Nonetheless, the release is expected to garner serious media attention locally because a heavy contraction in GDP in Q3 is already guaranteed due to lockdowns.

Should Wednesdays Q2 data also show a contraction, it will mean the Australian economy will fulfil the technical definition of a recession for the second time in two years; two consecutive quarters of negative GDP.

This morning saw the release of some key inputs into Wednesday's GDP data. Q2 Company Profits were much stronger than expected (+7.1% vs. 2.5% exp), driven by strong commodity prices lifting mining profits. Partly offset by a further step-down in government subsidies in the quarter.

However, Q2 Inventories rose less than expected (0.2% vs. 1.2% exp), bringing into question the strength of the rebuild following a sharp rundown in 2020 that will likely subtract from quarterly growth.

The final partials drop tomorrow morning in the shape of Balance of Payments data, expected to show Net Exports fell in real terms, driven by a decline in export volumes that may subtract as much as 1.5ppt off GDP growth.

For the record, the range of Q2 GDP estimates is from -0.1% to a more optimistic +1%. The wide range reflects the many moving parts that go into GDP, Australia's average expenditure, incoming, and production estimates.

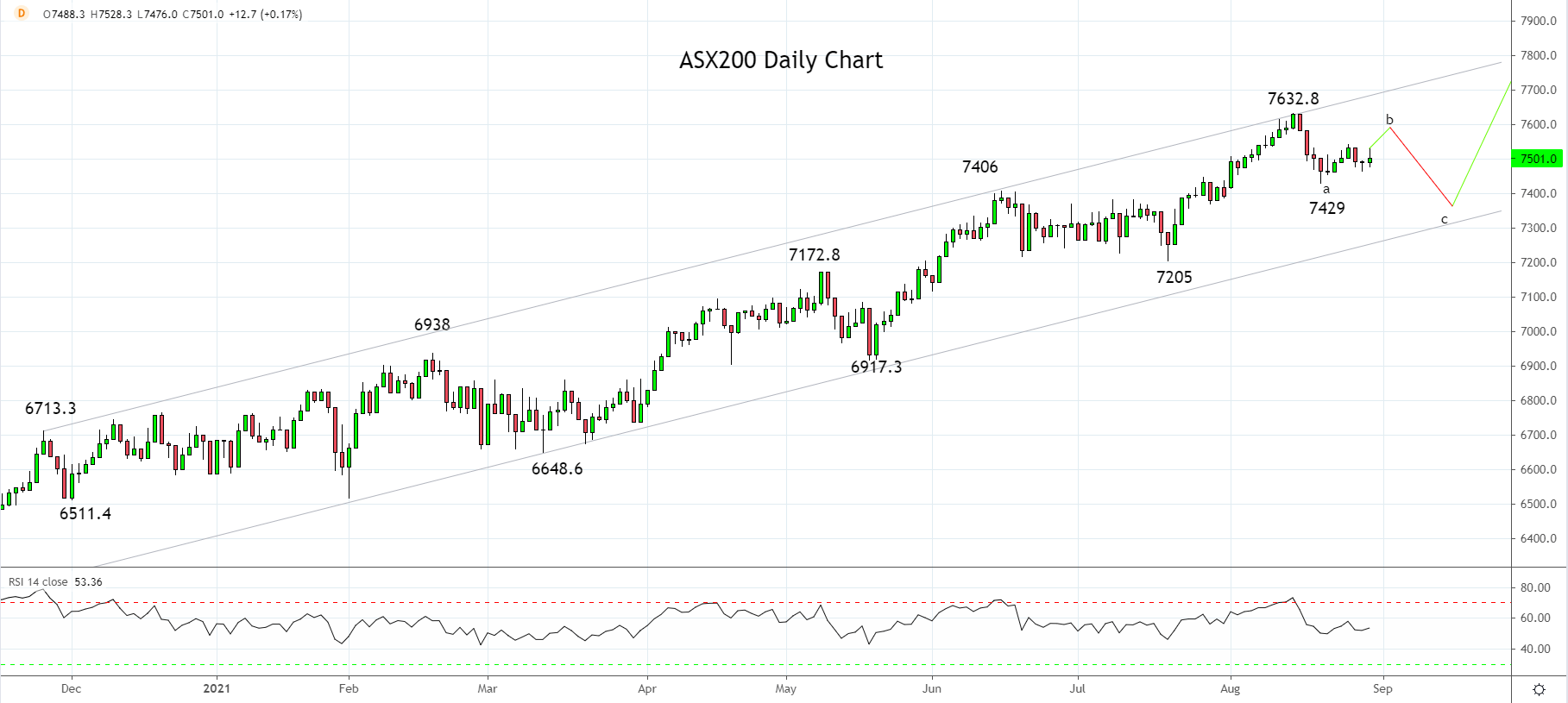

Turning to the charts, after falling from its 7632.8 high of Mid-August, the recovery from the 7429 low is viewed as the incomplete second leg (Wave b) of a three-wave corrective sequence.

A break below the 7429 low would indicate that the third leg lower (Wave c) is underway towards trend channel support near 7320/00, which remains our preferred buying level.

Source Tradingview. The figures stated areas of August 30th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Latest market news

Yesterday 10:40 PM

Yesterday 04:00 PM