The ASX200 has given back over 50 points of early gains to be trading flat at 7145 at 3.00 pm Sydney time.

The retreat came after Beijing reported a record number of Covid 19 cases sparking fears that the city will be forced into lockdown just as stifling restrictions in Shanghai begin to ease. And has soured hopes that the market might spring higher after the weekend's Federal Election, which removed the uncertainty of a hung parliament and raised hopes that the ALP might be able to mend fractured diplomatic relations with China.

A cut to China's prime lending rate on Friday to support its stuttering economy, behind a 6% surge in iron ore futures today and good gains for the Materials sector. Fortescue Metals (FMG) added 2.1% to $20.57. Mineral Resources (MIN) added 1.7% to $60.83, Rio Tinto (Rio) added 1.4% to to $109.88 and BHP Group (BHP) added 1.35% to $47.83.

Gains also for the Energy sector as the price of crude oil cemented a toe hold above $110 p/b. Santos (STO) added 1.1% to $8.17, Woodside Petroleum (WPL) added 0.42% to $28.89, Beach Energy (BPT) added 0.31% to $1.62.

Weighing on the index, a fall in the Heath Care Sectors led by heavyweight CSL, which fell 1.64% to $270.73, Resmed (RMD) fell 0.85% to $28.11, Virtus Health (VRT) fell 0.1% to $8.11. Going the other way, Cochlear (COH) added 1.6% to $219.18 and Ansell (ANN) added 1.75% to $27.33.

The Finance sector is also trading lower today led by ANZ which fell 0.9% to $25.27, National Australia Bank (NAB) fell 0.85% to $30.85. Westpac (WBC) fell 0.7% to $23.40, Commonwealth Bank (CBA) fell 0.4% to $104.21, and Macquarie (MQG) fell 0.83% to $179.92.

A mixed day for the IT sector. Novonix (NVX) fell 4.14% to $3.94, Afterpay owner Block (SQ2) fell 3.57% to $123.08, Sezzle (SZL) fell 2.5% to $0.58c. Zip (ZIP) fell 2.15% to $0.91c. Bringing some respectability to the IT Sector scoreboard, Megaport (MP1) added 2.56% to $7.42, Xero (XRO) added 2.1% to $90.35, and Appen (APX) added 1% to $6.79.

Lithium names have suffered another round of falls. Liontown Resources (LTR) fell 1.53% to $1.29, Pilbara Minerals (PLS) fell 1.25% to $2.82, Galan Lithium (GLN) fell 1.05% to $1.43, while Lake Resources (LKE) fell 1% to $1.50.

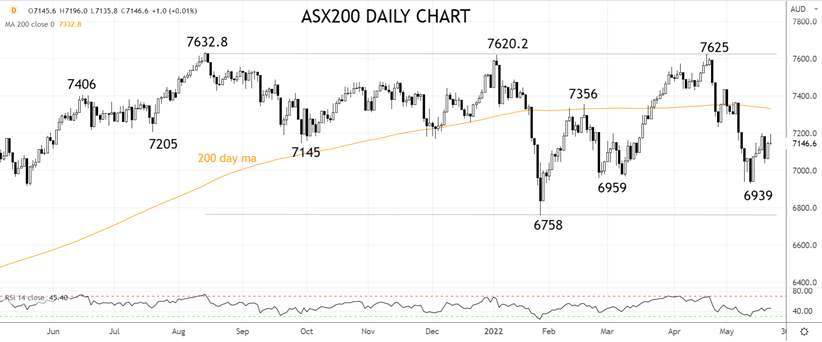

Over the past fortnight, the ASX200 has followed our road map to perfection. From our 7000/6950ish downside target, the rebound in the ASX200 last week reached our upside target at 7200. With the uncertainty of a hung parliament removed, I expect to see the ASX200 embark on a relief rally towards 7300/50, providing Wall Street behaves itself in the interim.

Source Tradingview. The figures stated are as of May 23rd, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade