After an impressive start to trading yesterday, the ASX200 spent the remainder of the day in retreat after reports from China that under a revised methodology, there had been a 15,424 jump in new coronavirus cases to over 60,000 with the death toll revised higher to 1370.

Yesterday’s revisions will confirm the suspicions of many that the official numbers released by Chinese authorities on a daily basis significantly underestimated the extent of the outbreak and comes from a new technique that uses CT imaging scans to diagnose patients, alongside the previous method of nucleic acid testing kits.

As it seems highly unlikely that all the unconfirmed cases could be included in the revised figures in such a short period of time, it does place a cloud over the validity of the February stock market rally that gained traction as official numbers showed a declining rate of new cases.

In our two most recent updates on the ASX200, on January 22nd here and on January 30 here our view for the ASX200 was for a 3-5% pullback which would present a buying opportunity before the uptrend resumes.

“This would see the ASX200 fall and then bounce from the support coming from previous highs 6900/6850 area.”

After trading to a low of 6897 (into our projected support zone), the ASX200 rebounded strong, trading very briefly at new all-time highs yesterday and celebrating Valentine’s day one day early. However, from here we think the price action is likely to become more challenging.

From a macro perspective, we envisage an arm wrestle between the continued liquidity injections/stimulus by Chinese authorities countered by concerns over revised virus numbers along with its impact on global growth and the Australian economy.

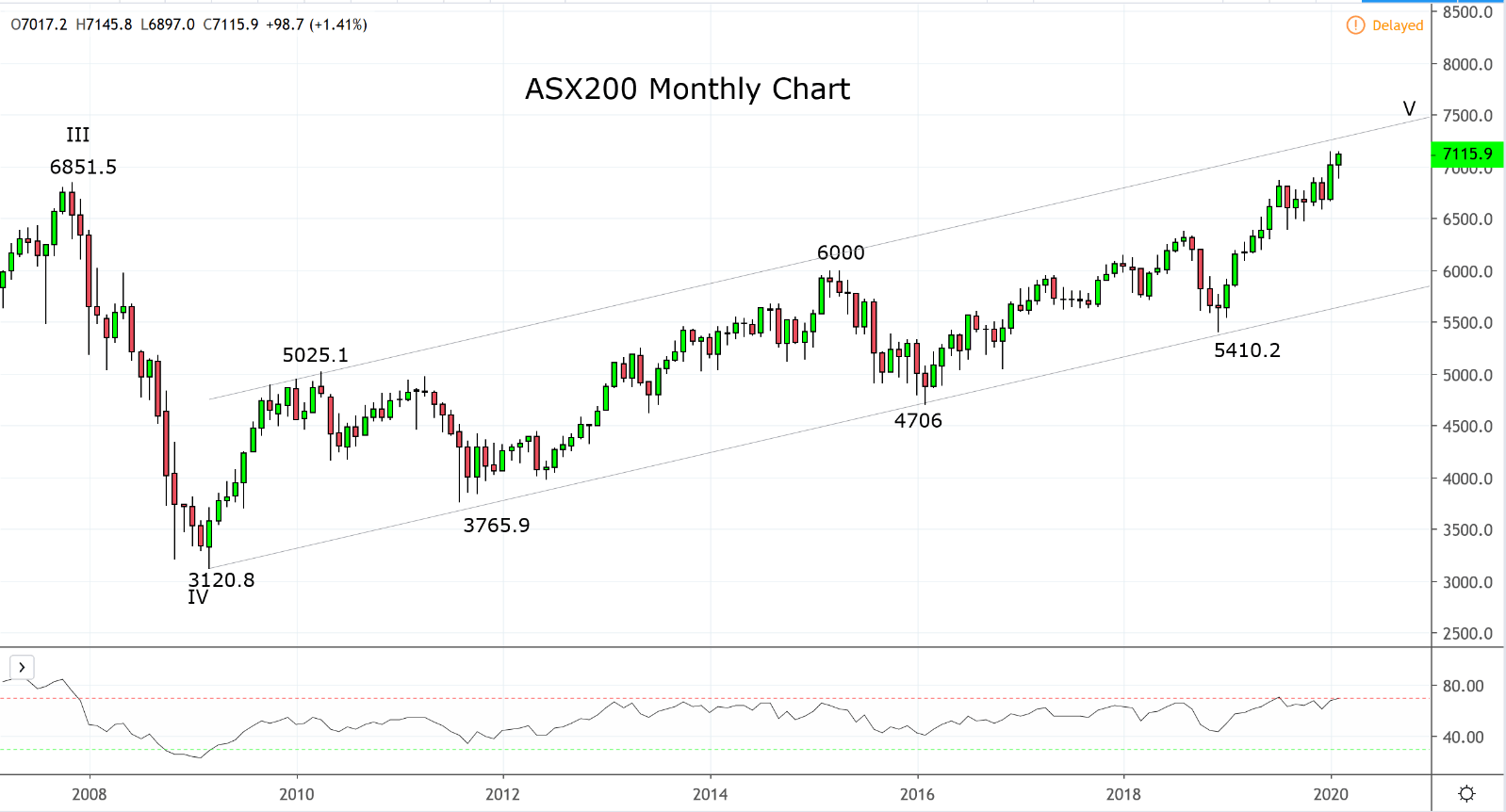

Technically the ASX200 is again trading towards the top of its 11-year bullish trend channel as viewed on the monthly chart below. For those that bought the January dip, we would consider lightening up longs, particularly if the current rally extends towards the very top of the trend channel 7200/7300 region and looking for levels back towards 6900 to re-establish longs.

Source Tradingview. The figures stated areas of the 14th of February 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation