A new post global financial crisis (GFC) high for the ASX200 yesterday, as it rallied over 100 points to close the session near 6550. Behind the rally, gains in financial and resource stocks with the latter benefitting from additional stimulus measures announced in China and gains in the price of iron ore.

The price of iron ore has rallied on supply concerns after reports that following the Samarco dam failure in Brazil in 2015, BHP had performed a “self-audit” on its tailing dams worldwide. The audit found that dams in South Australia and Western Australia were among five in the company’s global portfolio that carried an “extreme” risk should they fail. BHP is thought to be investigating the option of moving away from wet tailing dams to improve safety at some mines, although this is likely to increase the cost of production.

Further supporting the rally in resource stocks was an announcement earlier this week by China’s Ministry of Finance (MoF) to increase support for special local government bonds (SLGBs). SLGB’s are used to finance major infrastructure projects including the Belt and Road initiative and spread across sectors such as railways, toll roads, airports, energy and rural infrastructure construction projects.

The new measures are designed to backstop some of the downside risks arising from ongoing U.S.-China trade tensions. One of the impacts of Chinese infrastructure spending is increased demand for iron ore, which comes at a time of tight supply, has prompted calls for the iron ore spot price to hit $U.S.120 a tonne in coming months.

Building on yesterday’s rally, BHP is trading today another 2.50% higher, near $39.70. While fellow mining heavyweight, Rio Tinto has followed suit and is currently trading above $102.00.

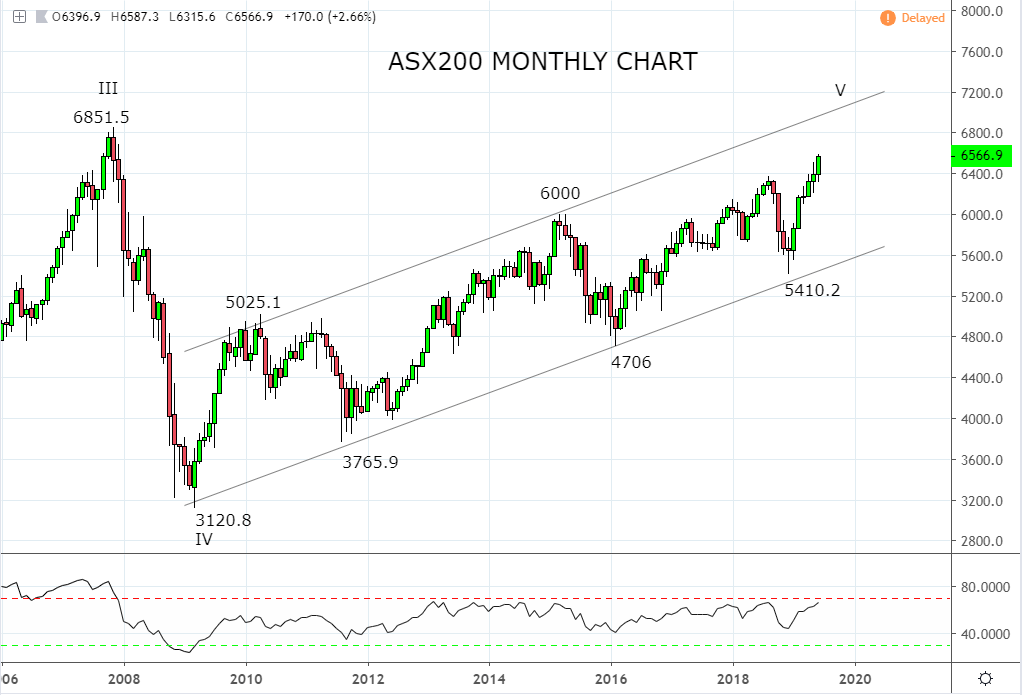

The ASX200 is up just under 0.20% at the time of writing. When viewed on the longer-term chart below, it continues to trade in an upward sloping trend channel with resistance near the all-time 6851 high from over a decade ago. Near term support resides at 6300. However, the lower bound of trend channel support is not until 5600.

Source Tradingview. The figures stated are as of the 12th of June 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.