AUD and NZD not Happy about Impeachment Inquiry

Its official: The transcripts of President Trump’s call with the President of Ukraine have been released! However, it may take some time for the various decision makers to comb through them and determine what exactly this means. In the meantime, AUD/USD and NZD/USD have been under pressure all day. Regardless as to what is actually in the transcripts, the Impeachment Inquiry into Trump does not bode well for a China-US trade deal. Why would China want to come to the table and negotiate with a President who may be impeached? So, as the possibility fades, restrictions and tariffs on China will continue. This means that China’s economy may continue to slow, and by association, so will the economies of Australia and New Zealand.

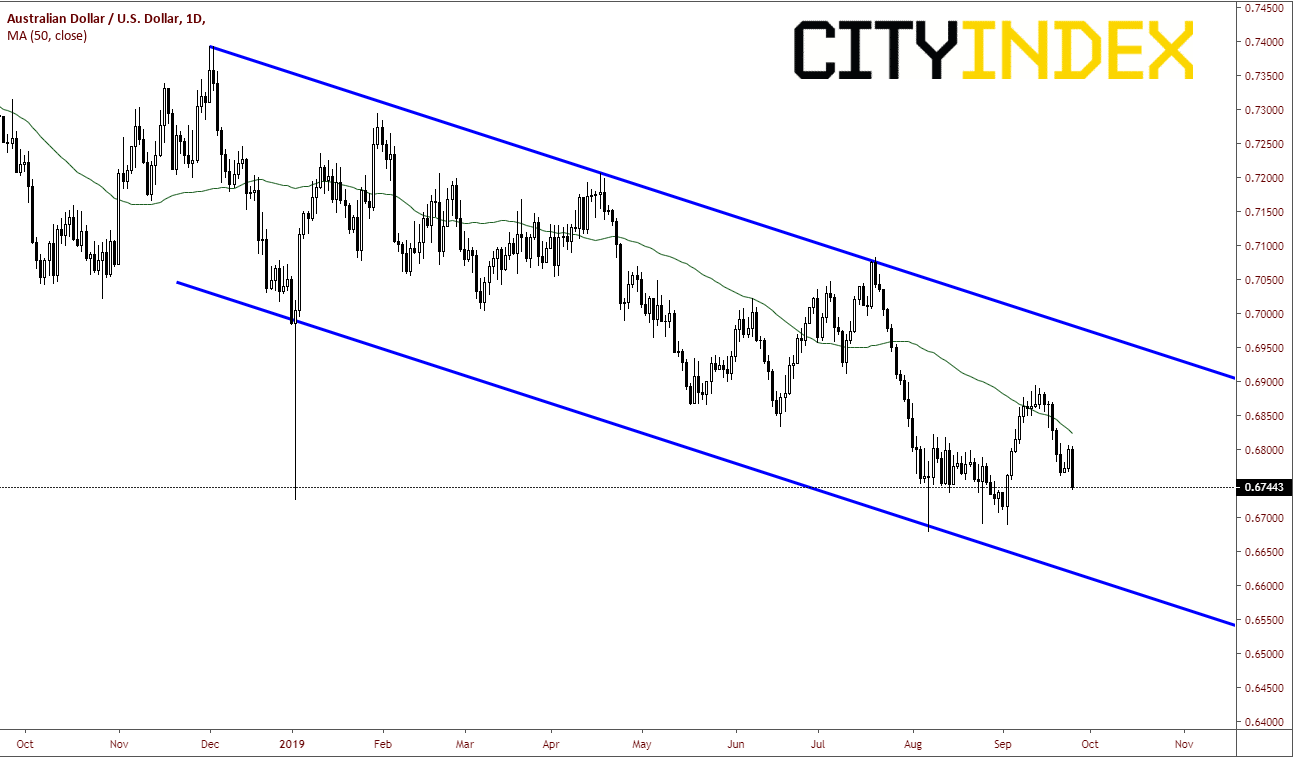

AUD/USD has been in a downward trend since January of 2018 (not shown). Currently, the pair is in the middle of a downward channel since December of 2018 (minus the false breakdown on January 3rd of this year), below the 50 Day Moving Average of .6820 and approaching the August 6th lows at .6750. Support below there comes in at .6700 near the bottom downward sloping trendline of the channel.

Source: Tradingview, City Index

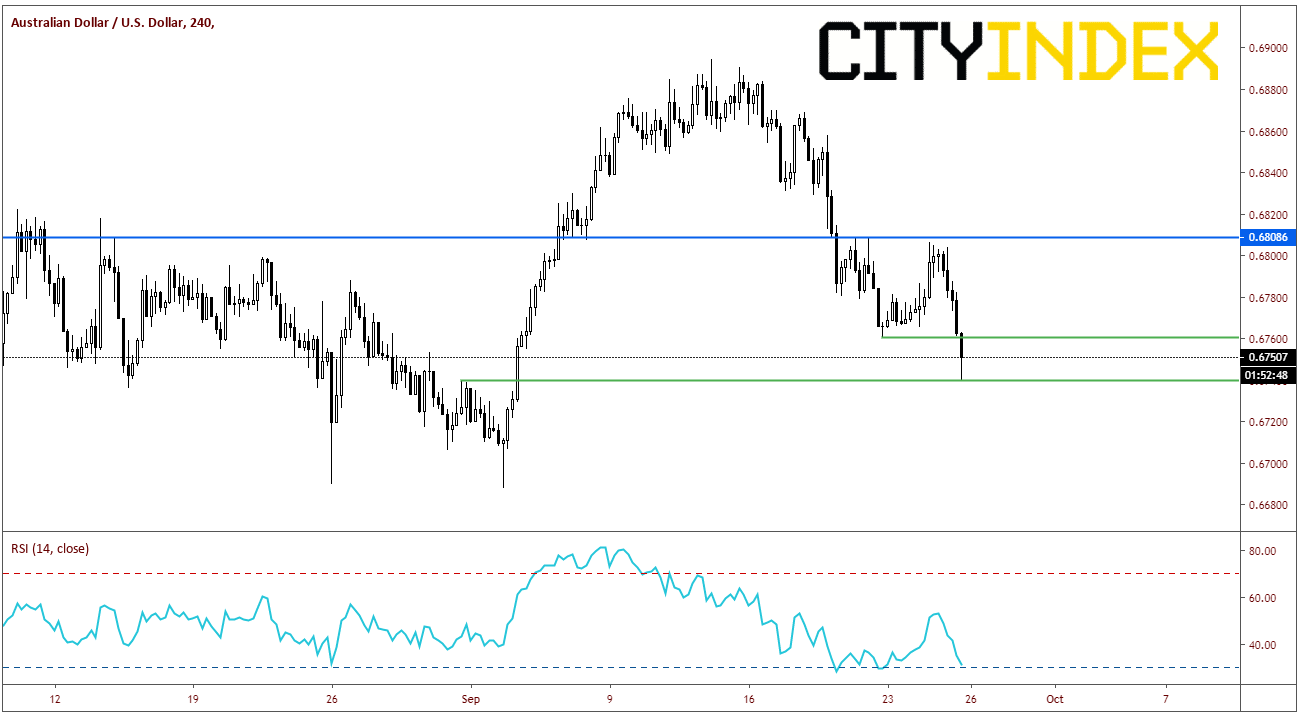

On a 240-minute timeframe, immediate horizontal support comes in at the days lows of .6740. First resistance is .6760. above there, the next meaningful resistance is the day’s highs ear .6800. The RSI is near oversold levels at 30, however is not below that level. This indicates there could still be room on the downside for AUD/USD to move.

Source: Tradingview, City Index

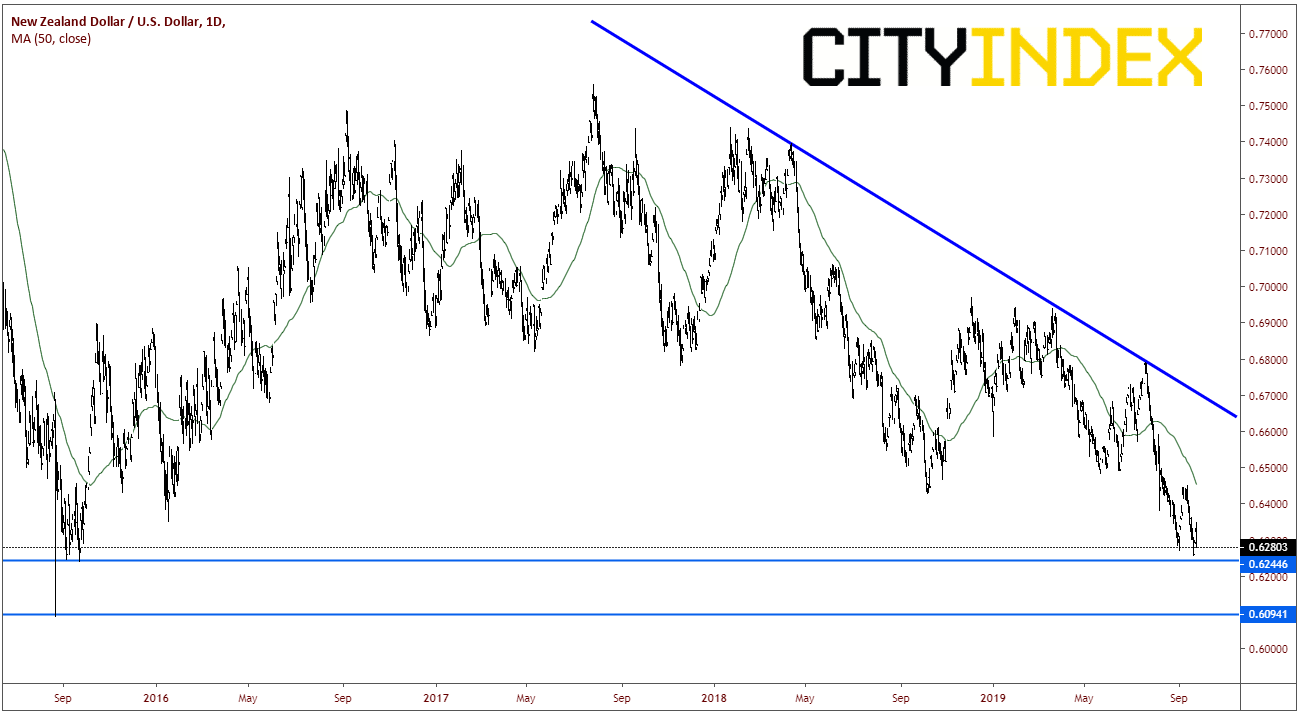

The RBNZ left rates on hold earlier (as expected) and they remain in the general work monetary policy view that scope for further fiscal and monetary stimulus remains “if needed”. No surprises. Therefore, the previous trend lower from July 2017 remains intact. The pair is currently testing the September 2015 lows near .6245. Although there is still time left in the day, NZD/USD is currently putting in a bearish engulfing candle as well.

Source: Tradingview, City Index

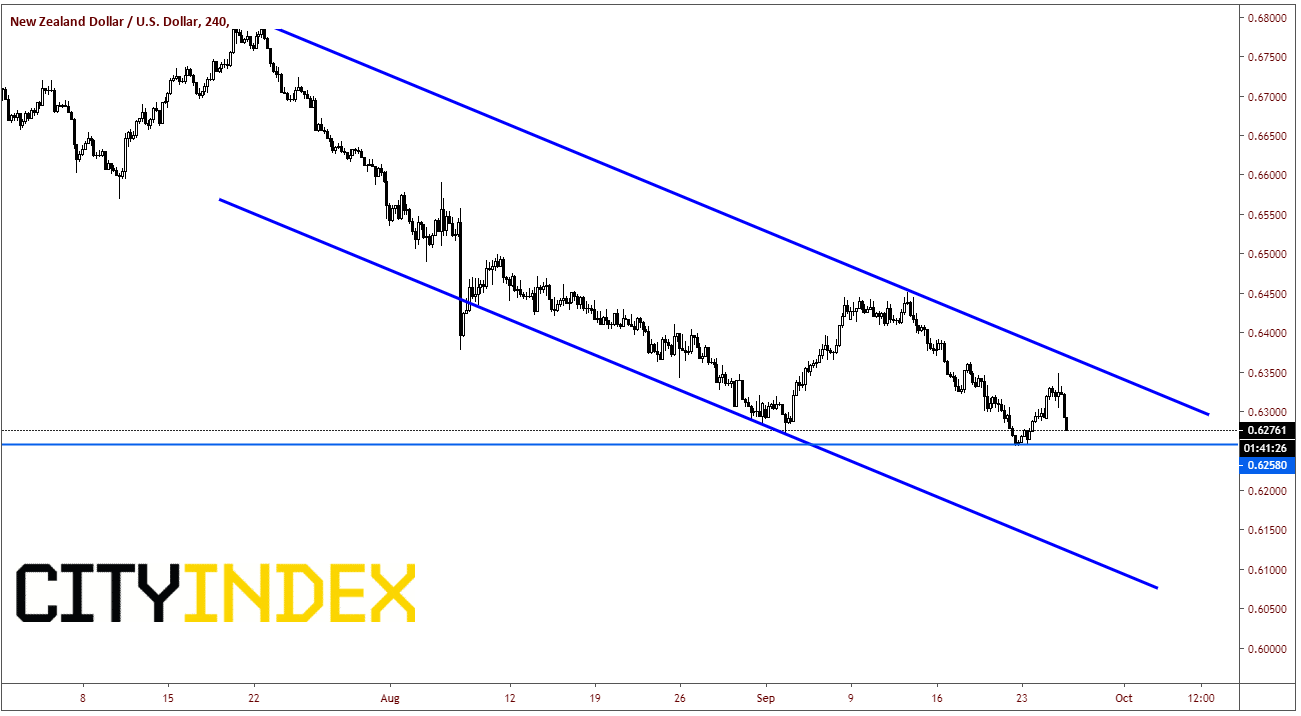

On a 240-minute chart, NZD/USD continues to put in lower lows and lower highs. Next support level is the lows from September 23rd near .6260. Resistance on the upside comes in at the day’s highs near .6350. Next resistance level is the downward sloping channel trendline at .6375.

Source: Tradingview, City Index