ASX200 Index: Critical Upside Breakthrough

Australia's ASX200 Index jumped 4.4% last week, as market sentiment was lifted a breakthrough in Covid-19 vaccine development. During early trading hours today, the index advanced 3.5% further. This week, investors will focus on the official Australian jobs report for October due on Thursday (-27,500 jobs, jobless rate climbing to 7.1% from 6.9% expected).

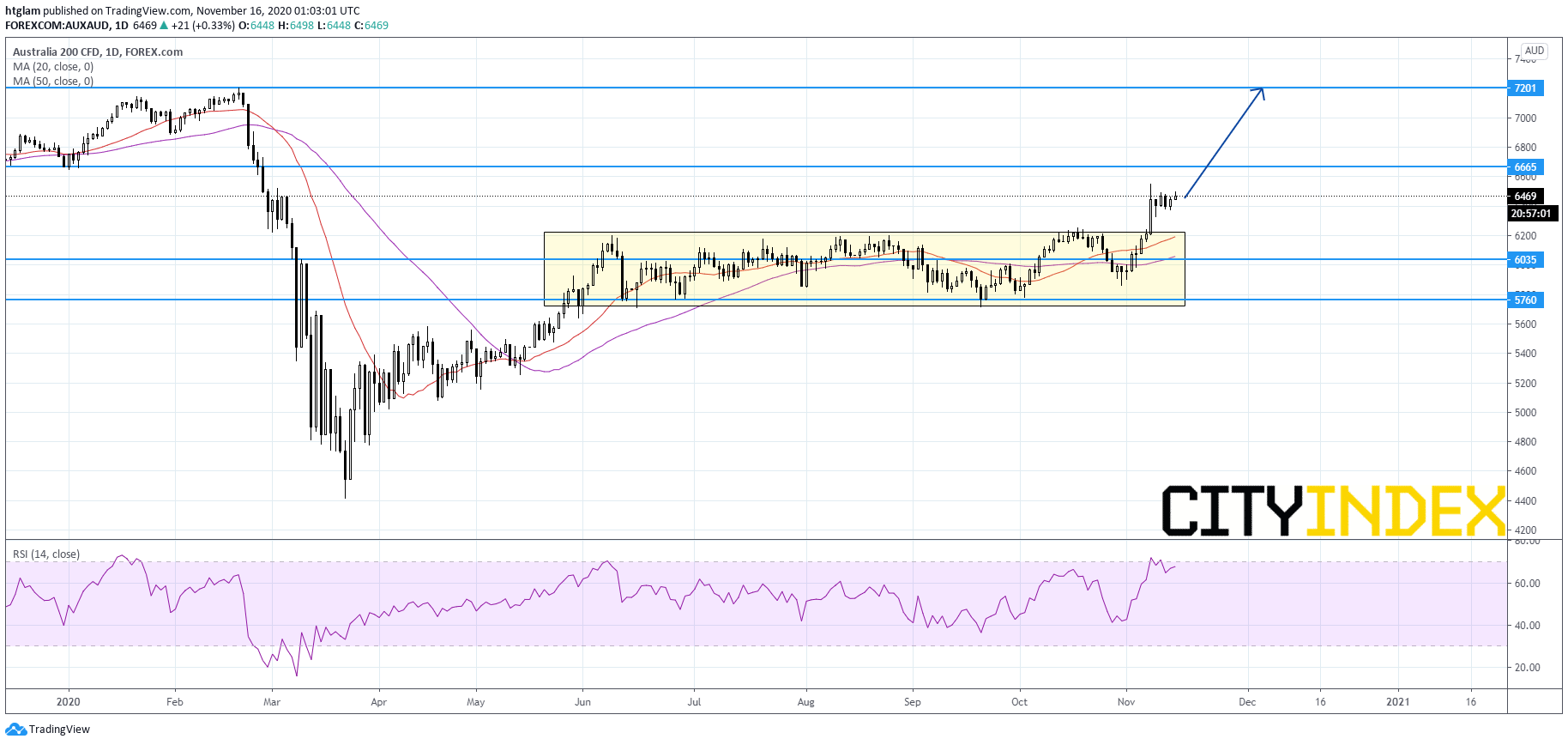

From a technical point of view, Australia's ASX200 Index has formed a critical upside breakthrough as shown on the daily chart. It has broken above a nearly 6-month consolidation range, while the 20-day moving average is moving higher and away from the 50-day one. The level at 6,035 might be considered as the nearest support, while the 1st and 2nd resistance are expected to be located at 6,665 and 7,201 respectively.

From a technical point of view, Australia's ASX200 Index has formed a critical upside breakthrough as shown on the daily chart. It has broken above a nearly 6-month consolidation range, while the 20-day moving average is moving higher and away from the 50-day one. The level at 6,035 might be considered as the nearest support, while the 1st and 2nd resistance are expected to be located at 6,665 and 7,201 respectively.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM