A fall of this magnitude in Chinese stocks would have flowed through into other regional capital markets in days gone past. One of my best days of trading ever was pre the GFC while part of the proprietary trading team at Goldman’s in Sydney after a 10% fall in the Shanghai Composite.

At the time, I had a good-sized long position in 3yr SFE bond futures calls that were worth considerably more the next day, benefitting from a flight to safety as global equity markets crumbled due to contagion fears.

This time around, key US equity indices have remained undeterred by this week's events in China, trading at or near to record highs. A reflection of the modern-day realisation that China is still not integrated into global markets.

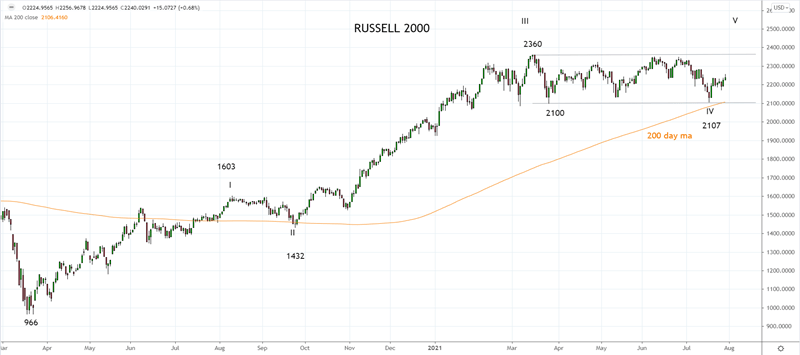

Notably, this week, the “small cap” Russell 2000 outperformed its bigger brothers, the S&P500 and the Nasdaq. The last time the Russell saw a period of significant outperformance was following Joe Bidens election victory and the arrival of vaccines in November 2020, through until March 2021.

However, since early March, the Russell 2000 has marked time, trading sideways in a range between 2350 and 2100. Potentially the recent bottoming in US yields, which supports small cap value stocks, along with stretched valuations in tech, is ushering in a new period of outperformance for small caps.

>From a technical perspective, charts don’t get much better than the Russell 2000 currently. It appears to have completed a correction from the March 2360 high at the recent 2107 low, just above the 200-day ma.

From here, a test of range highs at 2360 is expected, before a push to fresh all-time highs near 2600, which would then complete an Elliott Wave, five-wave advance from the pandemic low of 966.

Source Tradingview. The figures stated areas of the 30th of July 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation