The 1996 inflation scare sent the bond market into a six-month tailspin. Yields on benchmark US 10 year bonds rose from around 5.50% to 7% by mid-1996. Not immune from the bond market rout, US equities topped out in May, before falling over 11% into mid-July.

Despite concerns that inflation would continue to surge as the economy strengthened, the then Chairman of the Federal Reserve Allan Greenspan, stared down the bond market vigilantes as well as fellow board members and refused to raise official interest rates.

Greenspan’s decision was later viewed as a key catalyst for the “Tech Wreck’ in 2000. However, in between the US economy enjoyed four years of low unemployment and extraordinary growth.

Of course low unemployment is not the cause of rising inflation in 2021. As current Fed Chairman Powell likes to remind, the US economy is still about 8 million jobs short of where it was pre the pandemic.

Like Greenspan in 1996, Powell does not believe the recent rise in inflation requires a tightening of monetary policy. Instead the current rise is viewed as temporary, caused by a combination of base effects, surging global demand as well as supply shortages and bottlenecks.

Time will tell if Powells decision to follow Greenspan is correct or whether he will be forced to raise interest rates. In the interim, the tug of war between the Fed and market participants is likely to ensure recent equity market volatility will continue.

In that respect, we refer back to 1996 when equity markets topped out in May, as they appear to have done again in May 2021.

Learn more about trading indices

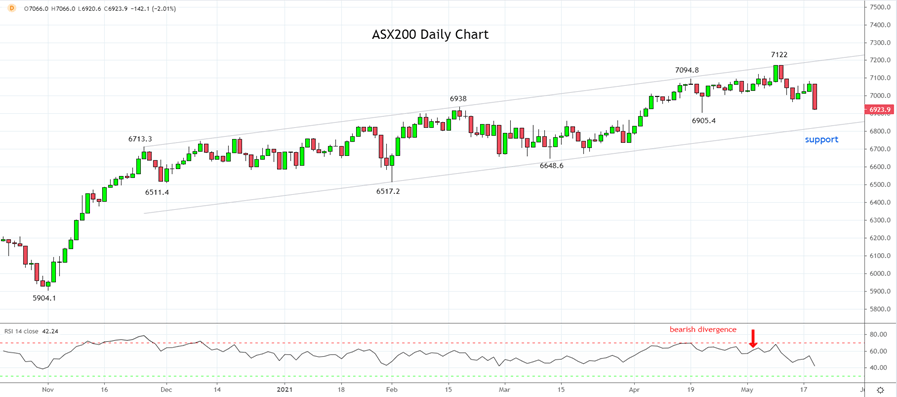

Technically the view of the ASX200 remains that a deeper pullback towards trend channel support at 6800 is likely, as written about in early May here

Should signs of basing emerge from 6820/00, the expectation would be for a retest of the recent 7122 high. Aware that should support at 6820/00 fail to halt the decline, the next level of support is not until 6650.

Source Tradingview. The figures stated areas of the 19th of May 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation