I remain sceptical that a deal will be reached before the U.S. election. However, with both parties aware of the poor optics of being the first to walk away from the negotiation table, just two weeks before the election, it would appear that the stimulus headline “ping pong” is set to continue.

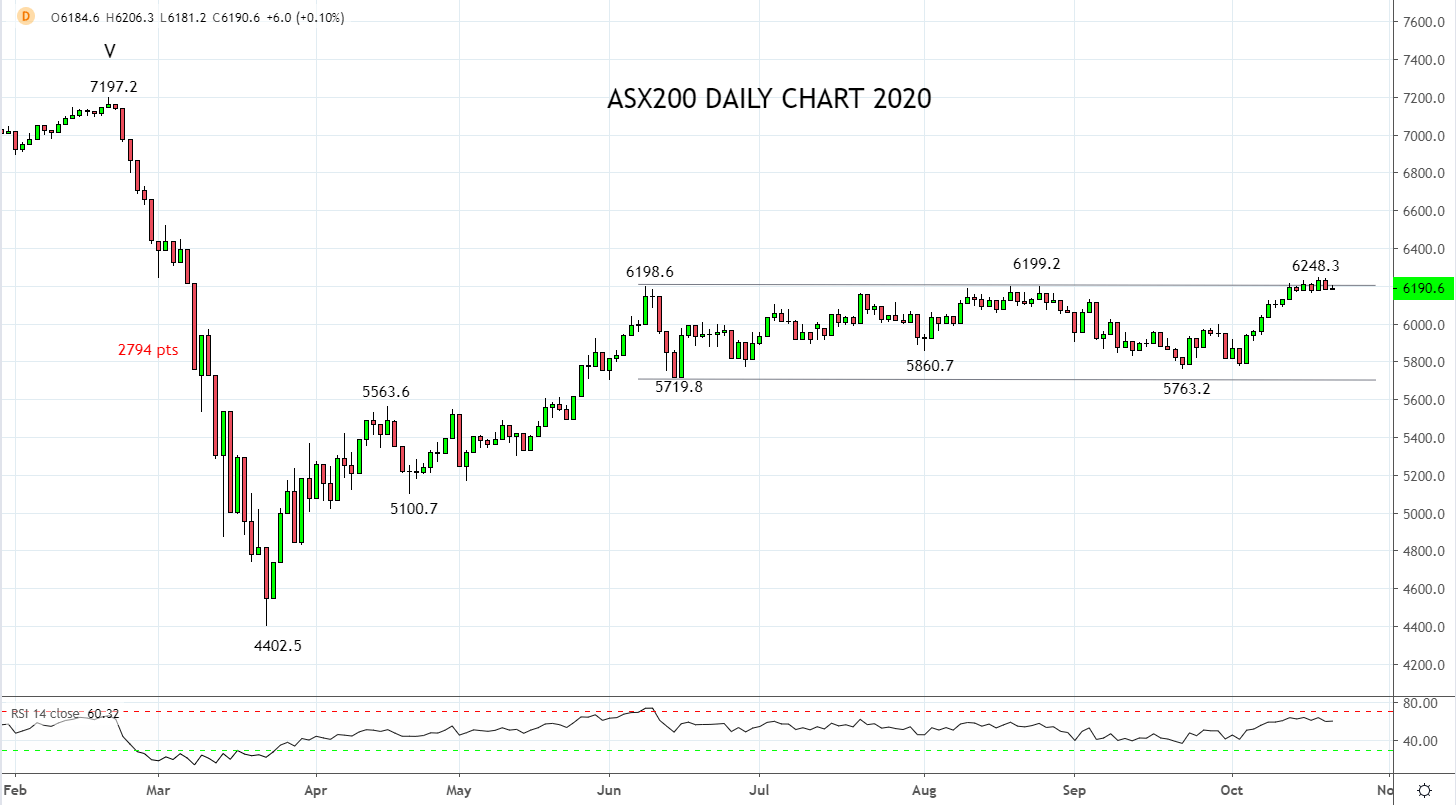

Little wonder then after putting its best foot forward in early October, the ASX200 has lost significant upside momentum and today entered its sixth straight session stalled around the 6200 level.

The lack of reaction from 6200, likely a reflection of two opposing cross currents. On one hand, it would make sense for investors with memories of the volatility around the 2016 U.S. election to be reducing their long equity position and moving into cash, to increase flexibility.

Others may be content to look beyond the short-term fluctuations caused by the election, reassured by the continued global economic recovery, the arrival of another round of U.S fiscal stimulus after the election, and the possible arrival of a COVID-19 vaccine to boost shares into year end.

Given the unpredictable nature of 2020 and the limited upside follow-through after trading above 6200, I have followed my suggestion in this article from last week here to increase the cash holding in my super portfolio.

“it would be prudent for those who bought the dip towards range lows ahead of the Budget to take the opportunity to lock in some partial profits here near 6200.”

A daily close below near term support at 6150/30 would be initial confirmation that the break above range highs at 6200 has failed and that a pullback towards range lows at 5800/5700 is underway and from where I will look to rebuild ASX200 longs.

Alternatively, I will add to core ASX200 longs after the election, pending a sustained break above 6250/70, in expectation of a rally towards 6600 into year-end.

Source Tradingview. The figures stated areas of the 21st of October 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation