U.S. indices lag Europe as intel hearing and trade news keep the pressure on

U.S. stock market participants are probably paying attention to the live testimony of Jospeh Maguire to Congress. He’s the Director of National Intelligence and is being grilled by a congressional committee about allegations of a whistle-blower relating to a conversation between U.S. President Donald Trump and the president of Ukraine. It’s riveting stuff to be sure. But he is playing it straight down the line. He’s neither responding to Republican plaudits for being impartial, or Democrat insinuations that his expressed determination to protect Presidential privilege could be shielding disclosure of misconduct.

As such, U.S. stock markets look to have reacted more to fresh, though vague, developments on the trade front. Headlines, quoting a State Department spokesman, suggesting the U.S. is unlikely to extend a temporary waiver for U.S. suppliers of Huawei, is hitting technology stocks. Specifically that means, chip shares and the like, with specialist processor maker NVIDIA, hardest hit. We should also expect some stock market aversion from a hit to copper, which has also reacted negatively.

The State Department also signalled that it will push on with a re-think of intelligence sharing with U.S. allies who aren’t inclined to stop using Huawei. So close to October trade talks with China, the latest commentary tends to place a dampener on their scope. It may be no coincidence that Thursday’s news follows the emergence on Wednesday of person-specific sanctions on certain Chinese officials.

Chart thoughts

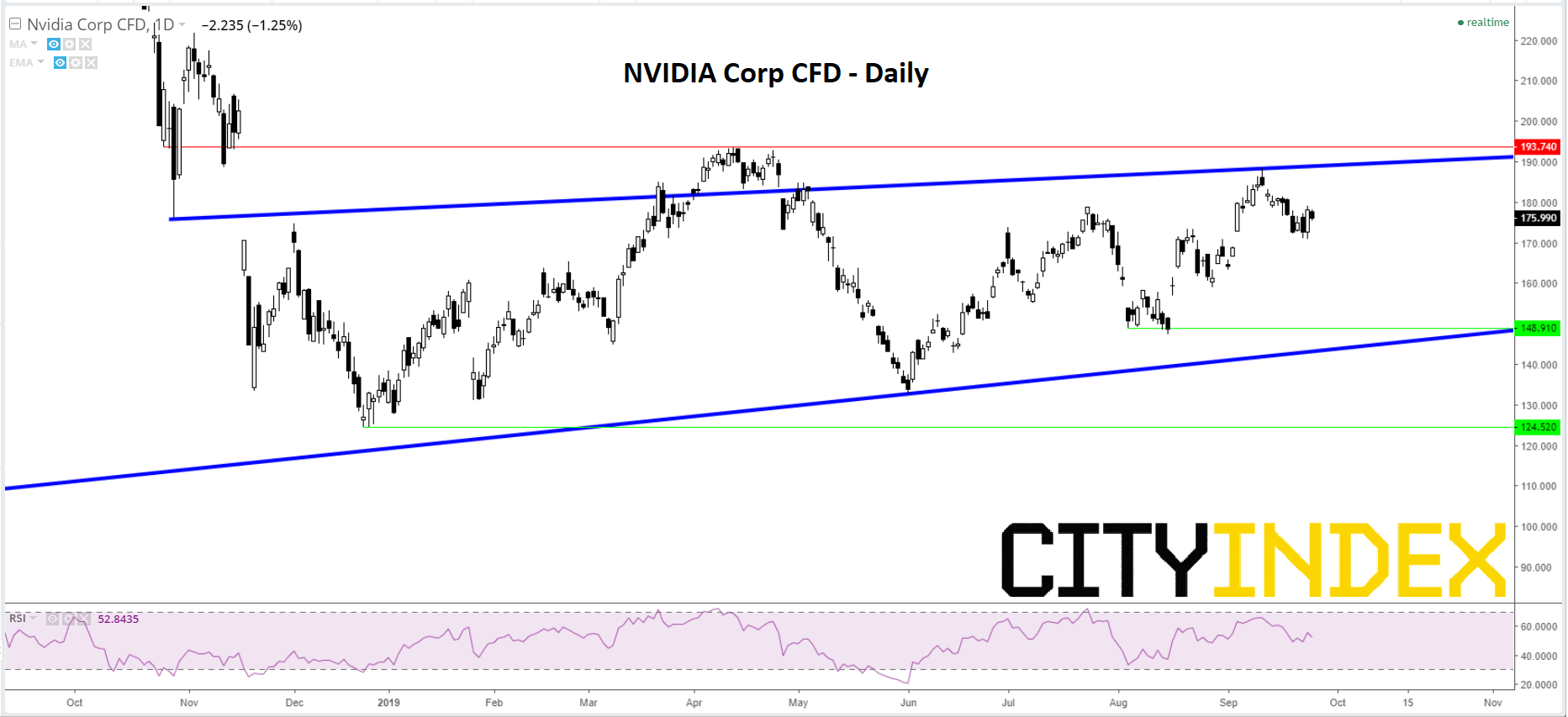

Assuming the graphics chip maker is particularly sensitive to trade-related developments that could significantly impact its business there, let’s take a glance at its chart. The zoomed-out view shows a bullish trend that can be backed linearly since February 2016, remains intact. Less positively, NVDA has now been capped since last October by overhead resistance; in fact a gently sloping uptrend. It’s complemented by the longer-term rising line mentioned above to create a channel. Upside impediments also include the strong appearance of resistance in the $193 region, which has seen bounces from above and below since November. As the stock drifts down following its latest impact with the ambivalent overhead line, a visit to the lower bound of the channel looks to have decent odds. Progress beyond the structure requires a break higher or lower first.

NVIDIA Corp CFD – Daily [26/09/2019 16:59:42]

Source: City Index