Offsetting the gloomy news, NSW hit its target of 6 million jabs yesterday. Providing the current record pace of vaccinations is maintained, the Government’s 70-80% vaccination target will be reached in mid-November.

Further boosting sentiment, a bounce in key commodities after the PBOC yesterday eased growth concerns with a commitment to stabilize credit and money supply to business. And news that China achieved zero new COVID cases, opening the door for a relaxation of restrictions and reducing tail risks to the slowing Chinese economy.

Returning to local events and reporting season aside, tomorrow brings the release of Q2 Private Capex data. The expectation is for a 2.5% q/q lift in private investment. Offset by a fall in the accompanying third estimate of FY2021–22 collected through July and August when business confidence plunged due to lockdowns.

Further evidence of the impact of the lockdown will be seen on Friday when retail sales for July are released. Estimates there range for a fall between -4% and -8% m/m.

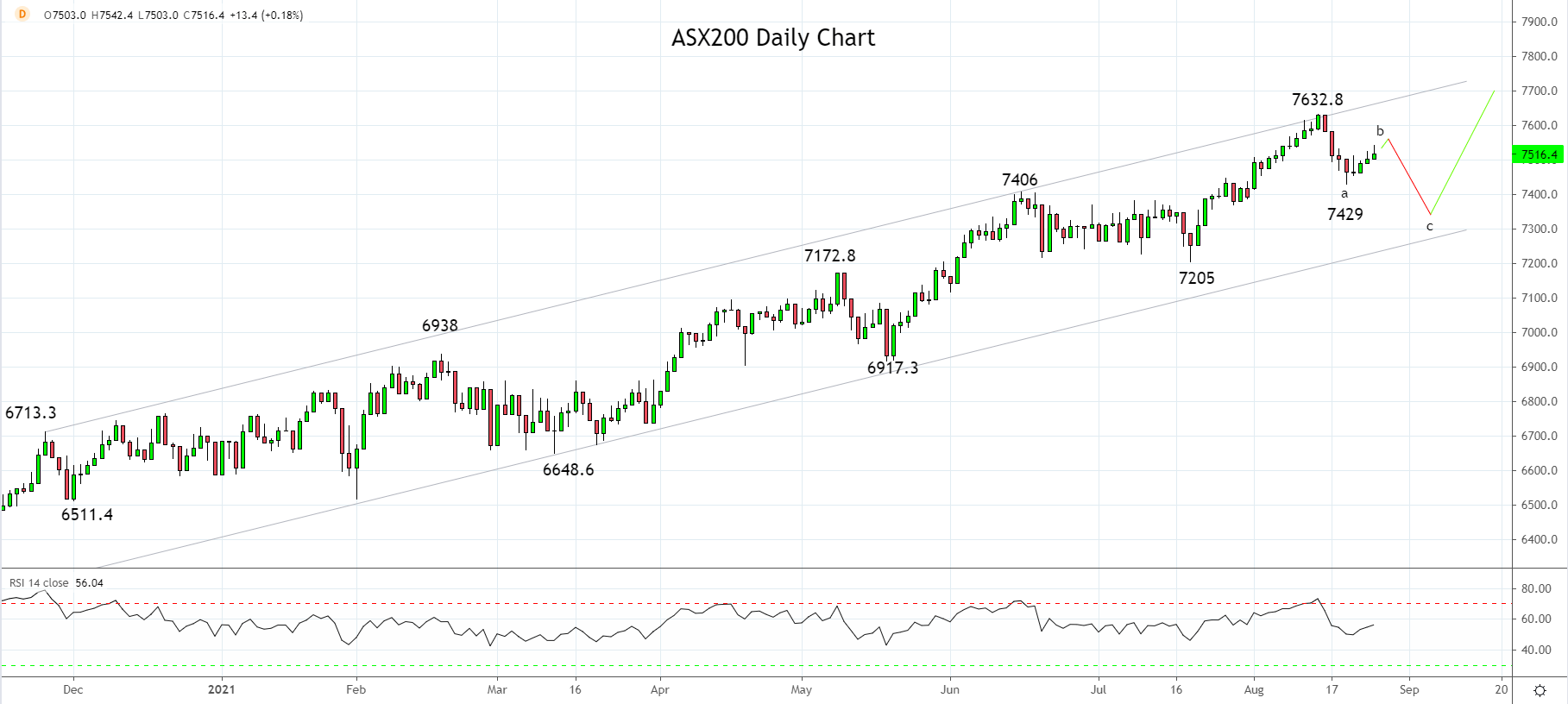

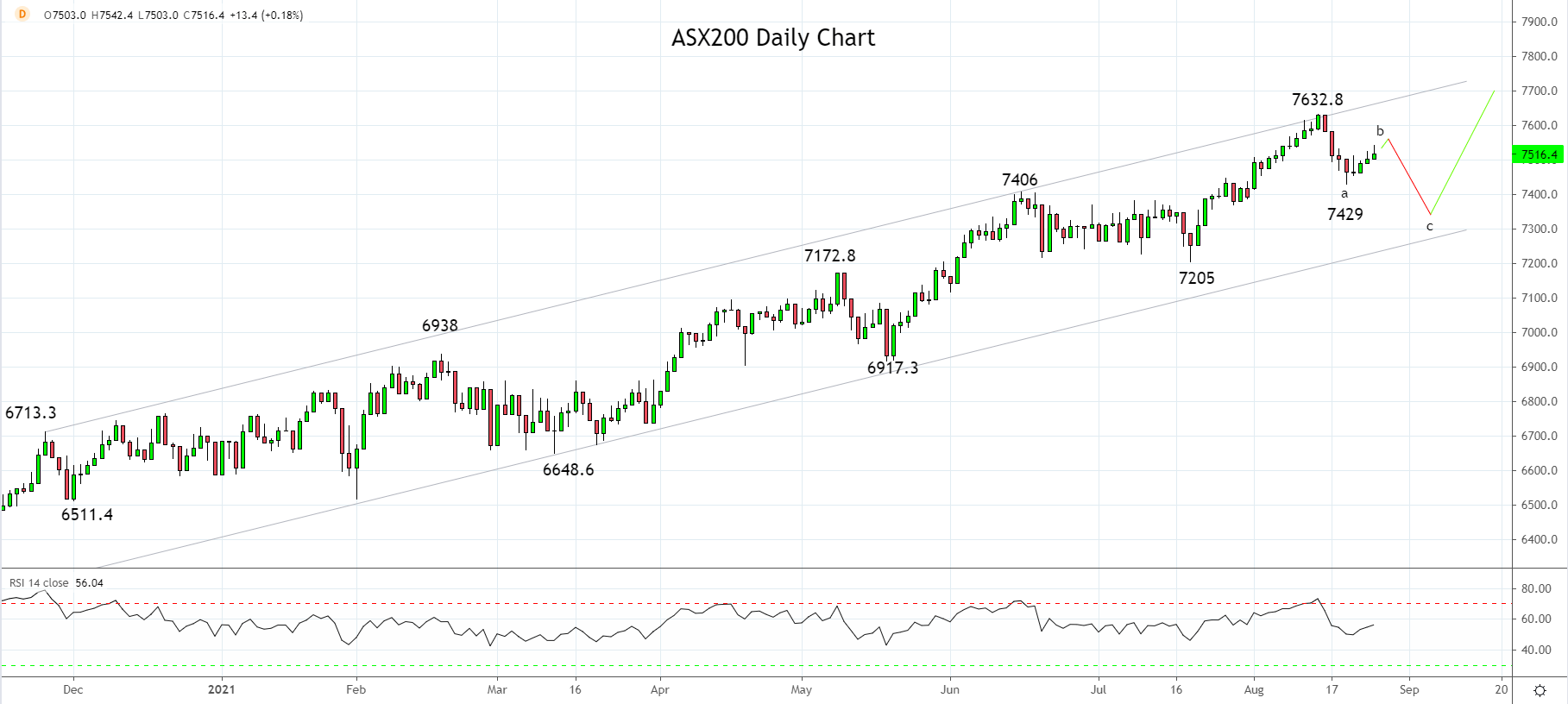

Turning to the charts after rejecting trend channel resistance at 7630 in Mid-August, the ASX200 tested and held horizontal support ahead of 7400. The recovery from the 7429 low is likely to be the second leg (Wave b) of a three-wave corrective sequence that should see a final leg lower (Wave c) towards trend channel support near 7300 in the coming weeks, as displayed on the chart below.

Source Tradingview. The figures stated areas of August 25th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM