"In the Bank's central scenario, it takes some years for the stronger economy to feed through into wage and price increases that are consistent with the inflation target."

Following yesterday's weaker Q2 wage price index at 1.7% y/y vs. consensus of 1.9% y/y, today's better than expected labour force data for July has come as somewhat of a surprise, given the extent of lockdowns across regions of NSW.

Employment rose +2.2k rise compared to median expectations for a -46.6k fall, and the unemployment rate fell to 4.6% vs. expectations of a rise to 5.0%. The fall in the participation rate from 66.2% to 66.0% partly explaining the lower unemployment rate. Monthly hours worked decreased by 3 million hours.

The head of Labour Market Statistics at the ABS, Bjorn Jarvis, was quick to point out "The fall in the national unemployment rate in July should not necessarily be viewed as a sign of strengthening in the labour market – it's another indication of the extent of reduced capacity for people to be active in the labour market, in the states with the largest populations."

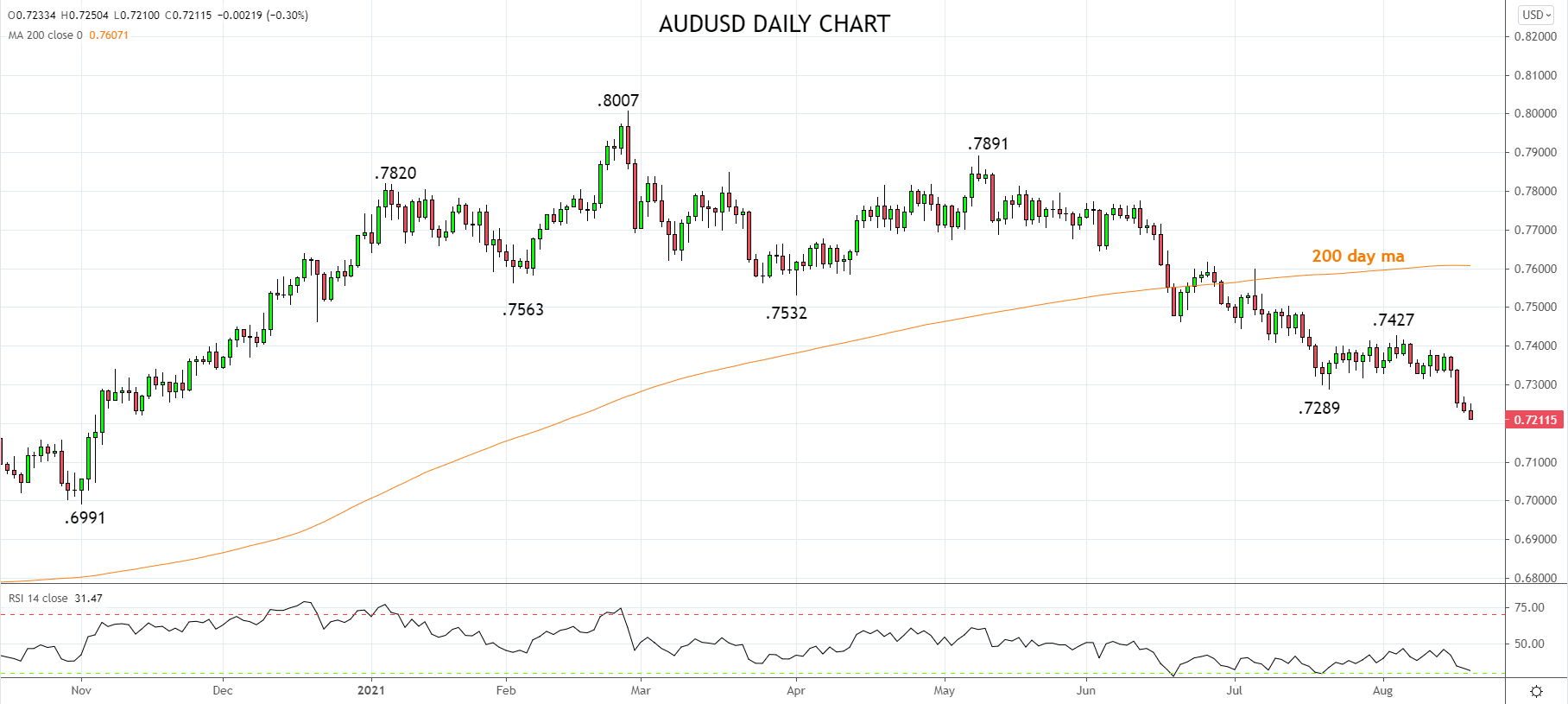

The better than expected jobs data means the worst is still to come in August, September, and October. With this in mind, the AUDUSD could not muster anything other than a quick 15 point bounce to .7235 before making fresh cycle lows.

Technically, the path of least resistance is lower for the AUDUSD, and providing the AUDUSD remains below resistance at .7320/30, the decline is expected to continue towards .7000c.

Source Tradingview. The figures stated areas of August 19th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation