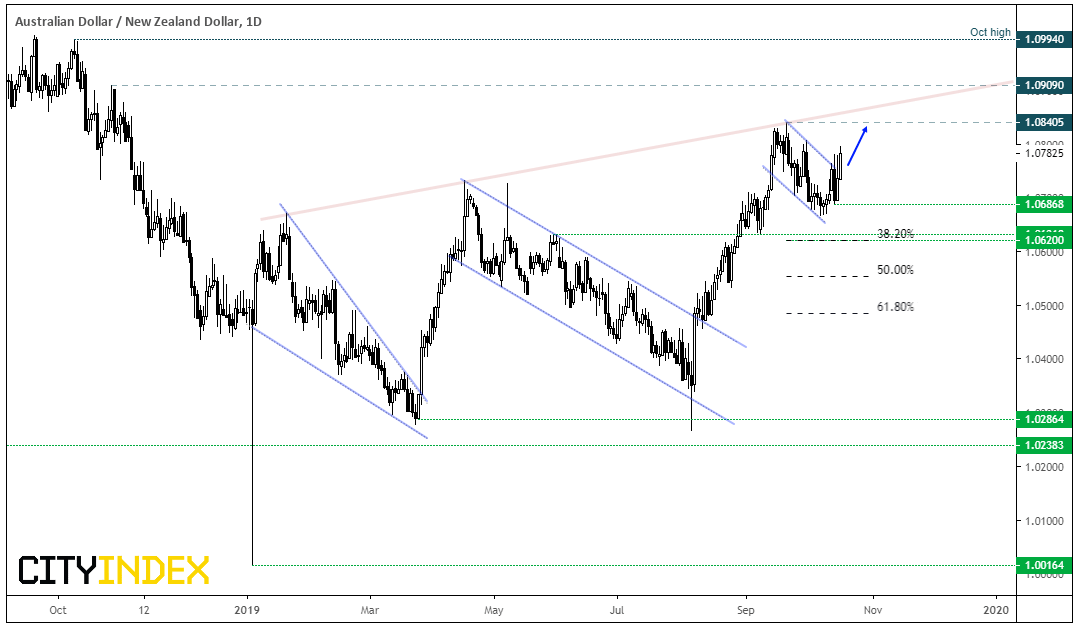

AUD/NZD: Since the prior analysis, a pullback within the bullish was seen with a bearish engulfing candle ahead of today’s breakout. Whilst this now reaffirms the low is in at 1.0666 (near the 50-day eMA), a higher low has been set to 1.0687 and AUD/NZD now appears set to head for a re-test and possible breakout towards 1.0910. However, take note of the rising resistance which could provide interim resistance, as it heads towards the 1.0900/10 target.

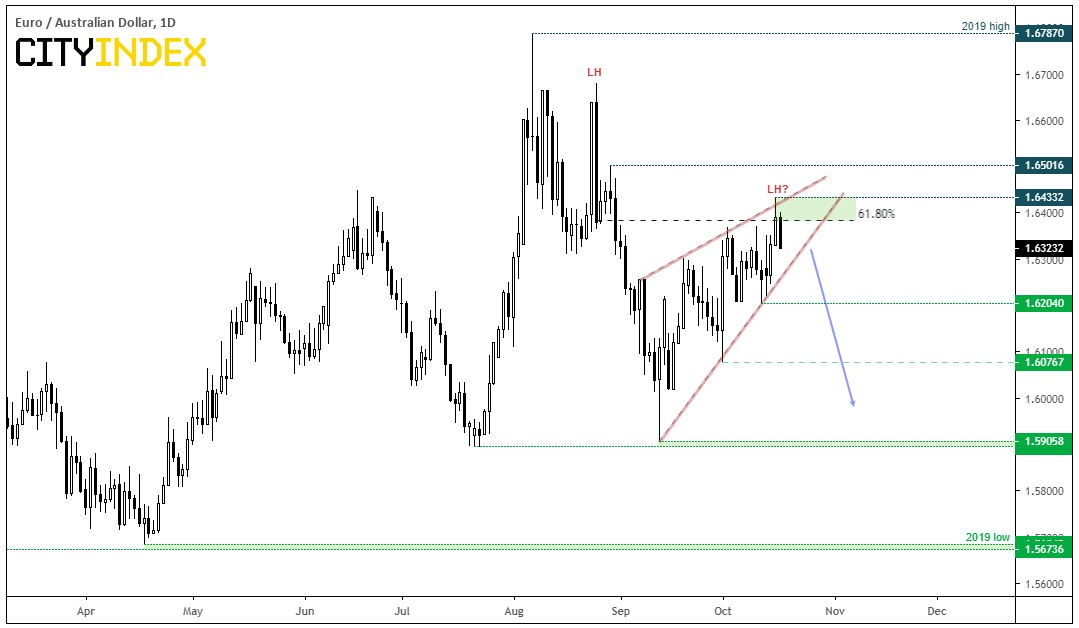

EUR/AUD: Since the prior analysis, another leg higher was seen into the region where a lower higher (LH) was pencilled in. It still appears that prices are coiling within a bearish wedge and its failed attempt to hold above the 61.5% Fibonacci retracement adds credence to this view. A bearish engulfing candle would be welcomed at the close and bears could perhaps consider a short to anticipate the high is in place. A more conservative approach is to wait for a break out of the wedge. If successful, the pattern projects a target around the base at 1.5906, although 1.6204 and 1.6078 could provide interim targets.

Related analysis:

RBA Discussed Keeping Cuts For A Rainy Day | AUD/EUR, AUD/NZD