The end of an era for my family as we prepare to move house this Friday for the first time since the 2009 Global Financial Crisis. The similarities between 2009 and now are striking. Big stock market losses, central banks riding to the rescue, bailouts, talk of deep recessions and job losses, the last of which, I want to focus on ahead of the release tomorrow of Australian Labour Force data for March.

As noted in our Week Ahead document on Monday, the survey period for the release was the first two weeks of March, before the step-up in social distancing measures. Because of this, the report is likely to show a “relatively” modest 40,000 job losses and the unemployment rate to rise from 5.1% to 5.5%.

The full impact of COVID-19 on the jobs market will not emerge until employment data for April is released in Mid-May. However, based on the impressive manner that social distancing has limited the spread of COVID-19 in Australia and with talk now turning towards an easing of restrictions, it is possible that the unemployment rate peaks earlier and from lower levels than the 10% feared.

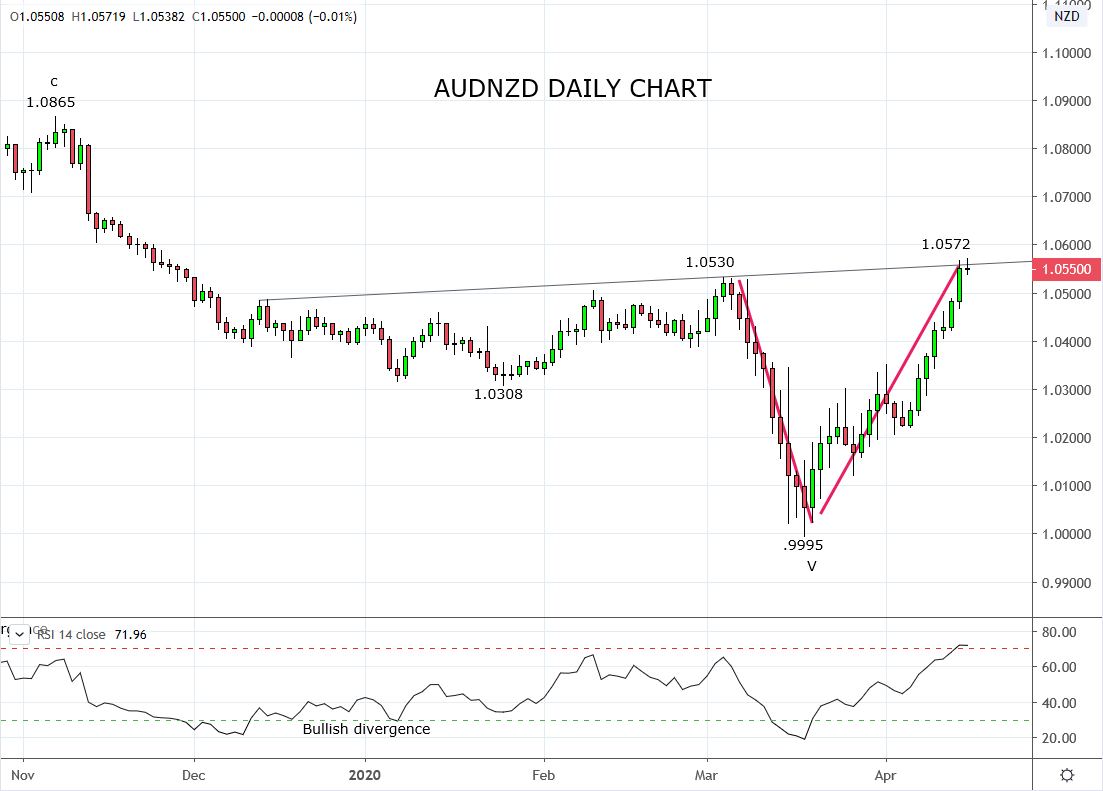

One possible way to benefit from this is via the AUDNZD cross rate which has enjoyed a phoenix-like recovery since falling below parity one month ago, sparking celebrations from Kiwis in dealing rooms across the country.

The recovery in AUDNZD has been driven by reasons similar to those outlined in recent articles on the AUDUSD. They are both benefiting from the market positioning for a recovery in China, the better management of the COVID-19 crisis in Australia, as well as the rally in equities from March lows as AUDUSD and to a lesser extent AUDNZD, remain correlated with moves in the S&P500.

Following its brief fall below parity, evidence of a V-shaped bottoming pattern continues to form. Confirmation that a V-shaped bottom is in place and that a rally initially towards the November 1.0865 high and possibly as high as 1.1150 is underway, would be a break and close above trendline resistance 1.0570/80ish, preferably after tomorrows employment numbers.

Keeping in mind, that while the cross remains below 1.0570/80ish resistance it is vulnerable to a retracement back towards 1.0310.

Source Tradingview. The figures stated areas of the 15th of April 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation