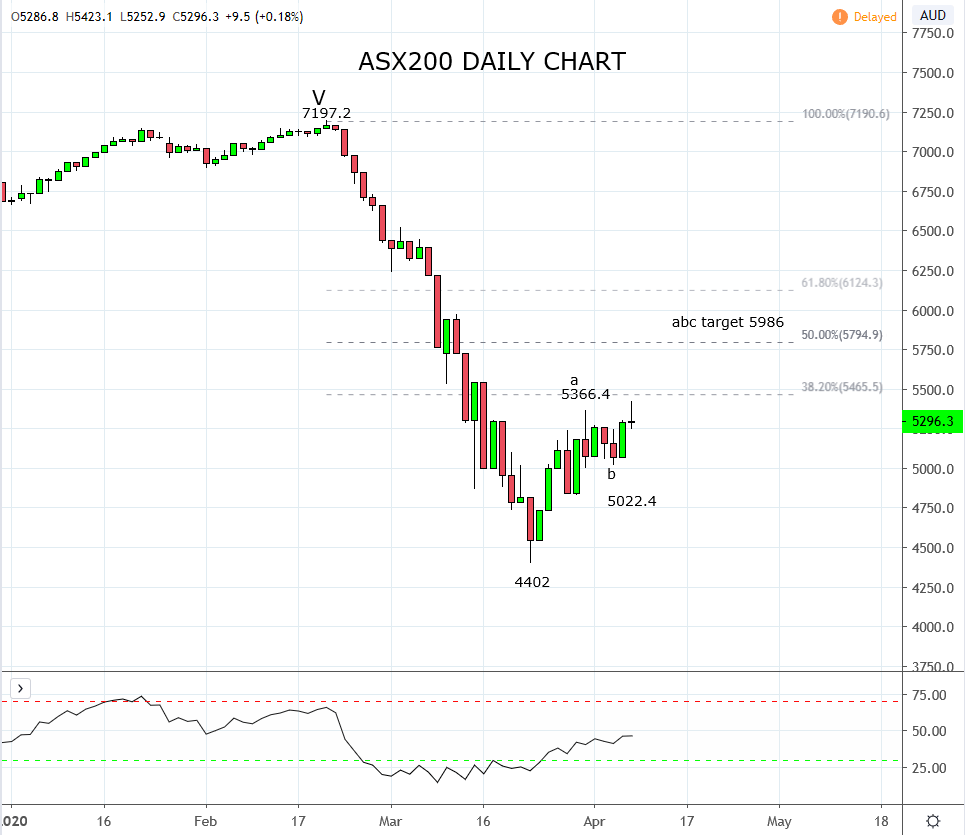

A milestone of sorts for the ASX200 today as the rally from the March 23rd, 4402 low extended +1000 points or over 23%. Amazingly it has satisfied the technical criteria for both a bear and a bull market, all within a frantic 7 week period.

The rally over the past two weeks provides another layer of confirmation to the view that markets have turned the corner for now. It also provides a sense of relief after we urged traders based on our observations of what happened during the GFC, to resist the temptation to liquidate equity portfolios at or near to lows here.

“With that in mind and if history is any guide, now is not the time to panic and sell stocks at their current depressed levels.”

Turning to some of the key catalysts behind the latest leg of the rally, there are unique to Australia, that we touched on in a note on the AUDUSD last week.

- The ASX200 and the AUDUSD are being used by some as proxies to position for a recovery in China, following the better NBS and Caixin PMI data.

- After both the RBA and the Australian government were slow to respond at the outset, investor confidence has now been restored following their subsequent responses and management of the COVID-19 crisis.

Also playing a factor there is evidence that social distancing measures are working well to slow the spread of COVID-19 in Europe and the U.S. This has prompted some European countries including Austria and Denmark to start easing restrictions as early as next week.

In this light, the view is that the ASX200 can continue to rally towards the 5800/6000 resistance region which encapsulates the 50% Fibonacci retracement and the wave equality “abc” target. However, much like an aftershock following an earthquake, I expect the price action to be at times violent and choppy in both directions. In this context, it will be important to remain patient and to wait for low-risk trade entries.

Source Tradingview. The figures stated areas of the 7th of April 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation