While today's positive number will prevent headlines and the deterioration in sentiment that negative economic headlines bring, the data also highlights a lost opportunity.

Following last year's reopen, the economy enjoyed its best run since the Global Financial Crisis thirteen years ago. An example of which Australia's unemployment rate dropped to 4.6% in July, the lowest level since 2008.

The momentum has now been lost, and it remains to be seen if the Q4 2021 reopening will acquire the same traction that followed the 2020 reopening. Notably, the current Australian household savings rate of 9.7% is half the 19.8% saving rate of June 2020, which helped unleash the pent-up demand wave at the start of this year.

Another feature of todays national accounts, Australia's terms of trade rose 7% in Q2, to its highest level in history. A supportive factor for the AUDUSD, as is the estimated A$19.7 bn of AUDUSD needing to be bought over the next month for dividend payments of Australian-based resource companies.

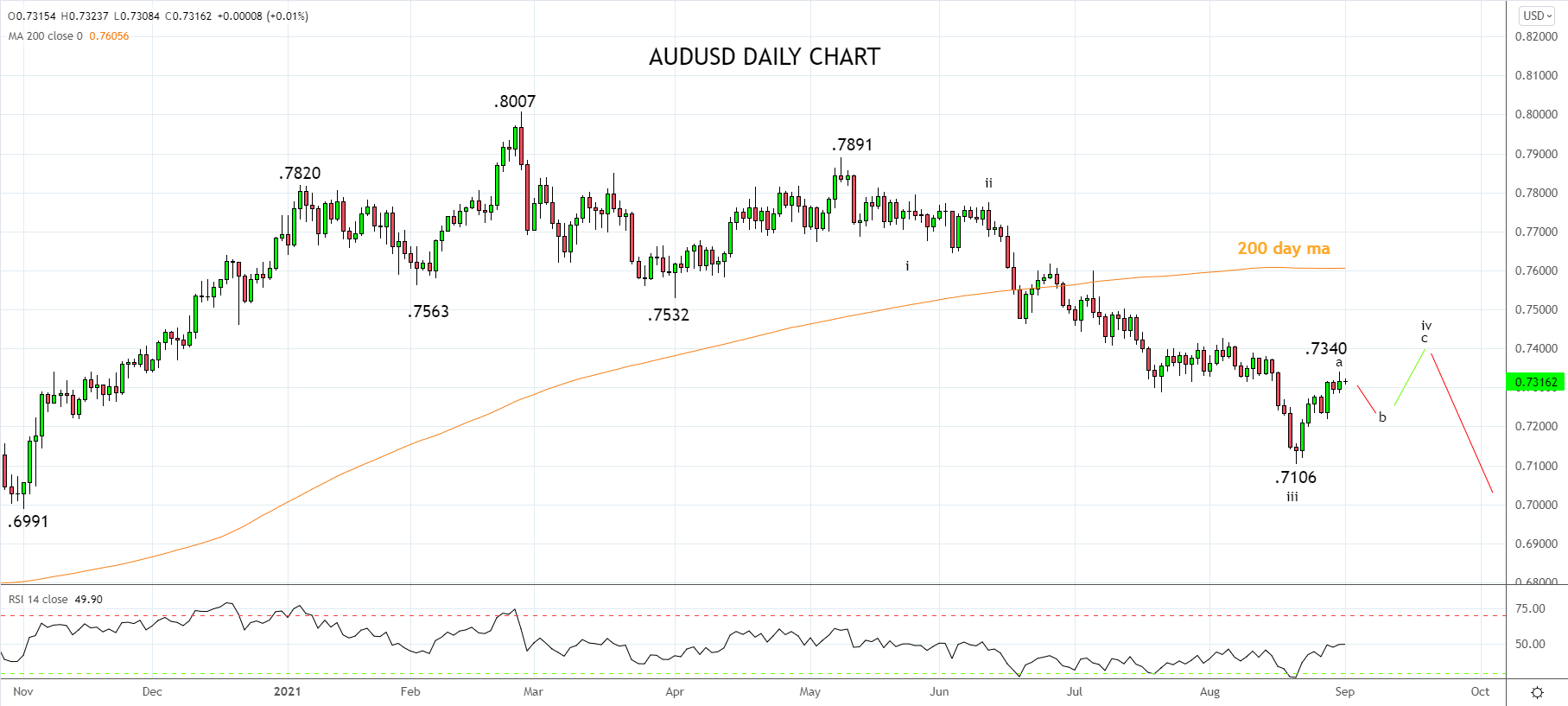

None of which has been able to shift the AUDUSD higher, contently trading near .7310c after failing to break horizontal resistance at .7320/40 overnight.

A break/daily close above .7320/40 would indicate another leg higher of the AUDUSDs corrective rebound towards .7420 is underway. Until then, dips are likely to find support at .7200c in coming sessions for the reasons outlined immediately above.

Source Tradingview. The figures stated areas of September 1st, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation