Offering traders an opportunity to assess whether last week’s equity market volatility was a glimpse into what lies ahead for the ASX200 in May, a month that over the past decade has averaged a 3% pullback.

Against the backdrop of another huge week for metals as copper surged +3.7% to close at a two-month higher at $9551 p/t. Outshone by a +4.1% price rise in iron ore, which closed at $US185.10 p/t, just below the 10 year high it hit earlier in the week of $187.50 p/t.

The subject of surging commodity prices brings us around nicely to the hot topic of rising inflation, ahead of this week's most notable domestic macro data release, Australian Q1 CPI.

The expectation is for headline inflation to rise by 1.0% q/q, taking the y/y rate to 1.5%. The RBA’s preferred measure of inflation, the trimmed mean is likely to come in at 0.6% q/q and 1.4% y/y. Both measures of inflation are expected to remain below the RBA’s target band of 2-3%, although above the RBA’s inflation forecasts from February.

Presuming, the CPI numbers don’t come in much higher than the expectations outlined above, they are unlikely to shift the thinking behind the RBA’s current monetary policy stance. The story of higher inflation numbers that have the potential to create headlines and rattle markets is one for Q2, with a +4% print not out of the question, due to base effects.

Learn more about trading indices

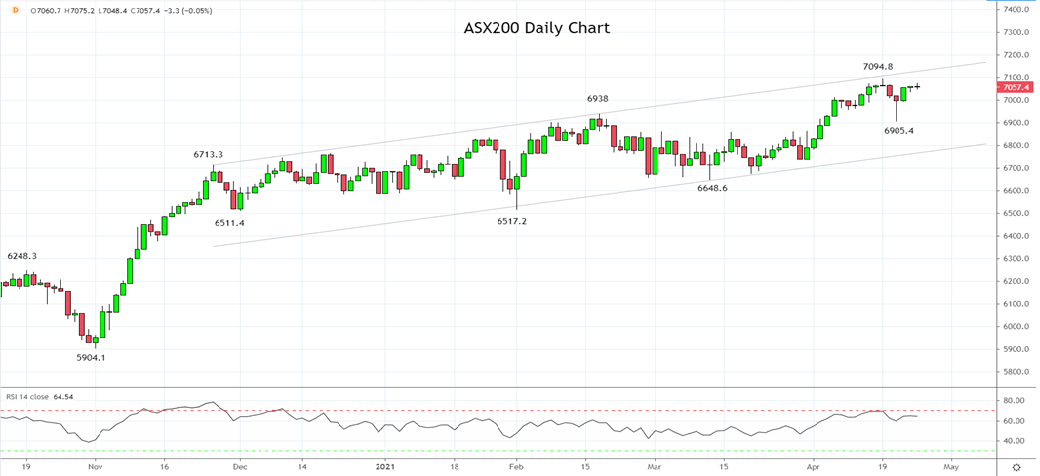

As such, the expectation remains for the ASX200 to continue to push towards trend channel resistance, currently near 7120/30ish, into the end of April/early May. From here, allow for a 3-5% pullback to develop towards the band of support between 6900 and 6770.

From this support zone, it is anticipated the uptrend will resume, looking for a test and break of the all-time high of 7197.2.

Source Tradingview. The figures stated areas of the 26th of April 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation