After an 8.8% rebound in April, the ASX200 followed the “sell in May and go away” roadmap to its strictest interpretation last week, plunging 5% on the very first day of May.

The catalyst for the sell-off, the Trump administration threatened China with tariffs on imports for its handling of the coronavirus.

While I have been quietly confident that global equity markets supported by rapid central bank and government action would allow equity markets to look through the impacts of coronavirus and continue their impressive recoveries, there are concerns that risk appetite is sturdy enough to withstand the dual-threat of COVID-19 and a renewal in U.S.- China trade hostilities.

Following its underwhelming preparation and management of the COVID-19 pandemic and with the U.S. election now just six months away, polling has shown that anti-China rhetoric is a reliable avenue to rebuild voter support for the current U.S. administration.

Therefore, more anti-China rhetoric and possibly an increase in tariffs from the U.S. in the second half of 2020, is probable and this brings into question the sustainability of the AS200’s rally from its March lows.

More so as investors have used the Australian equity market and the AUDUSD as a proxy to position for an economic recovery in China.

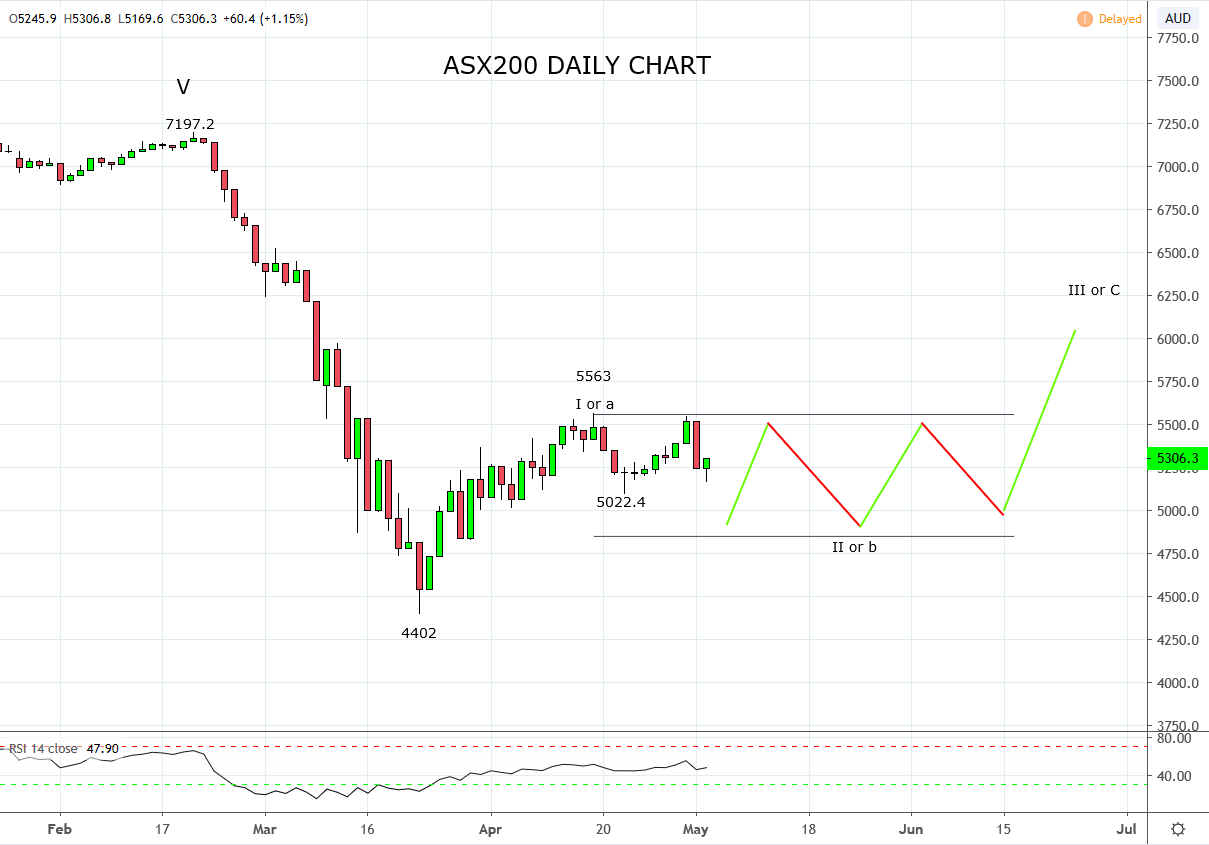

Looking at the daily chart of the ASX200, we favour that a short term high is in place at the April 17th 5563 high and are now looking for four to six weeks of consolidation between 5550 and support at 4850 (the 61.8% Fibonacci retracement of the April rally).

Following the completion of this correction and supported by the continued re-opening of economies and pickup in economic activity, we expect to see the rally resume that takes the index towards 6000 early in the second half of 2020.

Keeping in mind, that a break/close below support at 4850 would be a setback to the view outlined above and warn of a retest of March lows.

Source Tradingview. The figures stated areas of the 4th of May 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation