The RBA reiterated that it does not expect to raise interest rates until inflation returns to within the 2-3% target band for a sustainable period, as well as the need for a stronger labour market and higher wages growth. Conditions that it estimates are unlikely to be achieved until 2024 at the earliest.

There was some speculation in the lead-up to today's meeting that the RBA might intensify its commentary surrounding the booming Australian housing market. This proved to be spot on as the RBA sounded a warning note on lending standards in the paragraph below.

“Given the environment of rising housing prices and low-interest rates, the Bank will be monitoring trends in housing borrowing carefully and it is important that lending standards are maintained.”

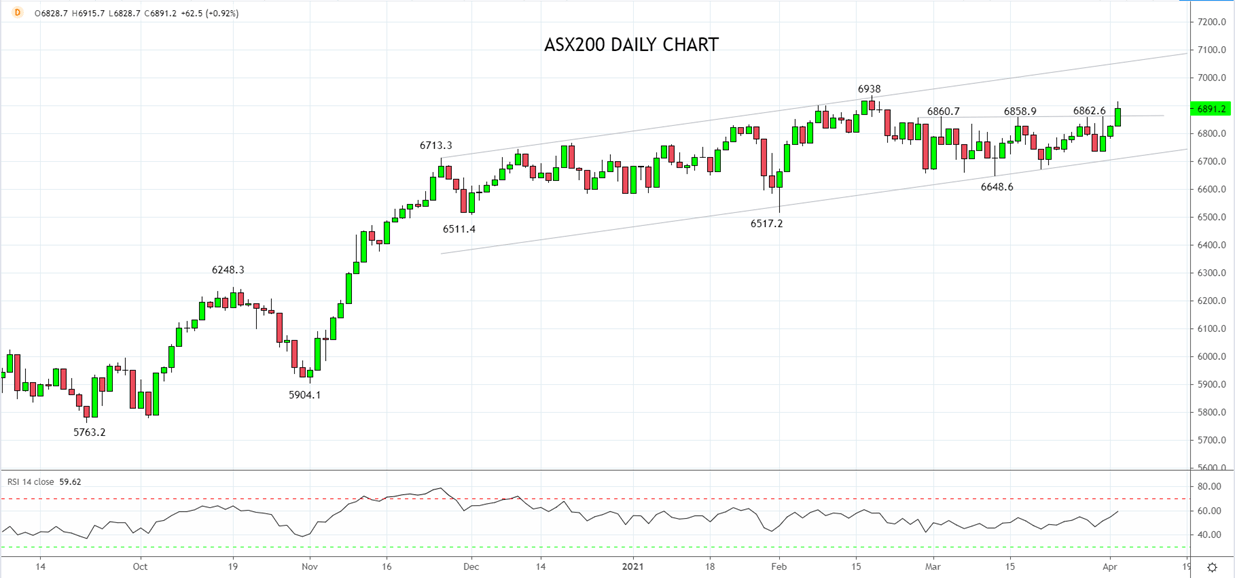

Despite this, following a strong overnight lead from offshore equity markets, including a third straight session of NASDAQ outperformance as alluded to last week here, the ASX200 has enjoyed its best day since early March, to be trading at 6896.50, +67.80pts or 0.99% at the time of writing.

Learn more about trading indices

Technically, today's break above the band of resistance coming from the four highs in March near 6860ish is a positive development that has the ASX200 within one good session of testing the February 2021, 6938 high. A break above 6938ish would then allow the ASX200 to extend its rally towards the top of the trend channel, currently near 7050.

On the downside, near-term support at 6860/40 should hold to keep today’s short-term break higher intact. To keep the medium-term bullish bias in place, the ASX200 has no right closing below trendline support 6710/00ish.

Source Tradingview. The figures stated areas of the 6th of April 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation