Locally, the confirmation of 75 new cases in Victoria, while partly attributable to a large increase in testing, underlines the need for continued social distancing requirements, protection of the vulnerable, and how quickly the virus can spread if left unchecked. It also highlights how challenging it will be for other countries who have employed a less regimented approach to flatten the curve.

Offsetting this, government and central banks have been quick to act and eliminate downside risks. Their action has helped the ASX200 recapture about 50% of its losses from its all-time highs of February but still leaves the ASX200 down over 10% for the current financial year.

With a vaccine still some time away, successful containment of the virus and a flattening of the curve remains a key requirement for the progressing re-opening of economies to progress and for the ASX200 to build further upon its rally from its March low.

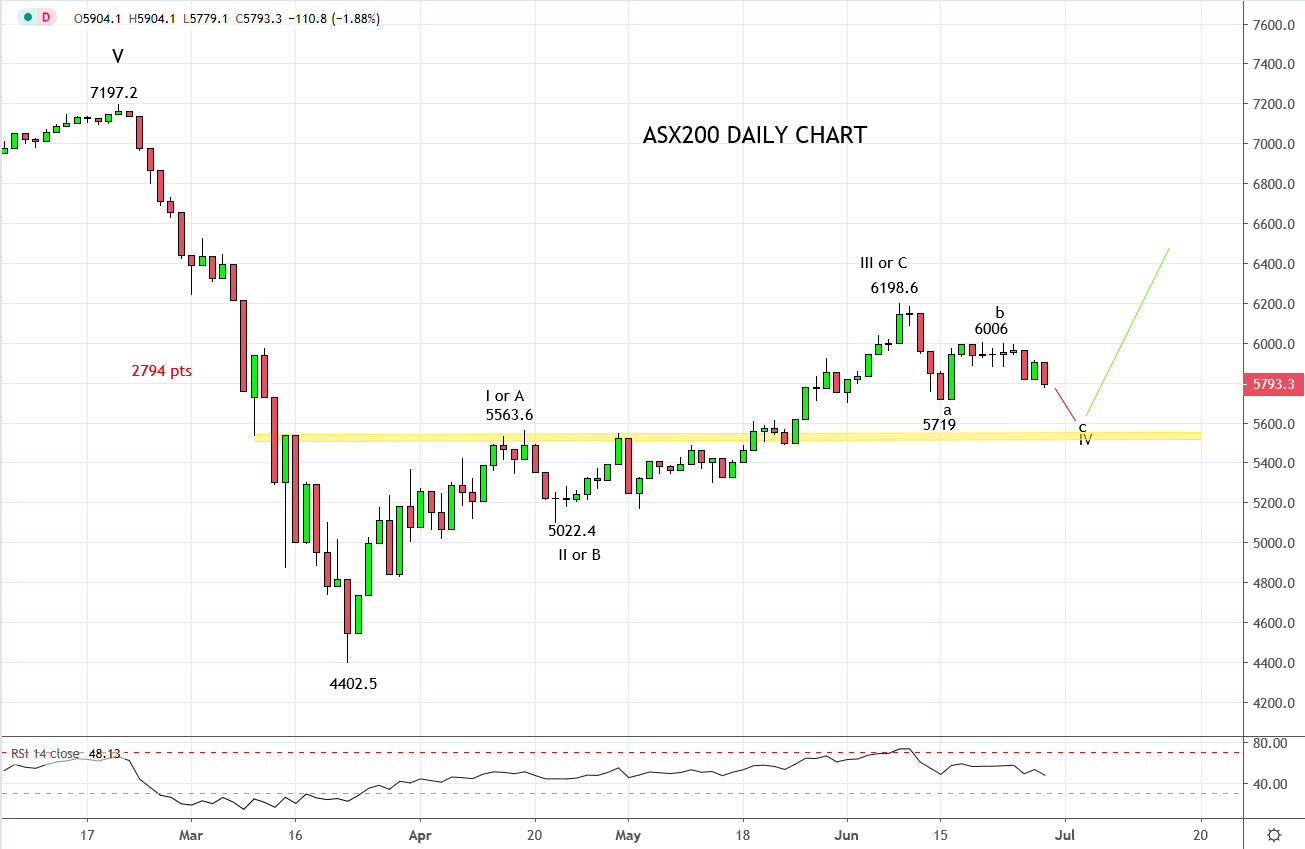

Technically this appears possible, although in the short term we favour the ASX200 continues its countertrend pullback from the 6198.6 high, (in line with our view of the S&P500 outlined last week), which targets a move towards the layer of horizontal support and wave equality 5550/20 area.

Should signs of a base emerge near this support zone and the ASX200 then rebounds back above the mid-June lows of 5719, my expectation would be for a retest and break of the 6198.6 high. This is a trade I like, supported by a positive seasonal bias for the ASX200 during July and August.

Keeping in mind, that should the ASX200 fail to base and stabilize ahead of the 5550/20 support zone, it would warn that a deeper pullback towards 5000 is possible.

Source Tradingview. The figures stated areas of the 29th of June 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation