In our note on Friday, we asked whether the relative calm viewed on Wall Street on Thursday night was the beginning of a display of resilience for global equity markets or the calm before the next storm. One of the dark clouds highlighted was a delay by U.S. Congress to approve a now $2tn fiscal stimulus package to counter the impact of Covid-19.

In a vote on Sunday evening, the proposed legislation was blocked by the Democrats, concerned the bill in its current shape is overly generous to big business at the expense of workers and hospitals.

While negotiations are set to continue and a deal could still be struck over the next 24 hours, some traders will recall how during the Global Financial Crisis (GFC) politics delayed the approval of programs such as the Troubled Asset Relief Program (TARP) in 2008, that proved crucial to healing the crisis.

The delay to the fiscal stimulus bill comes following a warning over the weekend from the President of the Federal Reserve Bank of St Louis, James Bullard that the U.S. unemployment rate may hit 30% in the second quarter, due to Covid-19 shutdowns.

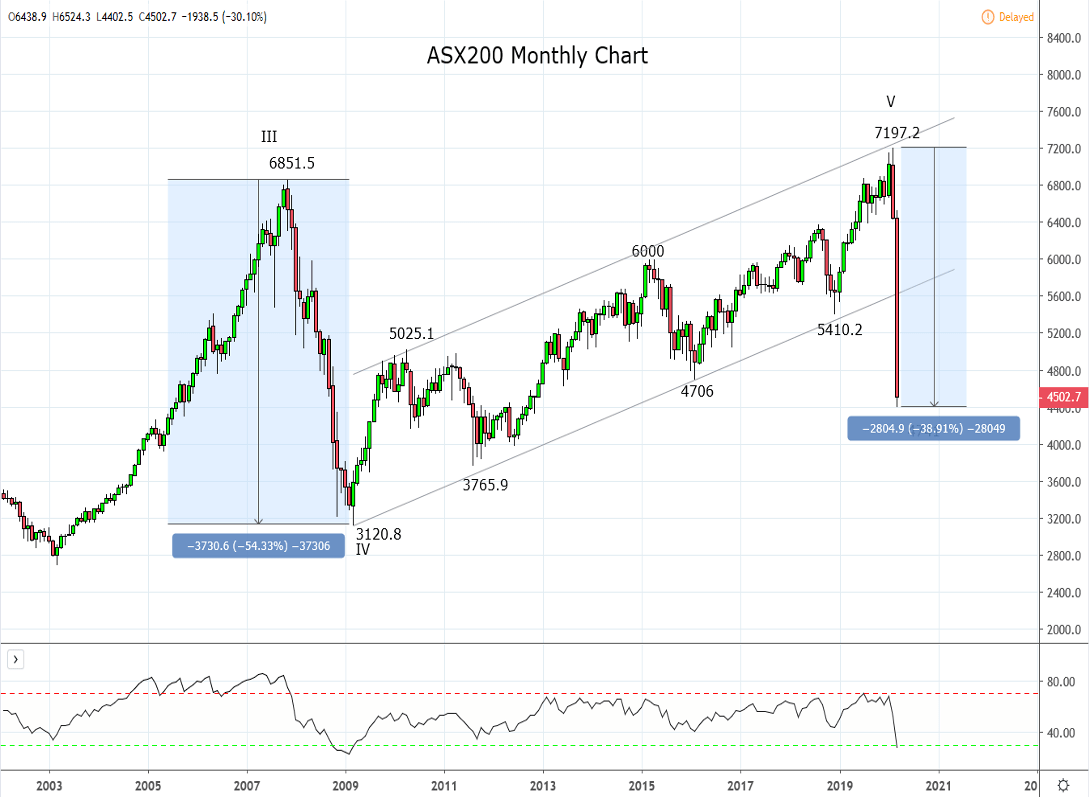

Little surprise then that S&P 500 futures went limit down this morning after the re-open, while locally the ASX200 fell another 8%, to an eight-year low of 4402.5. The total decline of the ASX200 after just two months is now almost 40% and approaching the ~55% decline experienced during the GFC. Keeping in mind the fall during the GFC took in comparison, a pedestrian 16 months to unfold.

Granted the challenge that Covid-19 presents is very different to the financial leverage challenge faced during the GFC. However, after the U.S. fiscal stimulus bill is approved the level of overall stimulus, including government spending, rate cuts, quantitative easing, equity injections, grants, and tax relief will exceed that seen during the GFC.

With that in mind and if history is any guide, now is not the time to panic and sell stocks at their current depressed levels.

Source Tradingview. The figures stated areas of the 23rd of March 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation