The rule of thumb definition for a recession is two consecutive quarters of negative GDP growth.

In Q1 2020, the Australian economy shrank 0.3% as a result of the bushfires, the drought, and the onset of the coronavirus pandemic. On Wednesday the market is looking for Q2 GDP to fall by 6.0% following the lockdowns that occurred during April and May.

For the full year 2020, the RBA is expecting the Australian economy to shrink by 6%. Because of Australia’s early success in suppressing the pandemic and the faster than anticipated re-opening, this is less than the 8% the RBA forecast in May and a far better outcome than experienced in many other countries.

Data this week has supported the view that the recession will be shallower than initially expected. Construction activity data fell -0.7% in Q2, far less than the -5.8% expected, helped by the exemption the construction industry received from lockdown restrictions. Likewise, Private Capex data was better than anticipated, helped in part by the mining sector which also avoided COVID-19 disruptions while also enjoying resilient iron ore prices. Both of these components feed into next week’s GDP print.

Whilst there will no doubt be a barrage of negative media headlines after Wednesday's data, aside from the second wave of infection in Victoria, the coronavirus shock has been shorter and less devastating than expected. Forward-looking markets have long since moved on from the happenings of Q2 with a view towards the recovery.

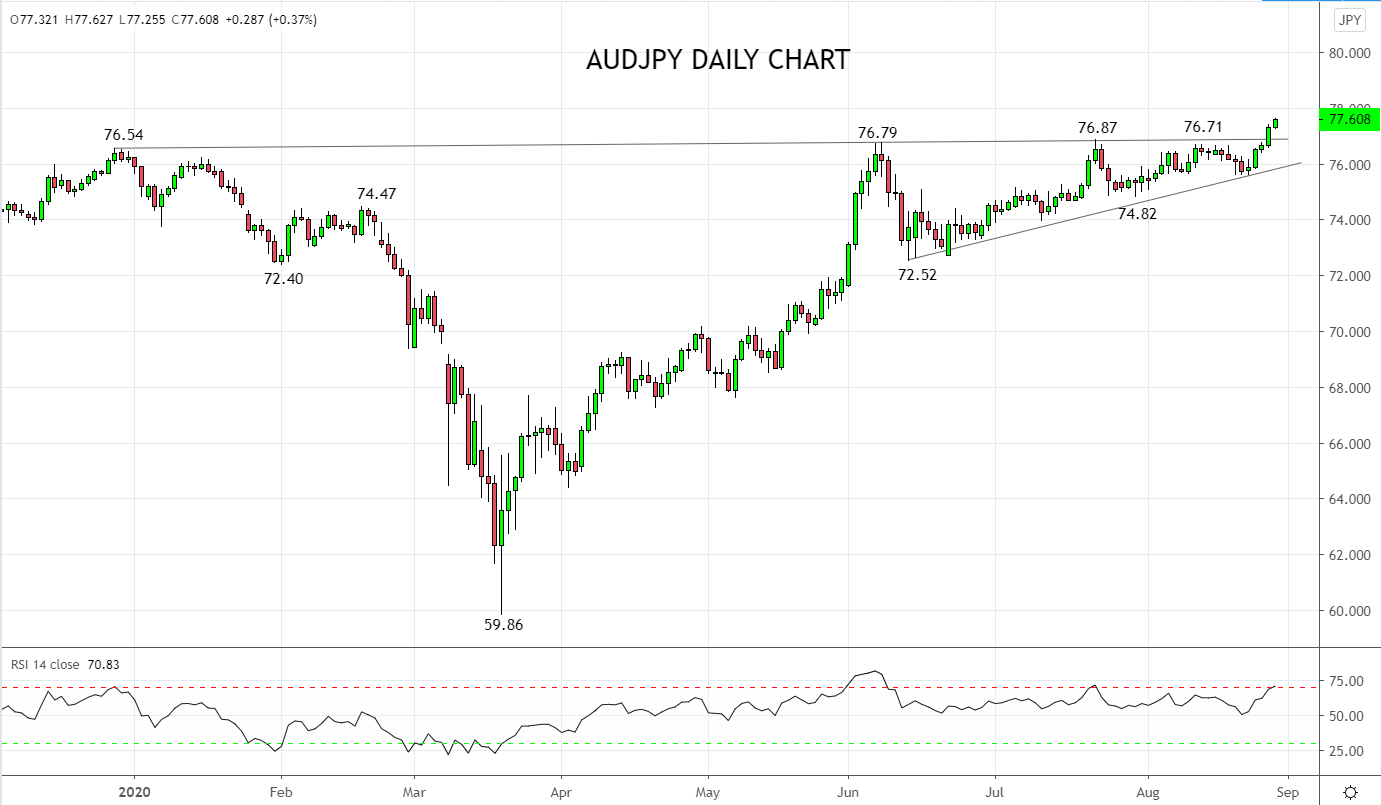

With this in mind, it is no surprise, that AUDJPY buoyed also by a supportive risk environment has overnight broken and closed above a cluster of strong horizontal resistance between 76.55 and 76.85. Dips back towards the 76.85/55 support zone would be viewed as a buying opportunity in anticipation of AUDJPY extending its rally towards 78.50 and then 80.00 in the coming weeks.

Source Tradingview. The figures stated areas of the 28th of August 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation