After rallying strongly in August, the easing in U.S. – China trade tensions, the calming of events in Hong Kong and the decision to approve a law to delay Brexit has resulted in the price of gold falling 4.5% the past four days.

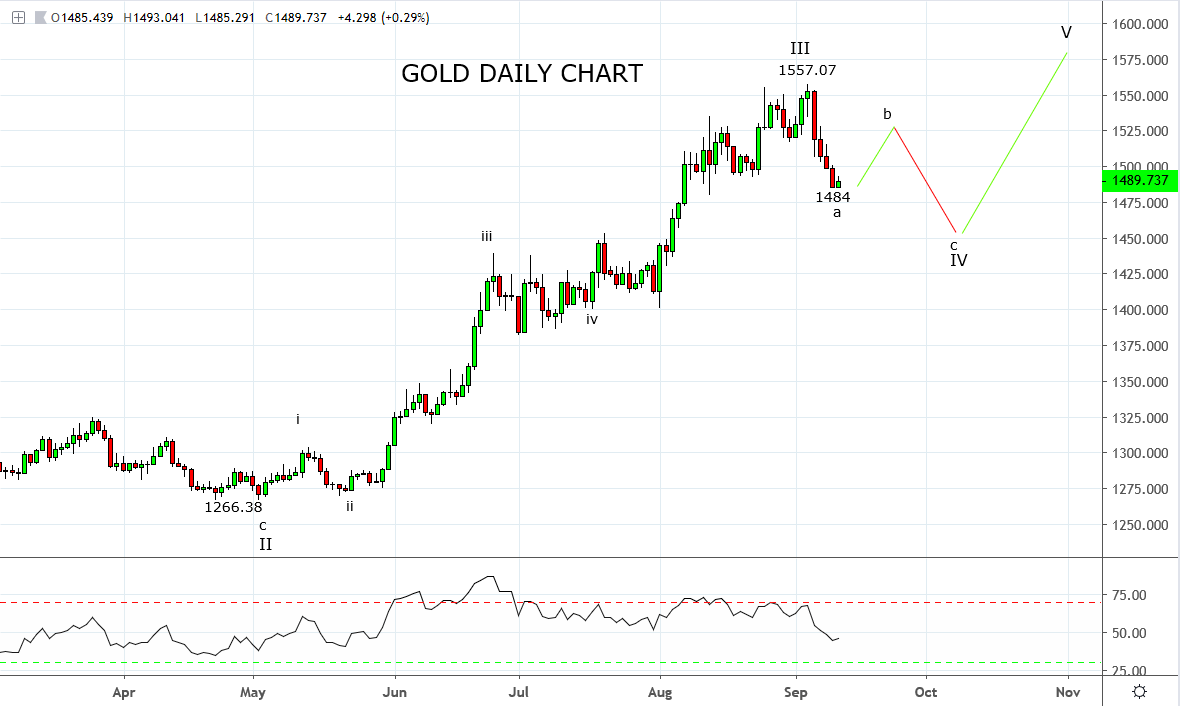

With the market holding its largest-ever speculative long gold position and growing signs of bearish divergence via the RSI, most will agree the gold market was vulnerable to a pullback.

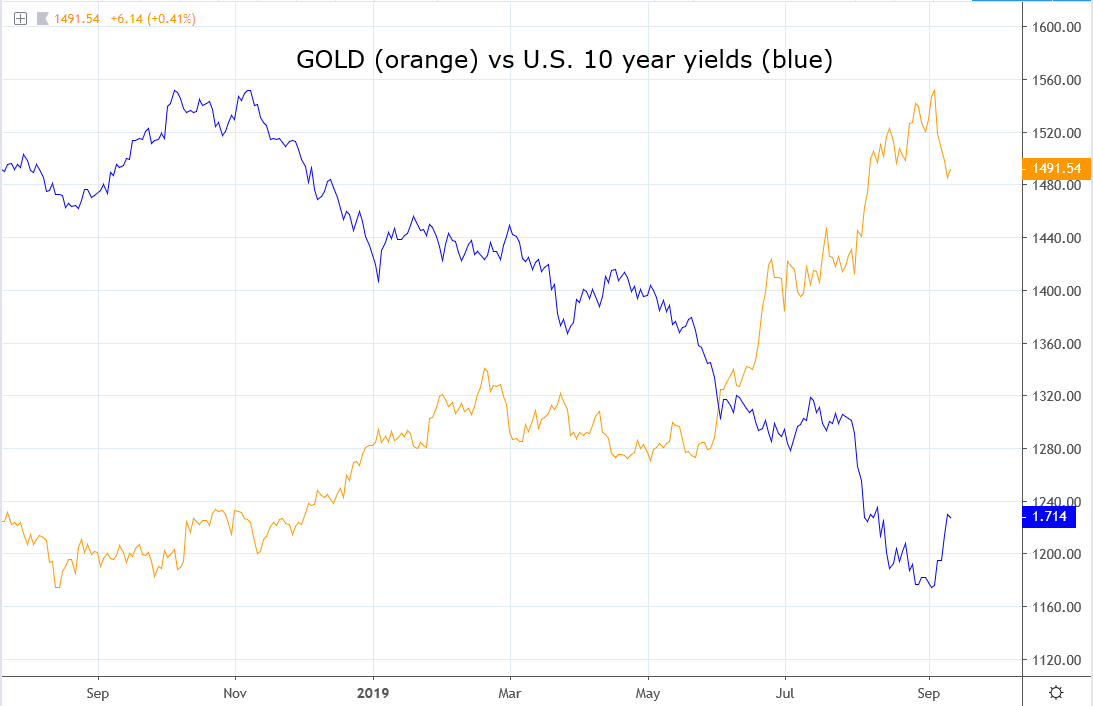

During the same four-day time period, U.S. 10-year Treasury yields have moved sharply higher, albeit from very low levels. As the chart below illustrates, the price of gold and U.S. yields are generally negatively correlated. Gold falls when yields are rising and vice versa.

For traders wishing to assess whether the recent fall in the price of gold represents a buying opportunity, it’s important to consider how much further U.S. yields can rally from their current price of 1.71%.

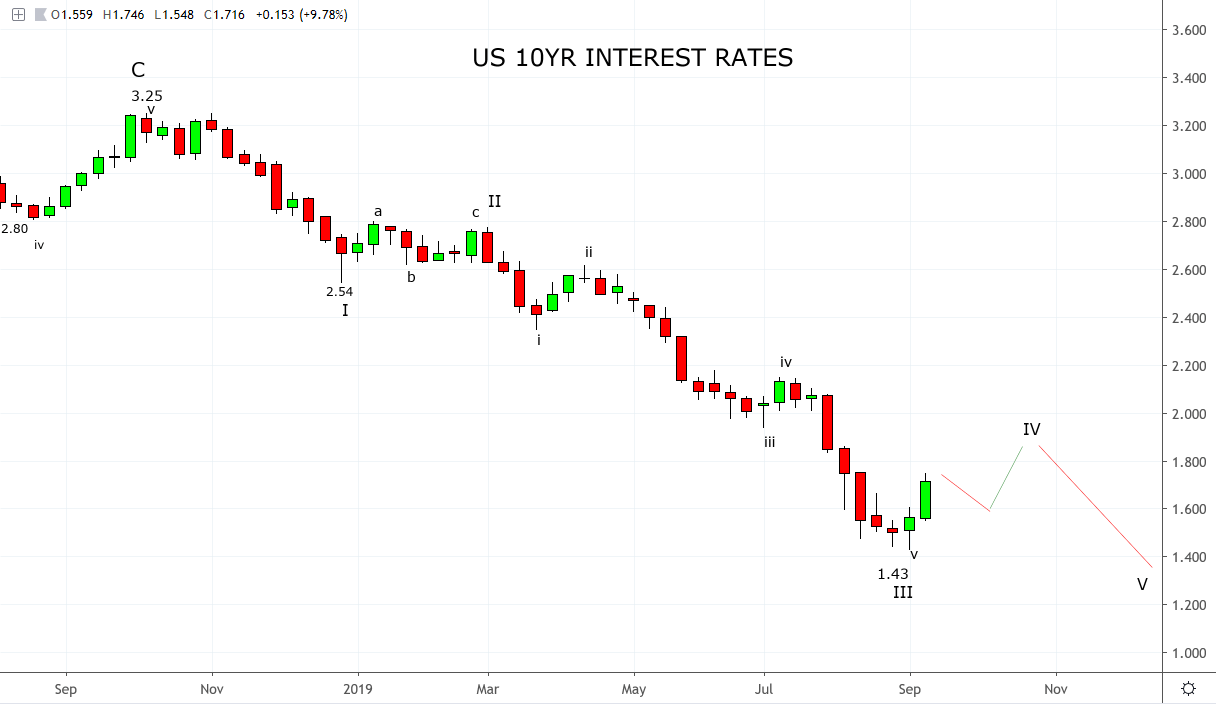

As the chart below shows, after falling from 3.25% in October 2018 to 1.43% last week, there is room for the current rally in U.S. 10-year yields to extend back towards 1.80%/2.00% in coming weeks, before the downtrend resumes.

Keeping the short-term view for further gains in U.S. 10-year yields in mind, the recent fall in gold to the $1484 overnight low is likely to be just the first leg or Wave a of a corrective Wave IV pullback. While a countertrend Wave b towards $1525 is possible, the wave count suggests that gold should ultimately retrace back towards the $1450/$1430 support area to complete Wave c of Wave IV.

In short, we will wait patiently for better levels to buy gold. Should the pullback play out as outlined above, it will be viewed as a buying opportunity looking for gold to push above $1600 for Wave V.

Source Tradingview. The figures stated are as of the 11th of September 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.