Economists often get a bad rap when their crystal balls don’t generate forecasts with the level of accuracy needed to base profitable trading decisions upon. I know in the past, I have been guilty of writing emails to economics teams asking where their forecasts went wrong.

However hats off today to the economics teams around town who despite the double impact of the bushfire catastrophe and start of the COVID-19 shut down, accurately forecast today's Australian Q1 GDP decline of -0.3%.

Today’s fall is the first since 2011, which occurred during the confidence-sapping European debt crisis. With a steep fall likely in Q2, Australia’s dream run of no recession since the early 1990s now comes to an end.

The net effect on the AUDUSD has been some gentle profit-taking after earlier reaching a new cycle high of .6983 just below the next upside target of 7000c. Dips are now likely to be supported towards .6800c before medium-term support at .6680.

Turning now to USDJPY, a market that overnight that appears to have just started its run - a possibility we alluded to last week here.

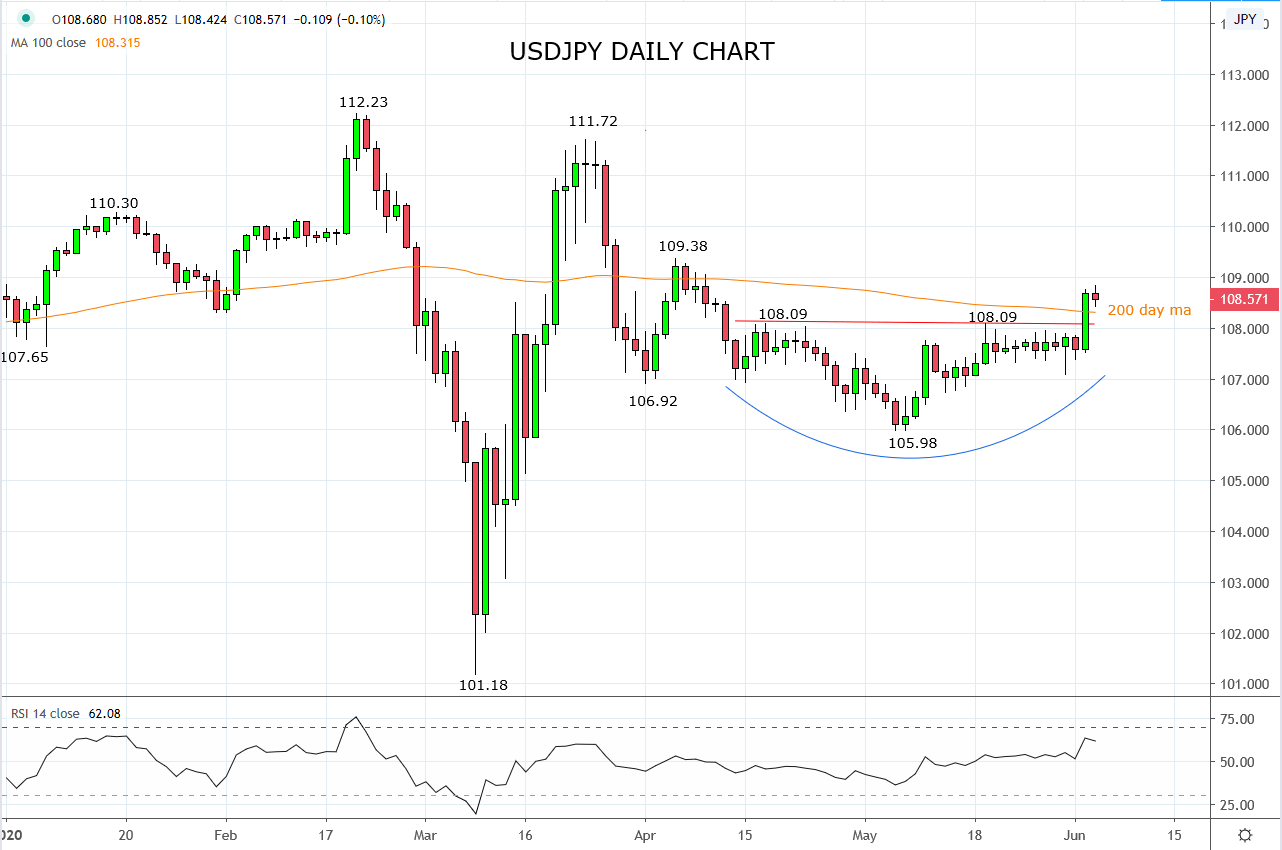

As can be observed on the chart below, USDJPY broke above two key levels overnight the 108.09 double high and the 200-day moving average which now sits at 108.31. While there is little love currently for the beleaguered U.S. dollar, the JPY is being sold against the cross rates as the market chases the reflation/reopening/recovery trade.

With that in mind and if traders missed the breakout overnight, we favour buying dips in USDJPY into the 108.50/30 support area. Sell stops should initially be placed 5 pips below yesterday’s low at 107.50, with a view to trailing the stop up initially to 107.99, if USDJPY trades near to the April 109.89 high.

The initial target is a move towards 110.30, before medium-term resistance 112.25/50 which encapsulates the February 112.23 high and the 2019, 112.40 high.

Source Tradingview. The figures stated areas of the 3rd of June 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation