An impressive performance despite an ongoing six-week lockdown in Greater Sydney and lockdowns in Victoria and Queensland, the effects are likely to be viewed tomorrow in the release of the NAB Business Survey.

Last month the business conditions component of the NAB Business survey fell to +24, from May's record high reading of +36. The decline was broad-based across segments, capturing Melbourne's snap lockdown in early June but predating Sydney's current lockdown.

Due to Sydney's extended lockdown and rising price pressures, the expectation is for business conditions to fall again to +10 when the data is released tomorrow at 11.30 am.

Also likely to influence the near-term direction of the ASX200, the release of earnings reports over the next three weeks, and how much further iron ore prices fall in the near term.

Further to the last point, China trade data over the weekend showed that Chinese demand for iron ore fell again in July, with imports at their lowest in 14 months. At the same time, combined iron ore exports from Australia and Brazil have surged partly due to Brazilian powerhouse Vale lifting supply back towards pre-Covid levels.

Iron ore prices have fallen by ~20% in the past three weeks, from $220 p/t to $170 p/t, a move that has weighed on the prices of the big miners. BHP is now trading about -5.50% below its July high, with FMG over 15% below its July high.

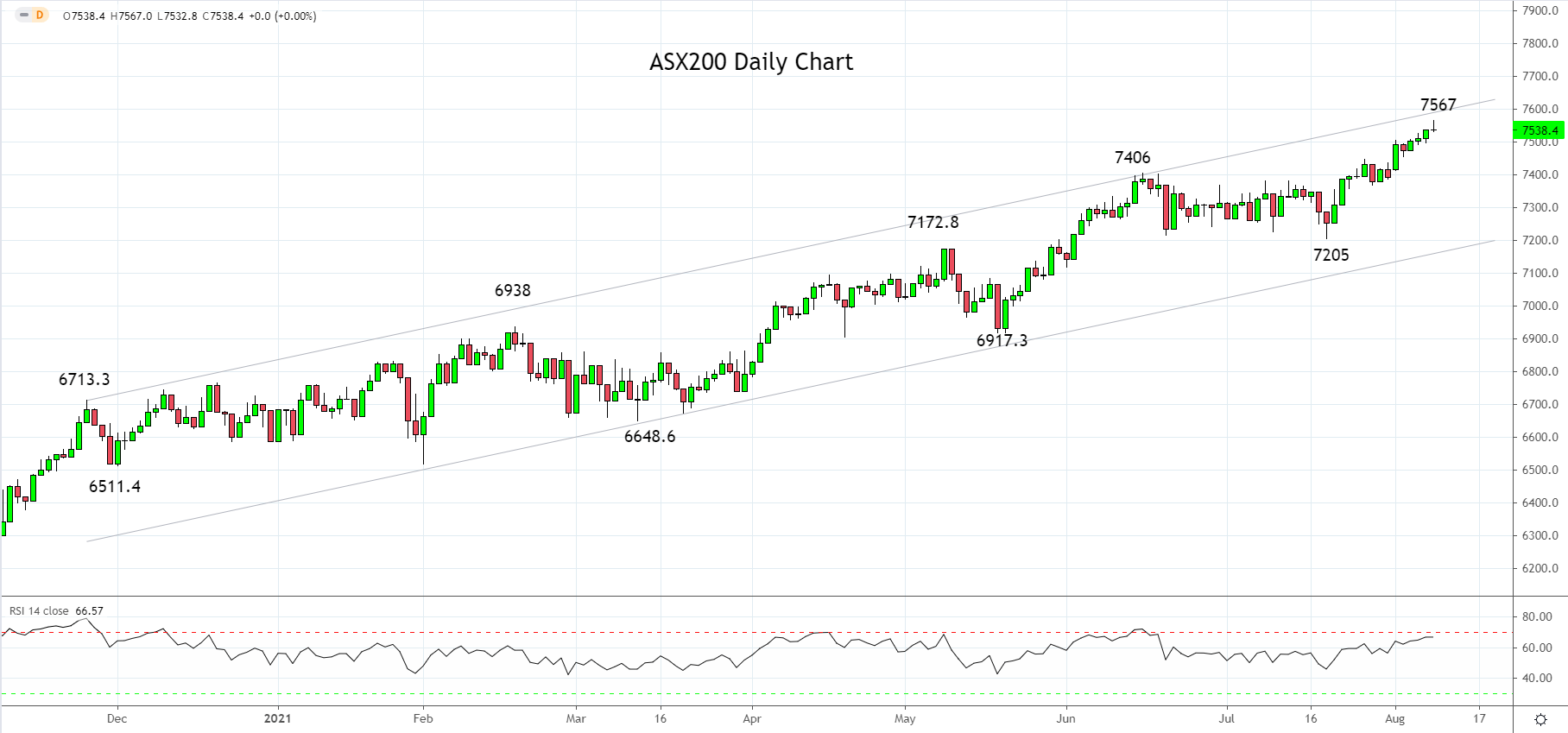

Technically the ASX200 today formed a daily Doji candle, very close to the top of 6-month trend channel resistance at 7600, a sign the strength of the uptrend is waning.

As a result, we would be very cautious about chasing the rally at current levels and prefer to buy a pullback leaning against trend channel support near 7200.

Source Tradingview. The figures stated areas of 9th of August 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation